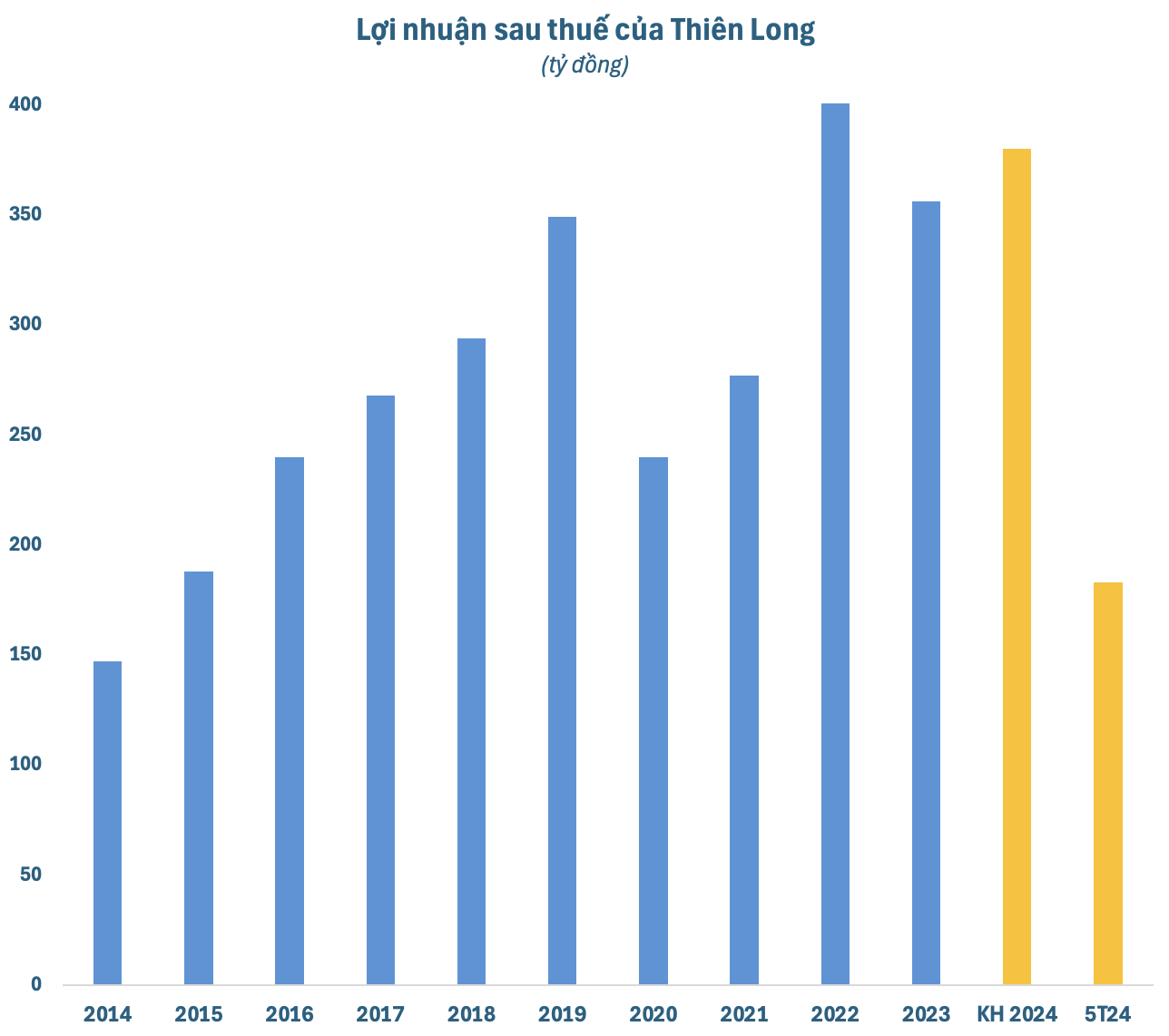

Thien Long Group JSC (coded TLG), the owner of the well-known Thien Long ball pen brand, has recently announced its business results for the first five months of 2024. The company’s revenue reached an estimated VND 1,430 billion, a 7% decrease compared to the same period in 2023. However, their gross profit margin improved to 43.9% during these five months, higher than the 42.4% achieved in the previous year.

The company’s domestic revenue decreased by 14% year-on-year, but their export revenue saw a positive increase of 13%. Thien Long attributed the overall revenue decline to the challenging domestic market conditions and slow recovery, with distributors remaining cautious in their inventory purchases.

For the full year of 2024, Thien Long has set a business plan with targets of VND 3,800 billion in revenue and a consolidated after-tax profit of VND 380 billion, representing a 9% and 7% increase, respectively, compared to the previous year. The company plans to pay dividends at a rate of 35% of par value. With these results, Thien Long has achieved 38% of its revenue plan and 48% of its profit target for the year.

At the 2024 Annual General Meeting of Shareholders, CEO Tran Phuong Nga shared that the company’s current growth drivers remain in the writing instruments segment, which are essential products for tens of millions of Vietnamese students and office workers. Additionally, their art products also show potential for investment. Thien Long can increase prices for products with creative and eye-catching improvements, rather than traditional ones.

Thien Long currently manufactures and trades four brands: Bizner, which supplies premium ball pens, fountain pens, brush pens, and pencils; Colokit, a brand for art supplies such as crayons, watercolors, and coloring books; Thien Long, a group of writing instruments and convenient office products; and Flexoffice, which serves the office segment with products like paper, file folders, tape, and glue.

Following the disclosure of its financial results, TLG stock witnessed a surprising surge. The share price soared, even touching the ceiling at one point on July 2nd, before closing with a 6.3% increase to VND 55,600/share, the highest in nine months. This was the strongest increase in a year since mid-June 2023. Trading volume was also very active, with the highest matched volume since mid-March. Thien Long’s market capitalization reached nearly VND 4,400 billion.

Thien Long’s shareholders approved a dividend payout ratio of 35% for 2023, including a 25% cash dividend and a 10% stock dividend. In 2023, the company had already paid an interim cash dividend of 15%, amounting to VND 116.7 billion. The AGM authorized the Board of Directors to decide on the record date for the remaining cash dividend of 10% and the stock dividend for 2023, in accordance with the approved plan to issue shares to pay dividends.

Additionally, Thien Long plans to issue nearly 7.9 million shares to pay dividends in shares at a ratio of 10%. The entitlement ratio is 10:1 (each shareholder owning one share will have one right to receive a share dividend, and for every 10 rights, one new share will be received). This is expected to be implemented in the second or third quarter of 2024, after receiving approval from the State Securities Commission.

Furthermore, Thien Long also intends to issue shares under an employee stock ownership plan (ESOP) if the company’s consolidated cumulative net revenue for 2024, as per self-prepared/audited financial statements, reaches VND 4,000 billion or more. The expected number of shares to be issued is 1% of the total outstanding shares of the company at the time of issuance.

Sell clean stock portfolio including NVL, VIX… A steel company ends the streak of using money from selling inventory to cover losses in stock investing

In Q4 2023, this steel company reported a net loss of over 9 billion Vietnamese dong from securities trading.