Woman Loses 26 Billion VND in Elaborate Scam

Court documents reveal a sophisticated scam where Ms. Tran Thi Chuc was deceived into transferring 26 billion VND to two separate bank accounts to “prove her innocence.”

According to the case file, Ms. Chuc filed a criminal complaint with the Police Investigation Agency (PC02) of Bac Ninh Province, accusing two individuals, To Ngoc Dau and Hai, of fraudulently obtaining her money. The perpetrators claimed that Ms. Chuc was involved in a traffic accident in Danang City and was associated with a drug trafficking and money laundering syndicate.

Hai instructed Ms. Chuc to open two bank accounts and install a “security software” application on her phone. She was then manipulated into transferring 26.56 billion VND into these accounts to demonstrate that her funds were legitimate and unrelated to any illegal activities.

Victim Installs Malicious “Security Software” as Instructed by Scammers

During the trial, it was revealed that by installing the so-called “security software,” Ms. Chuc unknowingly granted access and control of her device to the scammers. Forensic analysis concluded that this application connected to a server located in Japan and had functions to read and manipulate SMS messages, call history, contacts, and device location data.

Ms. Chuc’s internet banking services required her to log in using a user ID (her registered phone number) and a password that she created. The bank’s testimony confirmed that only Ms. Chuc’s phone could generate the successful OTP codes, which were then sent to the bank’s system.

The initial court ruling attributed blame to Ms. Chuc, stating that “as a citizen with limited knowledge, Ms. Chuc did not realize that by following the scammer’s instructions, she had given up access and control of her electronic device.”

However, Ms. Chuc argued that she did not read the contract’s contents, did not tick the boxes for the provided services, and was not adequately advised by the bank staff. In contrast, CCTV footage from the bank showed that after providing her personal information and requested services, Ms. Chuc reviewed the printed account opening request form before signing it. The court, therefore, determined that her claims were inconsistent with the evidence.

Prosecutors File an Appeal

The case has taken a new turn as the prosecutors from the People’s Procuracy of Tu Son filed an appeal for both lawsuits, arguing that the previous court’s decision to hold the banks accountable lacked sufficient grounds, and the compensation percentage of 5-6% was deemed unreasonable.

Notably, Ms. Chuc had previously opened multiple bank accounts, indicating a level of familiarity with the process. Furthermore, upon realizing she had been scammed, she did not request the banks to trace and recover the funds or lodge any complaints or compensation claims. Instead, she only asked for account statements to provide to the police.

As a result, the VKSND Tu Son has appealed the entirety of the two first-instance judgments.

“Victims are often psychologically manipulated, leading them to comply with the scammers’ demands, including transferring large sums of money. These criminals often use legal threats and target older women, who are more susceptible to such tactics,” said Mr. Vu Ngoc Son, Head of Research, Consulting, Technology Development, and International Cooperation at the National Cyber Security Association.

As of July 1st, banks have implemented Decision 2345 by the State Bank, enhancing security and privacy measures for online payments and credit card transactions. Any transfers exceeding 10 million VND or daily transactions totaling over 20 million VND now require biometric authentication, matching the facial data stored on the citizen’s ID card chip.

Couple Charged after Declaring a Pool Worth Over 49 Billion VND

With hundreds of participants, our organization is known for hosting multiple rope jumping events. However, due to financial difficulties, the owners of the organization have announced their inability to cover the costs totaling over 49 billion VND.

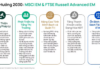

Common Scams to Watch Out for During the 2024 Lunar New Year Online

As the Lunar New Year approaches, cybercriminals are ramping up their activities in cyberspace, causing a significant impact on people’s lives. The rise in cybercrime has become more sophisticated and complex, posing a threat to individuals and their personal information. It is crucial for us to be vigilant and take proactive measures to protect ourselves and our online presence.