Optimism remains high in markets, but along with that is caution, meaning bonds may continue to grow strongly in February despite stocks still rising.

Here are the most notable financial events worldwide in the week of February 5-9, 2024:

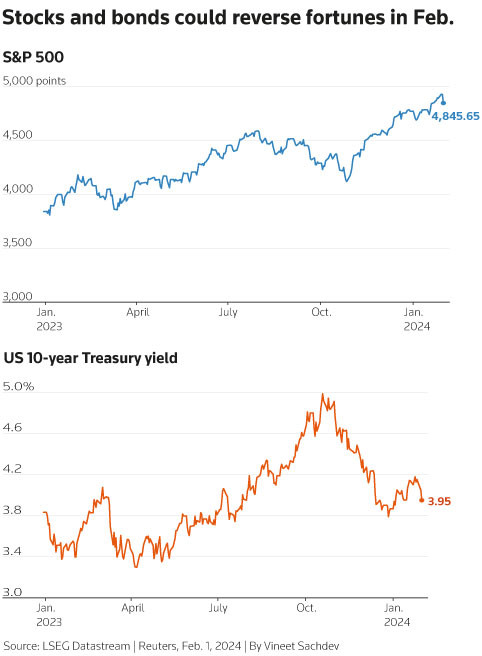

1/ Stocks and bonds continue to show opposite movements

If January saw exceptional stock gains compared to bonds, February could witness the opposite trend.

The hope that the US Federal Reserve will cut interest rates and the recent decline in US bank stocks – reminiscent of the banking crisis last March – suddenly dampened the stock market. Indeed, the global equities market overall in January has been on the rise, but note that the S&P 500 index on Wednesday (January 31, 2024) – right after the Federal Reserve’s meeting – fell the most since September 21, 2023.

In contrast, the government bond market – with generally rising yields in January 2024 – has been driven by strong demand for safe assets and increasing signs – such as the US ADP employment index and activities of factories in China and the eurozone – indicating major economies are weakening. This will set the tone for developments in financial markets in the week of February 5-9, 2024, where the focus will be on central banks’ discussions on upcoming policies. And it’s possible that 2024 will witness divergent movements in stocks and bonds.

US stocks and bonds moved in opposite directions in February.

2/ China’s inflation is declining

China’s inflation data announced on Thursday (February 8) will be the next test of the health of the world’s second-largest economy – which is being affected by prolonged weak demand, the real estate sector still in crisis, and investor anxiety.

The consumer and producer inflation figures for January 2024 of China could further confirm that this economy is facing difficulties in the recovery process, though the more worrying question is whether deflation pressure is increasing or not.

The Chinese stock market did not start the new year well, with the blue-chip index ending January down 6%, marking a record consecutive decline – 6 months in a row.

The recent support measures from Beijing seemed to have calmed investors at the moment and expectations of further stimulating measures have pushed China’s 10-year government bond yields to the lowest level in two decades.

As the Year of the Tiger approaches, the movement wave as people return home for the traditional Lunar New Year may become a boost for the world’s second-largest economy to resume growth.

China’s inflation is declining.

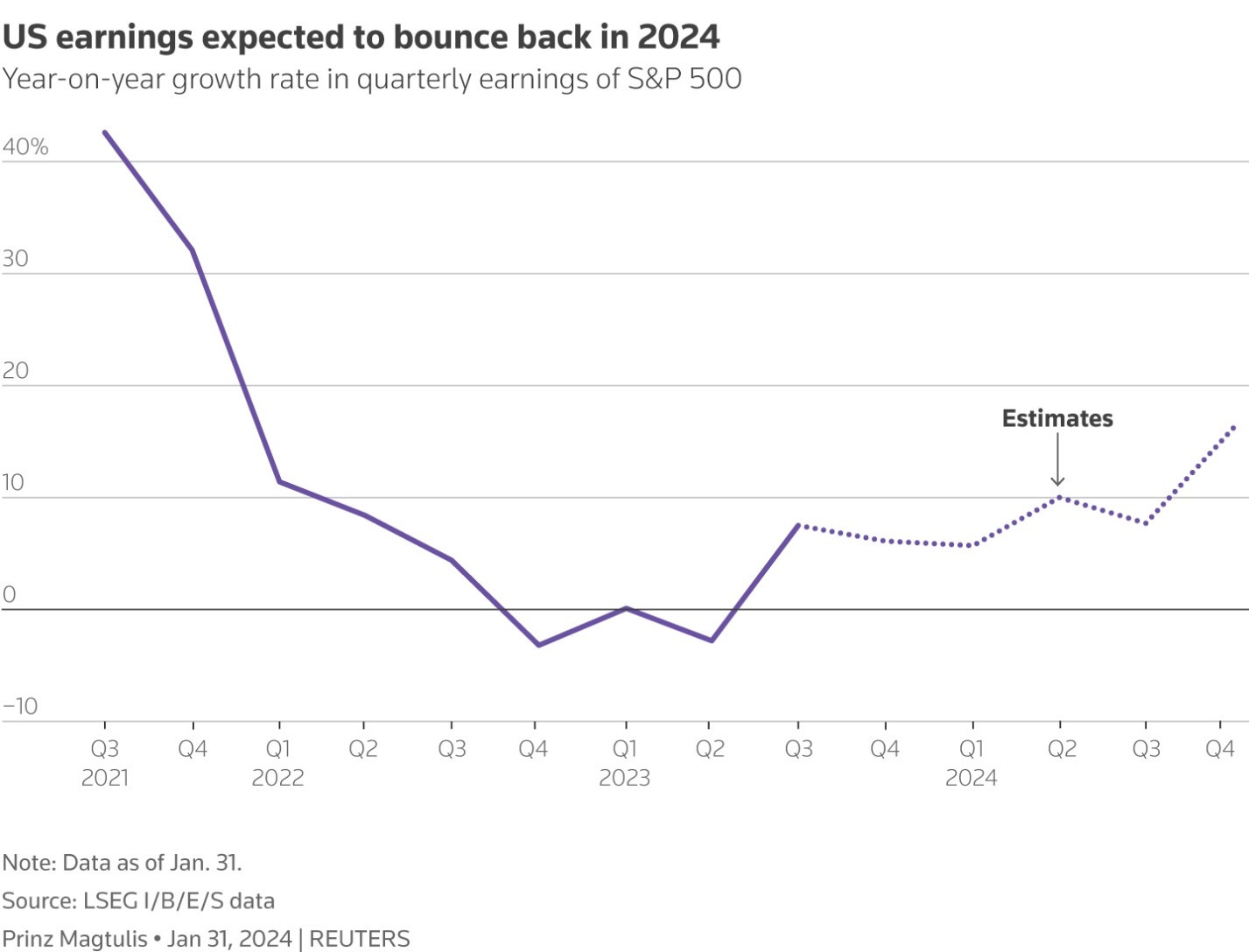

3/ Continued earnings reporting season

The business results of US companies will continue to be released in the coming days, which will help determine whether the stocks of these companies will continue to reach new records or not.

Last week, most major technology companies reported revenue, but in the coming days, many companies in the S&P 500 will report quarterly earnings, including Eli Lilly, Walt Disney, ConocoPhillips, and PepsiCo.

According to LSEG data as of January 31, S&P 500 companies’ Q4 2023 revenues rose 6.1% compared to the same period last year. Up to the present, 80% of companies have reported higher-than-expected earnings, exceeding the previous four-quarter average of 76%.

Investors will pay attention to any in-depth information that companies provide about 2024, with expected earnings projected to grow faster than 2023.

US companies’ earnings in 2024 are expected to increase.

4/ The real estate market will indicate the health of the UK economy

The UK has avoided recession. Inflation is decreasing, wages are increasing, and loan interest rates are starting to decline. In the coming days, there will be data on how UK consumers are spending, specifically data on new car sales and mortgage rates, as well as prices and activities in the real estate sector.

If there is one thing the British people love, it is their homes. Some of the largest construction companies in the UK will report earnings in the coming days, including Barratt, Redrow, and Bellway.

Last quarter, major UK construction companies sounded serious warnings about 2024. However, there may still be a glimmer of hope. According to mortgage provider Halifax, the measure of UK citizens’ ability to buy homes fell at the end of 2023 to the lowest level since 2015. The Bank of England’s January 2024 data showed that UK mortgage lenders approved the most mortgages since June, while mortgage rates fell for the first time in over three years.

House prices and mortgage rates in the UK.

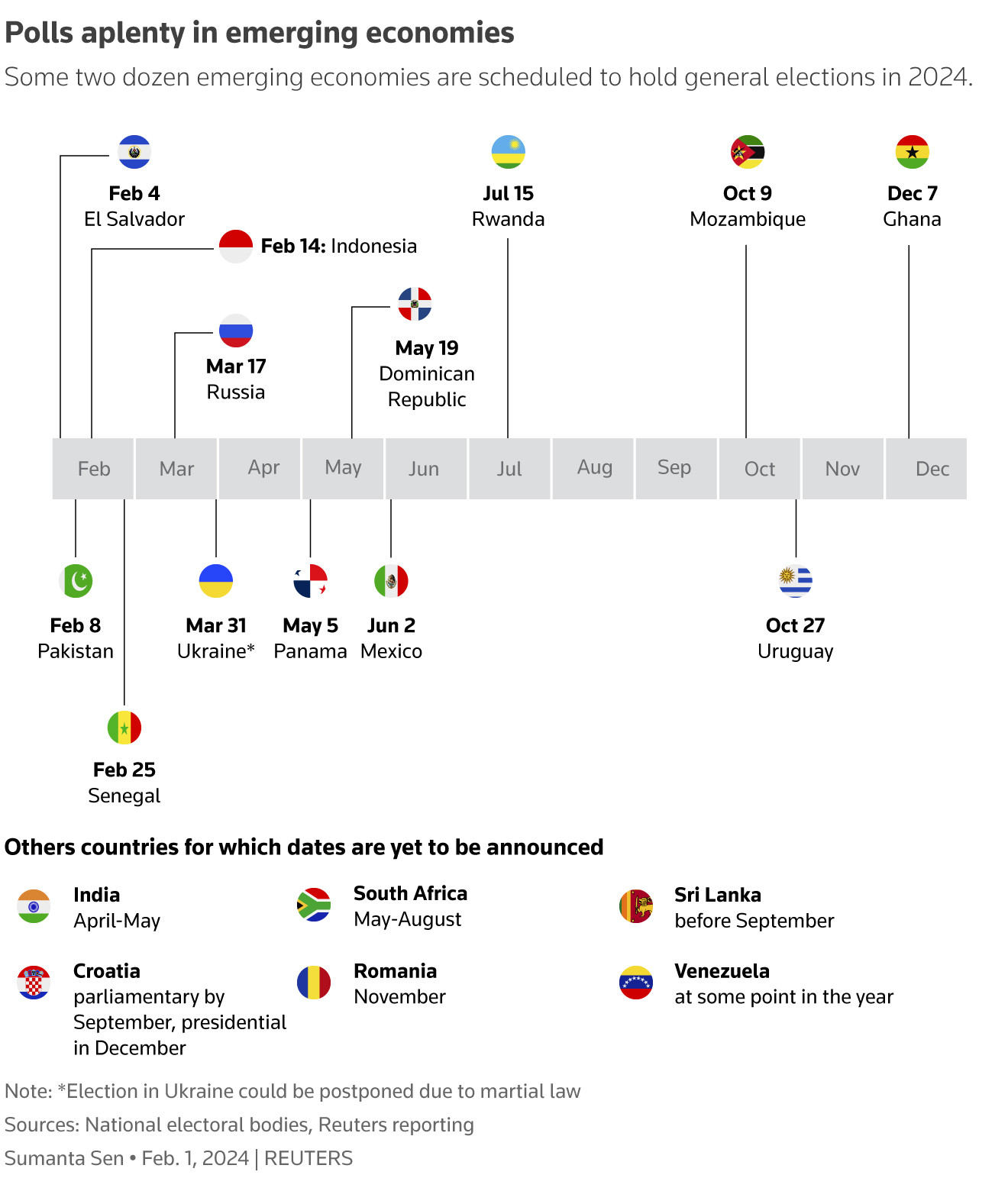

5/ A series of countries hold elections

The 2024 election season is starting to heat up, with the opening in some of the world’s most populous countries. Pakistan’s general elections are expected to take place on Thursday (February 8) amidst violent outbreaks. The country is facing an economic crisis with inflation at nearly 30%, weak currency, and the government will have to find a way to restore the economy from the International Monetary Fund’s $3 billion relief package, which will expire in April. Meanwhile, voters in Indonesia will participate in the elections on February 14, with leading candidate Prabowo Subianto expected to win. In the Americas, El Salvador President Nayib Bukele, who calls himself the “Greatest Dictator in the World”, claimed victory in the first round of elections on Sunday (February 4).

Election schedules of countries around the world.

Reference: Reuters