While the underlying stock market is unpredictable with declining liquidity, derivatives are attracting strong capital inflows. In April alone, the average trading volume of VN-30 Index futures contracts increased by 12.03% from the previous month to 269,000 contracts per session, with a transaction value increase of 10.43% to VND 33.5 billion per session. As of the end of April, the number of new accounts opened in the derivatives market increased by 2.35% from the previous month to 1.6 million.

With the ability to trade both ways, buying and selling continuously within a session, investors can make profits even when the underlying market declines. Derivatives are increasingly becoming an attractive risk management tool and investment channel.

In addition to the advantages, derivatives are also a risky channel for inexperienced investors due to their high leverage and significant volatility. Therefore, to profit from derivatives trading, investors need to possess certain essential skills.

First is emotion management. To profit from derivatives, investors need to control their personal emotions and not be influenced by market fluctuations. To develop a sensitive and resilient mindset, investors need to be well-versed in fundamental and technical analysis skills.

Next is the application of the 2%-6% rule. This is a popular derivatives trading method. With this rule, investors can determine their stop-loss point by dividing the acceptable loss by the number of contracts to find the most suitable price. The 2%-6% rule is based on three principles: (1) Applying Fibonacci support or resistance levels, (2) Loss amount not exceeding 2% of the total investment per position, and (3) Maximum acceptable loss not exceeding 6% of the total investment per position.

Lastly, short-term investing preserves profits. Derivatives are subject to intraday fluctuations, so investors should opt for short-term investing and square off positions within the day instead of holding them overnight. In cases of market downturns, investors can only look for profit-taking opportunities within the trading session. Many investors have made significant profits by opening short positions and squaring off before the ATC session.

In addition to the above factors, investors need to understand the “rules of the game” to make accurate and effective choices. Choosing a reputable brokerage firm with a stable trading system is crucial for investors to react promptly to market changes. It is also advisable to prioritize firms with lower margin requirements to optimize market opportunities.

Future X, a derivative product offered by DNSE, stands out for its convenient trading features and effective risk management. Besides its intuitive interface and easy deposit and withdrawal functions, Future X enables investors to optimize profits with a competitive contract opening margin of only 18.48%.

Additionally, Future X’s superior features, such as trading derivatives and underlying assets under the same account, managing and lending individual orders, and providing real-time profit and loss alerts, have contributed to investors’ success in derivatives trading.

With these advantages, DNSE Securities has ranked among the top five derivatives brokers on HNX in Q1. Notably, DNSE achieved this feat just a year after launching its derivative product, Future X, on the Entrade X by DNSE application.

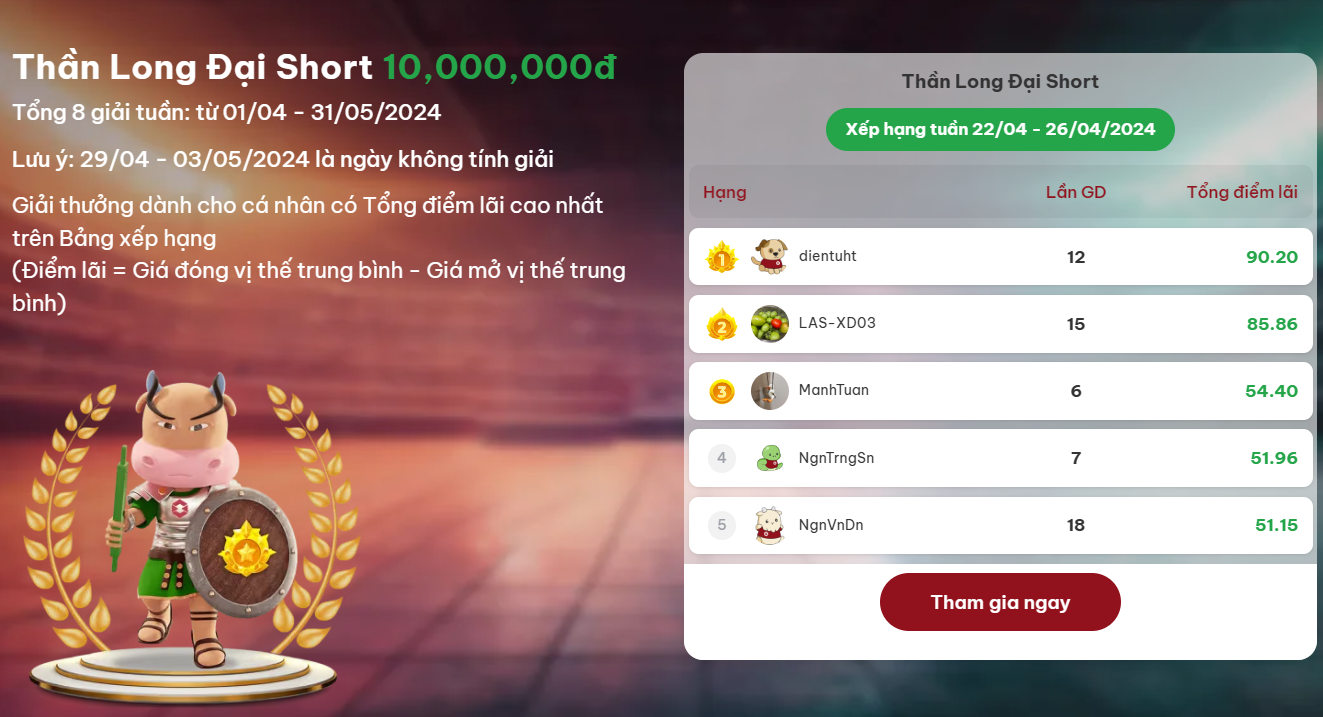

Recently, DNSE introduced the “Derivatives Arena” tournament to offer an exciting competition for investors. Anyone with a derivatives trading account on Entrade X can participate and win attractive prizes worth up to VND 110 million. The tournament is ongoing from April 1 to May 31, 2024.

With its simple rules and valuable prizes, the contest has attracted nearly 3,000 investors. Halfway through, the competition has already revealed its leading performers.

Sharing his secrets to success, Nguyen Huu Pho, the top performer in the first week with a 100% win rate across 22 deals, said: “My strategy is relatively simple. I mainly focus on technical analysis, market news monitoring, and knowing when to make the decisive move. To beat the market, one needs patience, speed, and a holistic view. Once the market trend is identified, it is best to stick to a single position instead of constantly switching.”

Mr. Pho also highlighted Future X’s low-margin requirement, which helps save costs. Additionally, he praised the platform’s user-friendly interface, the convenience of trading underlying assets and derivatives under one account, and the efficient deposit and withdrawal processes.

The “Derivatives Arena” contest by DNSE is now in its second half, with an increasing number of derivatives “masters” joining the race for the valuable prize chain. The investors with the highest weekly profit scores will receive the “Thần Long Đại Short” award. There are also three monthly awards: “Bá chủ deal lãi” for the individual with the highest profitable order, “Hảo hán chốt lời” for those with the highest total profit, and “Cao thủ lãi bền vững” for those with the highest profit rate and a minimum of ten transactions, calculated as the ratio of profitable transactions to total transactions.

Register for the “Derivatives Arena” here: https://s.dnse.vn/cafeF.