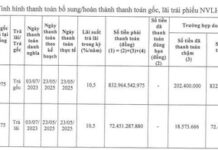

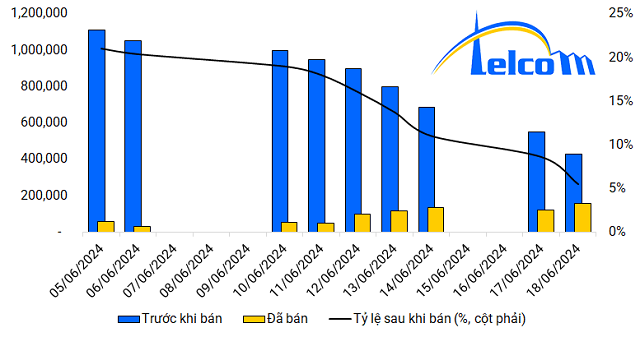

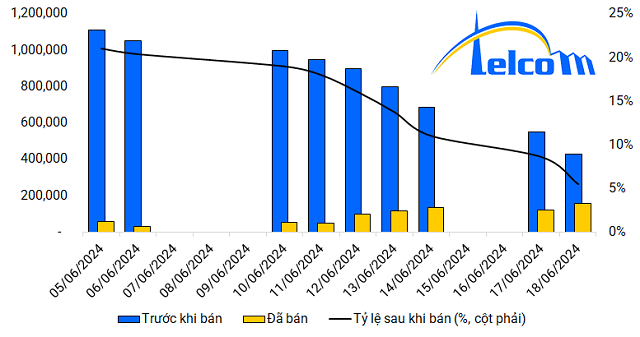

This marks Mr. Dung’s ninth sale and the largest one in June. Since the beginning of the year, there have been 11 recorded instances of him divesting. His holding ratio has decreased from 24.13% to 5.45%.

|

Mr. Lai Trung Dung’s selling spree in June (in units of shares)

Source: Author’s compilation

|

During this period, no matching transactions were recorded in the market, and some sessions saw matching volumes equal to the large sale by this major shareholder. Mr. Dung likely pocketed around VND 10.7 billion, with an average selling price of about VND 13,000 per share.

Mr. Dung is the husband of Ms. Ngo Thi Bich Van, who served as a member of the Board of Directors of TEL from 2021 to June 2023. Three months before her dismissal, Mr. Dung started reducing his stake, which paved the way for the massive sell-off in 2024.

On June 24, the closing price of TEL shares suddenly plunged by nearly 15% to VND 13,900 per share, while the previous two sessions had hit the ceiling.

Excluding Mr. Dung’s transactions, TEL shares were almost illiquid. The trading volume has only picked up since the beginning of June, with an average of more than 84,000 shares traded per session, in contrast to the first five months of the year, which saw an average of just over 1,400 units traded daily.

| TEL’s share price movement since the beginning of 2024 |

TEL, formerly known as the Postal Engineering Company under the General Postal Department, was established in 1954. In 2006, it officially operated as a joint-stock company and was renamed Telecommunications Construction Joint Stock Company as it is known today. Its charter capital was VND 50 billion at that time and has remained unchanged since.

TEL mainly focuses on the construction and installation of telecommunications works, consulting, design, and office leasing.

In 2016, the Vietnam Post and Telecommunications Group (VNPT) held 49% of TEL‘s shares. Another major shareholder was the Postal Finance Ltd., holding 7%.

The telecommunications giant attempted to auction these shares several times as per the decision of the Prime Minister, offering them at around VND 16,400 per share in 2015 and VND 16,700 per share in 2017, but to no avail. It wasn’t until October 2020 that they successfully divested through over-the-counter transactions when the market price was around VND 12,000 per share. The state-owned enterprise withdrew from the list of major shareholders of TEL, earning nearly VND 30 billion. The Postal Finance Ltd. also fully divested at the end of 2019.

As VNPT withdrew, Mr. Lai Trung Dung became a major shareholder by purchasing 1 million shares, increasing his ownership to 24.62%. The remaining 1.45 million shares belonged to Mr. Nguyen Hoa Hiep (holding 29%). Mr. Hiep (born in 1989) was also elected to the Board of Directors of TEL for the term 2016-2020 and is currently the Chairman of the Board for the term 2023-2028.

In July 2021, Mr. Dung continued to increase his ownership to 26.29% but was fined VND 100 million by the State Securities Commission of Vietnam (SSC) for failing to make a public offer. In addition to the fine, he was forced to relinquish his voting rights on the number of shares violating the regulations and was compelled to sell a portion of his shares to reduce his ownership below the threshold requiring a public offer. This had to be done within six months from the effective date of the decision.

TEL shares were registered and officially traded on UPCoM from 2017, with a reference price of VND 10,800 per share. The trading volume was quite vibrant in the first few months, coinciding with a series of sales by the company’s leaders and related parties.

During this period, an individual named Mr. Le Hai Doan repeatedly “accumulated” shares for investment purposes. By July 2020, he owned 24.8% and currently serves as a member of the Board of Directors of TEL. He was recently appointed as the Director of Operations in April 2024. Previously, Mr. Doan had been fined VND 5 million by the SSC for inaccurate transaction reporting.

| TEL’s share price movement since its listing on UPCoM |

[IR AWARDS] February 2024 Information Release Schedule Reminder

There are several noteworthy information disclosure events in the stock market in February, including the Fed’s announcement of FOMC meeting results, the effective restructuring of VN30 portfolio, the announcement of portfolio restructuring by MSCI, the release of economic and social situation in February, and the expiration of VN30F2402 futures contract.

![[IR AWARDS] February 2024 Information Release Schedule Reminder](https://xe.today/wp-content/uploads/2024/02/ir-awards--150x150.jpg)