|

Rendered illustration of Aeon Mall Tan An, Long An, which broke ground on May 18th

|

Vietnam will continue to be a key market

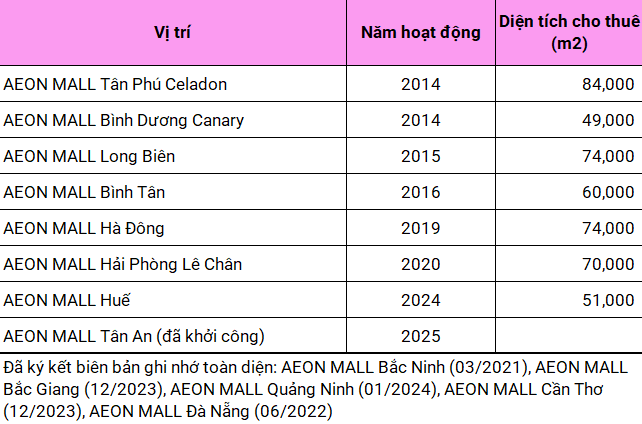

In the latter half of this year, the Aeon Mall Group plans to open a shopping center in Hue City, offering 51,000 square meters of leasable space. This will be the brand’s first location in Central Vietnam. Construction also began on the group’s eighth shopping center in Vietnam, located in Long An province, with an investment of over VND 1,000 billion. The mall is expected to be operational by 2025.

Earlier this year, the People’s Committee of Dong Nai province approved the investment of the Viet Phat Group in the Aeon Mall Bien Hoa project, with a total investment of over VND 6,100 billion. The project will be carried out in two phases, with the first phase expected to be completed in the second quarter of 2027. The mall is estimated to attract around 10 million visitors annually.

The Japanese brand stated that it will accelerate the search for and opening of shopping centers in high-growth areas in the coming years, with Vietnam being a key market, especially in Ho Chi Minh City, Hanoi, and some provinces in Central Vietnam.

|

Existing and planned Aeon Mall shopping centers in Vietnam

|

The company has no plans to open new malls in Japan this year but will instead focus on renovating and expanding its existing malls to improve their efficiency. By the end of 2025, Aeon Mall expects to operate 44 shopping centers overseas, a decrease of 6 malls compared to previous plans due to the postponement of new openings.

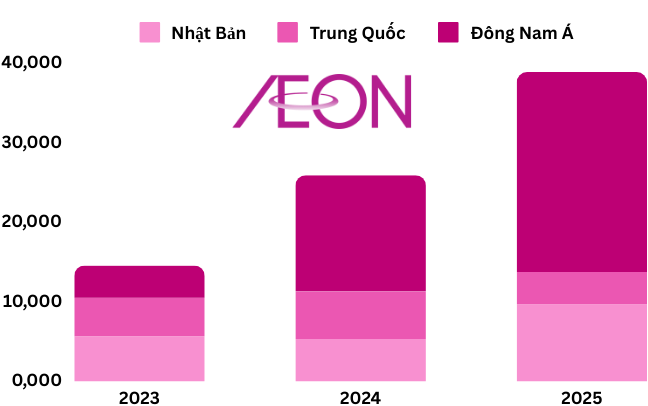

For now, the group intends to invest heavily in the Southeast Asian market, allocating nearly VND 15,000 billion to the region this year and over VND 25,000 billion in 2025, a significant increase from the VND 4,000 billion invested in 2023.

Aeon Mall recently inaugurated the Aeon Mall Delta Mas in Indonesia, featuring 86,000 square meters of leasable space. The group is also planning to open two new malls in Zhejiang and Hunan provinces in China, offering 70,000 and 84,000 square meters of leasable space, respectively.

|

Aeon Mall’s investment plan by region (in VND trillion)

|

Net profit increased by 57% in 2023

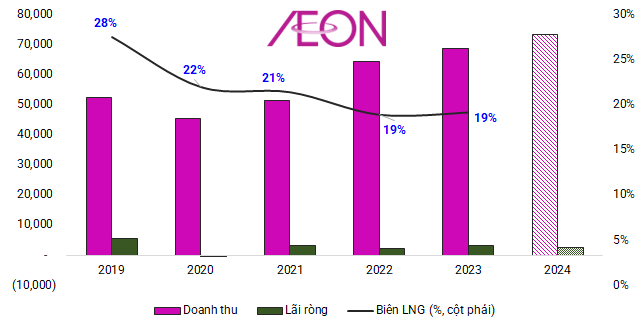

For the fiscal year 2023, which ended on February 29, 2024, the group reported a net profit of approximately VND 3.3 trillion (exchange rate: 162.2 VND/JPY), a significant increase of 57% compared to 2022. This improvement was achieved despite only a slight increase in revenue, which reached nearly VND 69 trillion. The main reason for the profit surge was the reduction in extraordinary losses from VND 2.1 trillion in 2022 to VND 594 billion in 2023.

This result improved the return on equity (ROE) to 4.5%, up from 3% in the previous year. Earnings per share (EPS) also increased from VND 9,200 to VND 14,500. The company allocated over VND 1.8 trillion for dividend payments, maintaining the same level as in 2022. The dividend payout ratio decreased to 56% from 87% in the previous year.

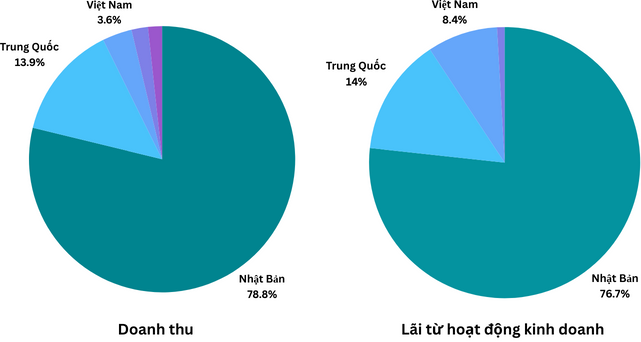

Japan continued to be the largest contributor to the group’s revenue, accounting for 79% with VND 54 trillion. However, this proportion decreased compared to 2022 due to the better performance of overseas markets.

China was the second largest market, generating revenue of VND 9.5 trillion, or 14% of the total, and an increase of 12% compared to the previous year. Revenue from Vietnam increased by 15% to nearly VND 2.5 trillion, improving its contribution from 3.3% to 3.6%.

|

Revenue and profit contribution by region in 2023

|

Cambodia and Indonesia were the most improved markets, with revenue increases of 50% and 23%, respectively, although they only contributed about 2% and 1.7% to the total revenue. The strong performance in Cambodia was attributed to the opening of the third shopping center in Phnom Penh in late 2022.

Japan accounted for approximately VND 5.8 trillion in profit, a slight increase from 2022, and contributed about 77% to the group’s operating profit. Vietnam, despite being the third largest market, saw a 27% increase in profit to VND 633 billion, which helped Aeon Mall maintain its growth trajectory, as profits from Cambodia and Indonesia were not as favorable.

The performance of some shopping centers in Cambodia was less than ideal due to lower-than-expected customer numbers and the impact of the pandemic on occupancy rates. A similar situation occurred in Indonesia, where the fourth shopping center opened in Tanjung Barat in 2021, although the loss was smaller compared to the previous year.

|

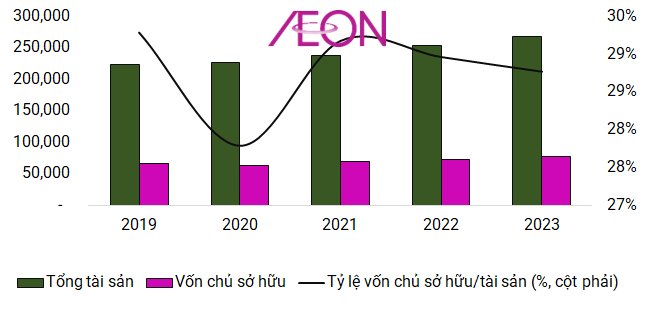

Financial performance of Aeon Mall from 2019 to 2023 (in VND billion)

|

Over the past five years, the group’s core leasing business has been significantly impacted by the pandemic, especially the Zero-COVID policy in China, which severely restricted mobility.

In 2020, the company reported a loss of VND 302 billion, a sharp contrast to the profit of VND 5.5 trillion in 2019. However, there has been a gradual recovery since then. Nonetheless, the gross profit margin of 19% is still lower than pre-crisis levels.

The group expects revenue to reach approximately VND 74 trillion in 2024, an increase of 7.2% compared to 2023. However, they are pessimistic about net profit, with a target of VND 2.6 trillion, representing a 19% decrease.

As of the end of 2023, Aeon Mall’s total assets increased by 6% to approximately VND 269 trillion, with equity capital of VND 77 trillion. The equity ratio was nearly 29%. The group allocated 80% of its capital to fixed assets, mainly in the form of buildings and structures, resulting in depreciation costs accounting for 20% of the cost of goods sold.

|

Balance sheet of Aeon Mall from 2015 to 2023 (in VND billion)

|

Tu Kinh