Source: VBMA

|

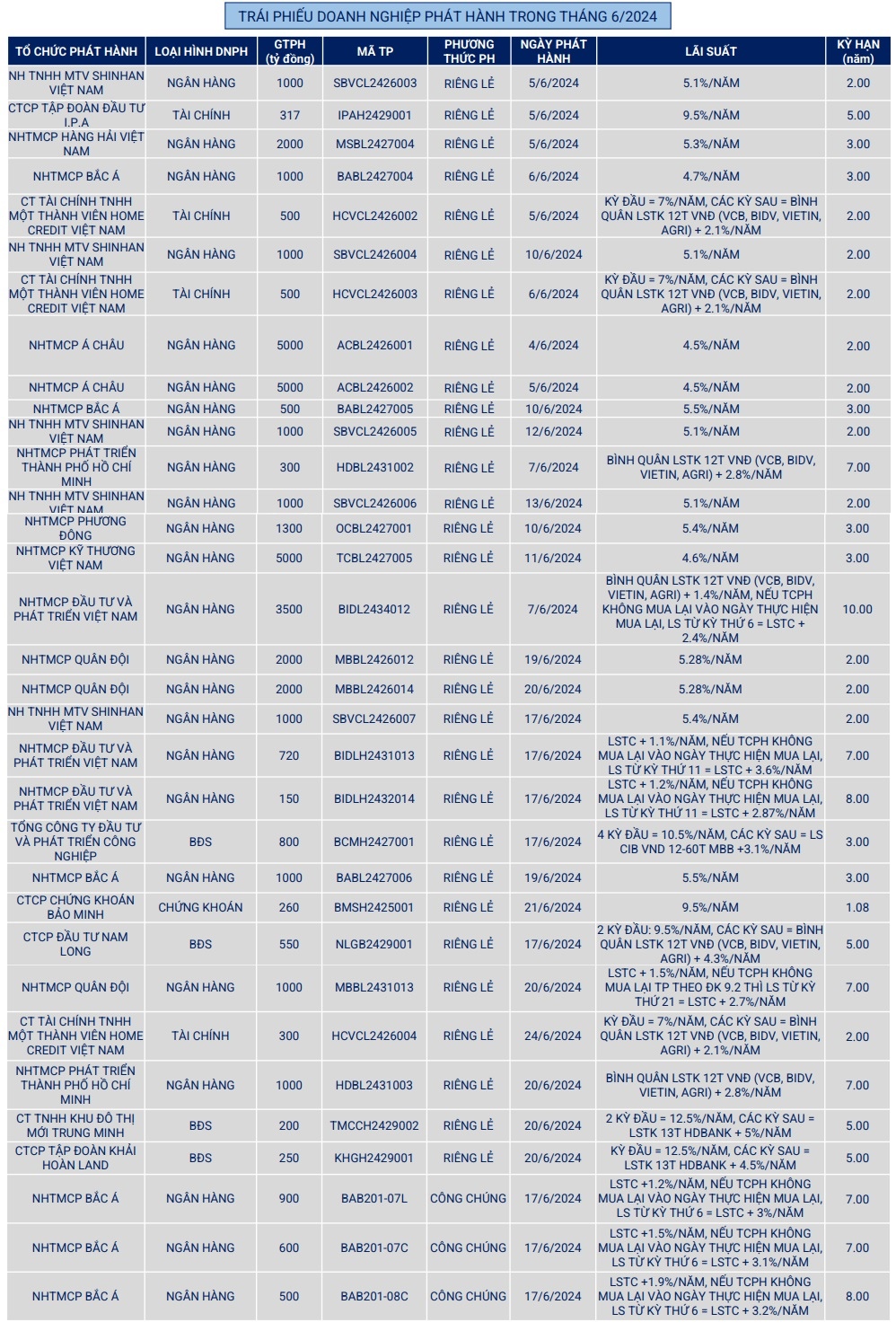

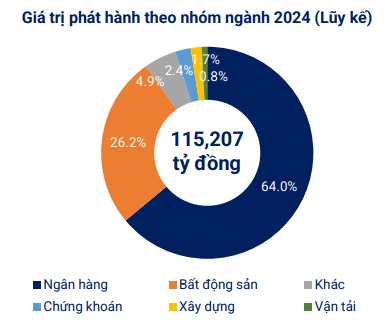

In the first half of the year, there were 102 private placements worth over 104 trillion VND and 10 public issuances worth nearly 11.4 trillion VND. Among the private placements, rated bonds accounted for 4.2% of the value.

Source: VBMA

|

In June, enterprises repurchased over 13.3 trillion VND of bonds ahead of schedule, down 68% from the same period last year. In the second half of 2024, an estimated nearly 140 trillion VND of bonds will mature, mostly in the real estate sector with nearly 59 trillion VND, equivalent to a weight of 42%.

Source: VBMA

|

Regarding abnormal information disclosure, there were 2 bond codes that announced late payment of principal and interest in the month, with a value of 980 billion VND, and 13 bond codes that were granted extensions of time to pay interest and principal.

In the secondary market, the total trading value of privately placed corporate bonds in June exceeded 99.4 trillion VND, averaging 4,973 billion VND/session, up 12.1% from the previous month’s average.

Regarding upcoming bond issuances, 2 enterprises will issue bonds. The first is GKM Holdings Joint Stock Company (HNX: GKM), as its Board of Directors approved the plan to issue private placement bonds in 2024 with a total maximum value of 44.9 billion VND. These are “3 non” bonds: non-convertible, non-warrant attached, and unsecured, but with a payment guarantee.

GKM’s bond lot will include 449 bonds with a par value of 100 million VND each, aiming to restructure debt. The bond term is 36 months from the issuance date (expected in Q2/2024). The issuer is APG Securities Joint Stock Company (HOSE: APG). The expected interest rate is 11%/year for the entire payment term.

The second is the Bank for Investment and Development of Vietnam Joint Stock Company (BIDV, HOSE: BID). Accordingly, the BIDV Board of Directors has approved the plan to issue private placement bonds in 2024 with a total maximum value of 3 trillion VND, expected to be issued in a maximum of 5 batches (minimum of 50 billion VND each). These are non-convertible bonds, without warrant, unsecured, with a par value of 100 million VND/bond, with a term of 5-10 years, expected to be issued from June to the end of November 2024. The purpose of the issuance is to supplement capital for lending to customers in the economy.

Chau An

Mr. Ngo Dang Khoa (HSBC): Exchange rate under pressure in Q1, expected to stabilize around 24,400 dong/USD by end of 2024

Prior to the rising trend of the USD, Mr. Ngo Dang Khoa – Director of Foreign Exchange, Capital Markets and Securities Services, HSBC Vietnam, has shared some insights and forecasts regarding the upward momentum of the USD and exchange rates.