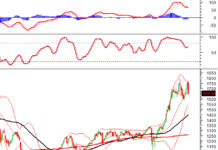

Gold prices fell sharply worldwide as investors took profits ahead of crucial US inflation reports due this week, seeking clues on the Federal Reserve’s monetary policy for this year. Domestic gold bar prices this morning (May 14) fell by up to a million VND per tael, while gold ring prices remained unchanged.

At the close of trading in New York, spot gold fell by $23/oz, or nearly 1%, to $2,337.7/oz, according to data from Kitco Exchange.

At over 9 am Vietnam time, spot gold in the Asian market was up $5.2/oz from the US close, trading at $2,341.9/oz. This amount is equivalent to about 71.9 million VND/tael if converted at Vietcombank’s selling exchange rate, down 500,000 VND/tael from yesterday morning.

At the same time, Phu Quy Group listed the buying and selling prices of SJC gold bars in Hanoi at 86 million VND/tael and 88 million VND/tael, respectively, down 1 million VND/tael at each end compared to the previous day’s close. However, compared to the beginning of the morning yesterday, SJC gold bars at this company are currently higher by half a million VND per tael.

In Ho Chi Minh City, SJC Company quoted the same brand of gold bars at 86 million VND/tael and 89 million VND/tael, respectively.

Compared to the international gold price, the selling price of SJC gold bars is higher by 16-17 million VND/tael.

The selling price of gold rings was mostly around 76.4 million VND/tael, unchanged from the previous day’s close.

In Hanoi, Phu Quy Company’s 999.9 gold rings were bought at 75 million VND/tael and sold at 76.4 million VND/tael. Bao Tin Minh Chau Company listed the buying and selling prices of Thang Long Dragon gold rings at 74.88 million VND/tael and 76.38 million VND/tael, respectively.

SJC Company quoted the buying and selling prices of SJC gold rings in Ho Chi Minh City at 74.6 million VND/tael and 76.3-76.4 million VND/tael, respectively, depending on the weight of the product.

Compared to the international price, the gold ring price is higher by 4.5 million VND/tael.

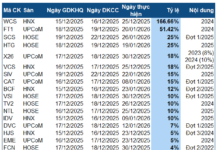

According to a notice issued yesterday, the State Bank of Vietnam held a gold bar auction this morning, offering a total of 16,800 taels of gold at a reference price of 88 million VND/tael.

In the international market, many investors took profits at the beginning of the week after gold prices hit a three-week high last Friday.

In addition, caution increased ahead of two important inflation reports expected to be released by the US Department of Labor this week, including the Producer Price Index (PPI) on Tuesday and the Consumer Price Index (CPI) on Wednesday. For CPI, economists surveyed by Dow Jones forecast a 0.4% increase from the previous month and a 3.4% increase from the previous year. PPI is expected to rise 0.3% from the previous month.

“Gold gave up some of last week’s gains as investors realized profits ahead of the CPI and PPI data releases this week,” said Tai Wong, a precious metals trader in New York, to Reuters.

“Gold speculators have a legitimate concern that the Fed needs to see weaker inflation data to begin lowering interest rates, not just weaker employment data,” Wong said.

Last week, gold prices rose more than 1% after weak US employment data reinforced the possibility of the Fed starting to cut interest rates this year.

In a Reuters survey, the vast majority of economists expected the Fed to cut interest rates twice this year, with the first cut in September. According to data from CME’s FedWatch Tool, traders are betting on a 66% chance that the Fed will start cutting rates in September.

The US Dollar Index showed little movement ahead of the release of US inflation reports, hovering around 105.3 points, the same level as last week’s close.