FPT shares surge as Vietnam’s leading tech company soars to new heights. After a brief adjustment period, FPT stock quickly regained its familiar upward trajectory. Trading closed on July 5th with FPT once again reaching a new peak at VND 138,700 per share, a 67% increase since the start of 2024. This marks the 33rd time that Vietnam’s top technology company has brought shareholders to unprecedented heights in just half a trading year.

This breakthrough pushed FPT’s market capitalization to a record high of VND 202,600 billion (~USD 8.1 billion), an increase of over USD 3 billion since the beginning of the year. For the first time in its nearly 18-year listing history, FPT’s market capitalization has surpassed the VND 200,000 billion mark. This figure cements FPT’s position as the largest private corporation on the stock exchange and the third most valuable listed company in Vietnam, following only Vietcombank and BIDV.

The primary driver behind FPT’s consecutive peak-breaking performances stems largely from domestic capital inflows, as foreign investors have been aggressively taking profits. In just over two months, from the beginning of May until now, foreign investors have sold a net VND 5,800 billion worth of FPT shares. As a result, FPT’s foreign ownership limit has been lifted by tens of millions of units, an unprecedented occurrence.

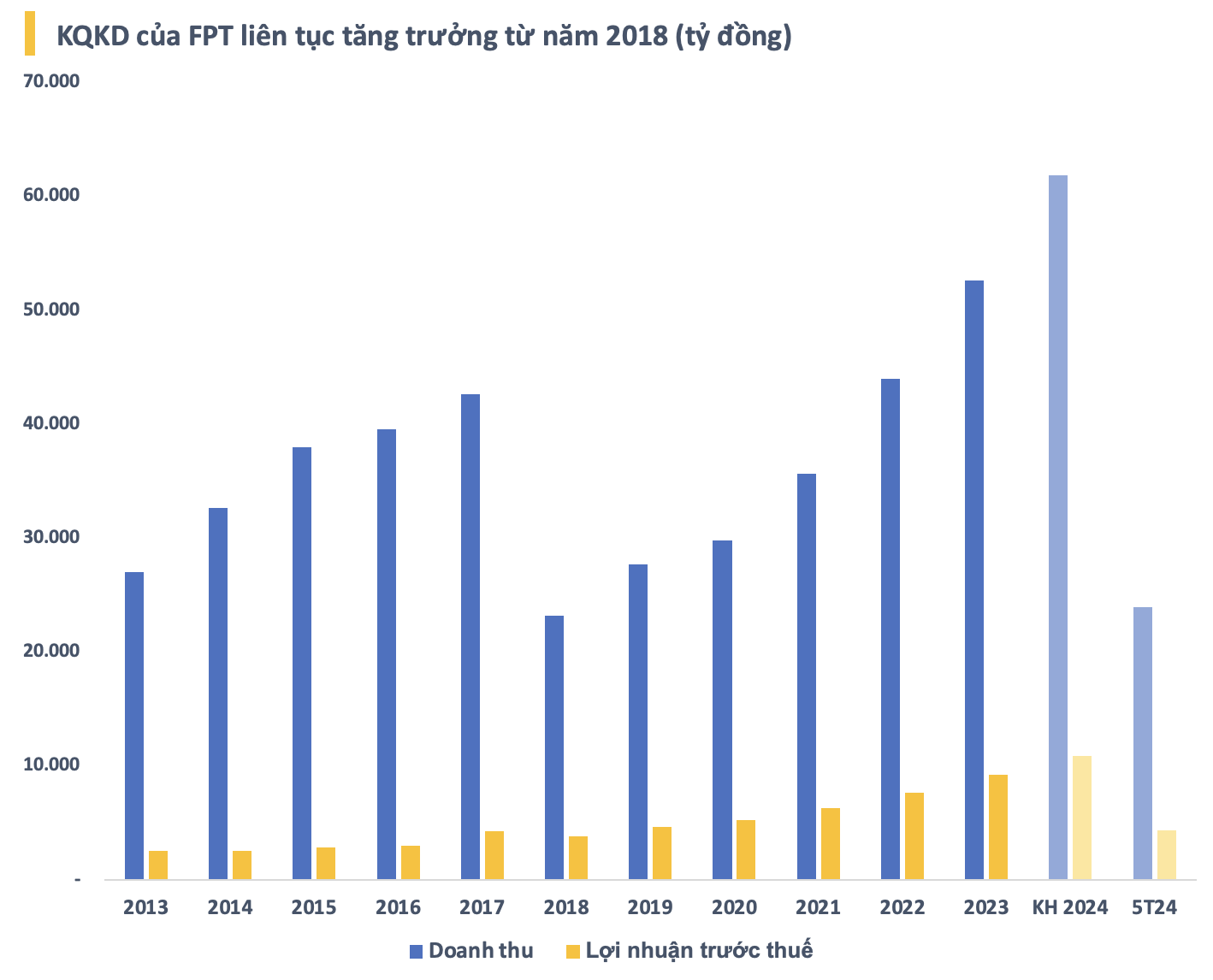

In terms of business results for the first five months of 2024, FPT recorded revenue of VND 23,916 billion and pre-tax profit of VND 4,313 billion, representing increases of 19.9% and 19.5%, respectively, compared to the same period last year. After-tax profit attributable to parent company shareholders also rose by 21.2% to VND 3,052 billion, corresponding to an EPS of VND 2,403 per share.

For the full year 2024, FPT has set historic high business targets, aiming for revenue of VND 61,850 billion (~USD 2.5 billion) and pre-tax profit of VND 10,875 billion, reflecting approximate increases of 18% compared to the actual results of 2023. With the achievements in the first five months, the corporation has accomplished 39% of the revenue plan and 40% of the profit target.

The IT Services for Overseas Markets segment continued its impressive growth trajectory, achieving revenue of VND 11,998 billion, equivalent to a 29.8% increase. This growth was driven by all four target markets, with the Japanese and APAC markets maintaining high growth rates of 34.2% (equivalent to 43% growth in Japanese Yen) and 31.1%, respectively.

The volume of new orders in overseas markets reached VND 16,341 billion, a 17.2% increase mainly due to FPT’s proactive approach in securing new deals as early as December 2023. Notably, in May 2024 alone, FPT secured 6 large-scale projects, each valued at over USD 5 million, bringing the total number of projects won so far this year to 26.

Recently, FPT and JAL Information Technology (JIT), a subsidiary of Japan Airlines (JAL), signed a memorandum of understanding to collaborate on creating new value in IT system development for the aviation and non-aviation sectors in the Japanese market. Additionally, FPT Software has become a Global System Integrator for Creatio, a US-based no-code platform provider.

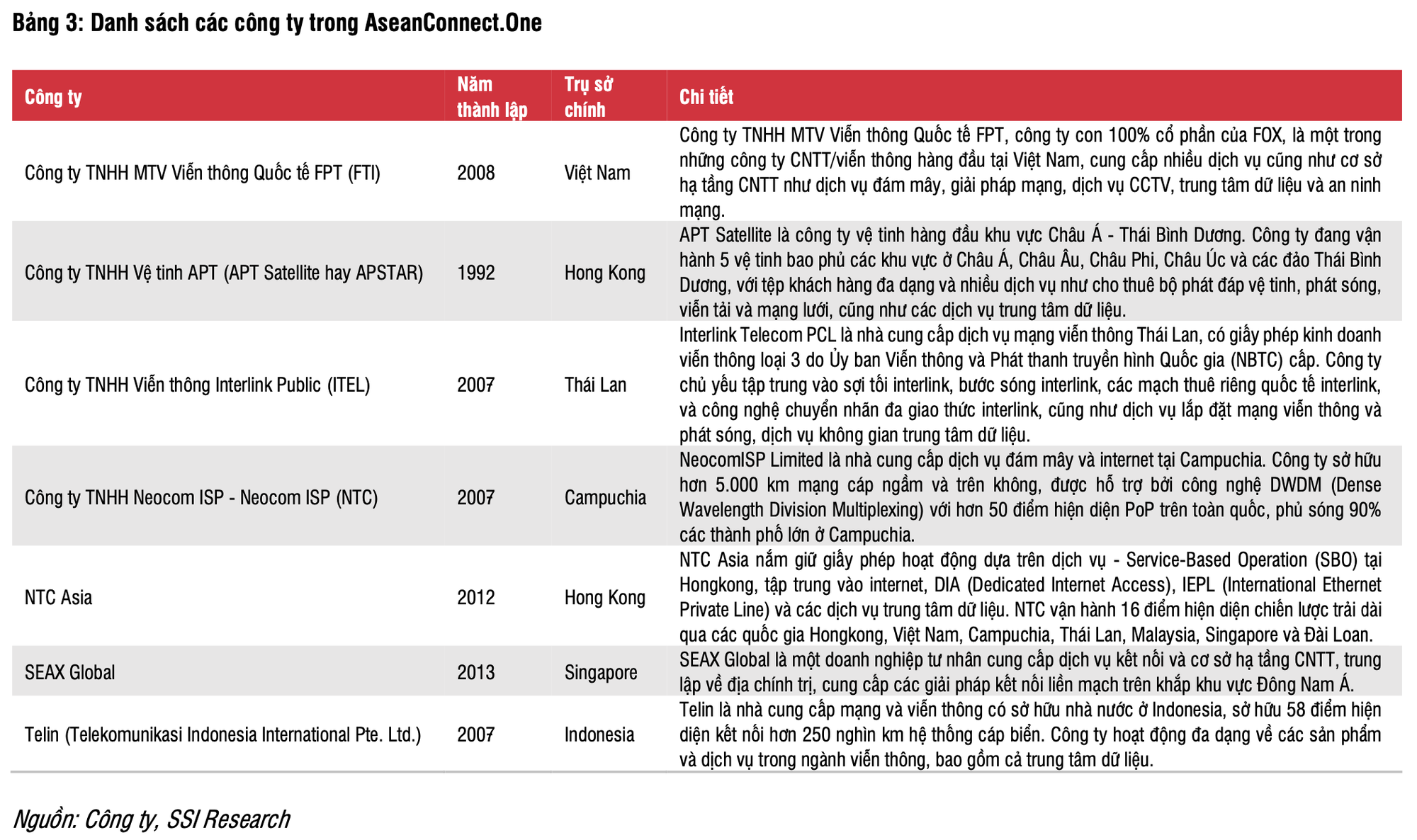

In a recently published analysis report, SSI Research highlighted FPT’s collaborations with NVIDIA and Creatio, as well as the formation of the AseanConnect.One alliance. They believe that these strategic moves will enhance the quality of FPT’s telecommunications services, particularly in data centers, while expanding customer reach. This is expected to benefit FPT’s technology segment in the long term.

According to Gartner, foreign IT spending is projected to increase by 8% in 2024 (compared to 4% in 2023). Foreign IT services spending is expected to grow by 9.7% (compared to 6% in 2023) as foreign businesses increasingly seek IT consulting services due to challenges in attracting IT-related talent. This trend bodes well for FPT’s technology business in the long run.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.

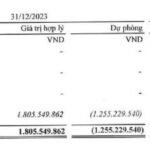

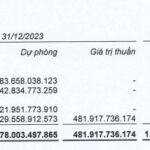

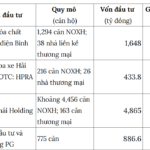

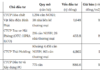

Coteccons profits nearly 50% from investing in FPT stocks, sets aside full provision of 143 billion for Saigon Glory receivables.

In the first 6 months of this year, Coteccons achieved a net revenue of VND 9,784 billion, a nearly 5% increase, and a net profit of VND 136 billion, which is nearly 8.9 times higher than the same period last year.