This is the outlook of the MBS Research Block of MB Securities Joint Stock Company (MBS Research) in the investment strategy report for the second half of 2024.

Profit growth in the second half of 2024 will be a good sign for the further expansion of the market.

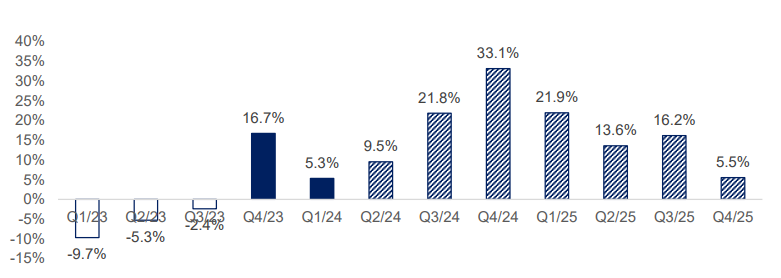

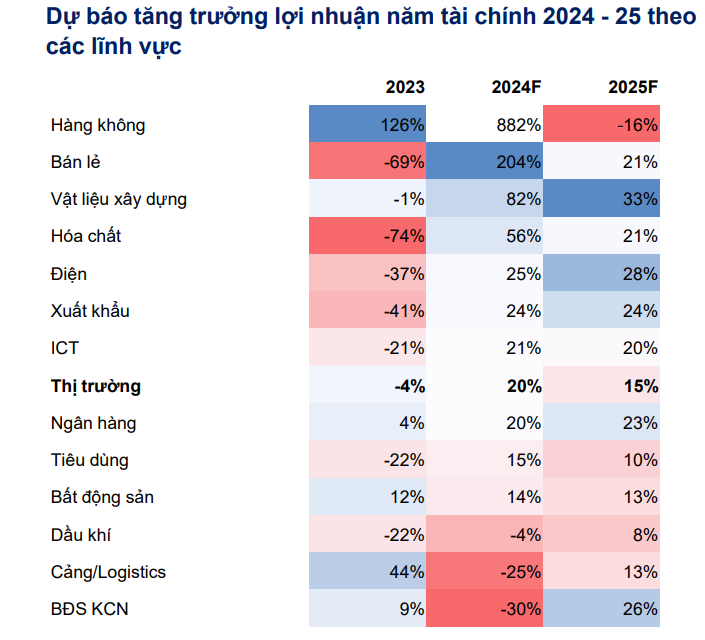

After a modest growth of only 5.3% in the first quarter of 2024, MBS Research predicts that total market profits in the second quarter will increase by 9.5% over the same period and respectively increase by 33.1% and 21.9% in the third and fourth quarters. For 2024, market profits are expected to increase by 20% from the low base of 2023. The main drivers will come from the solid business performance of the banking sector (up 20%), retail (up 204%), building materials (up 56%), and electricity (up 25%).

For the 2025 fiscal year, market profits are expected to continue to grow compared to 2024 but will decelerate to 15%. This growth is supported by the banking sector (up 23%), building materials (up 33%), industrial parks (up 26%), and electricity (up 28%).

Source: 2024 Mid-Year Investment Strategy Report by MBS Research

|

Source: 2024 Mid-Year Investment Strategy Report by MBS Research

|

MBS Research expects the economy to accelerate in the second half of 2024, driven by strong export growth and improved investment (both private and state sectors). GDP in 2024 is expected to grow by 6.7% compared to 2023, lower than the 7.9% of 2022 but higher than the government’s target of 6.5%.

In the second half of 2024, MBS Research will closely monitor the shift of central banks away from tight monetary policies, while predicting that the Fed will cut interest rates twice in 2024, bringing interest rates down to 4 – 4.25% by the end of 2025.

The macroeconomic outlook recovery indicates an improvement in projected income for the 2024-2025 fiscal year, signaling further market expansion.

Although there are signs of rising deposit interest rates, this increase is still lower than during the COVID-19 pandemic, which will attract capital inflows.

Exchange rate pressure is the top risk.

MBS Research also outlined the risks to be monitored for the second half of 2024. First, although the pressure on the VND is expected to ease in the second half of 2024 due to the Fed’s less rigid stance in the third quarter of 2024, the strength of the DXY (US Dollar Index) is projected to persist throughout the year. Along with the high demand for US dollars for export activities, MBS Research maintains that exchange rate pressure is the top risk, dampening foreign investors’ interest in the Vietnamese market.

MBS Research estimates that the CPI could rise in the second half, pushing the 2024 average to 4.3%, close to the government’s target. Any upward risk to inflation may cause the SBV to shift its priority towards inflation control rather than economic stimulus.

VN-Index is forecast to reach 1,350 – 1,380 by the end of the year.

“The recent strong increase has led some investors to question whether the market has peaked. However, we believe it has not reached its limit”, MBS Research stated.

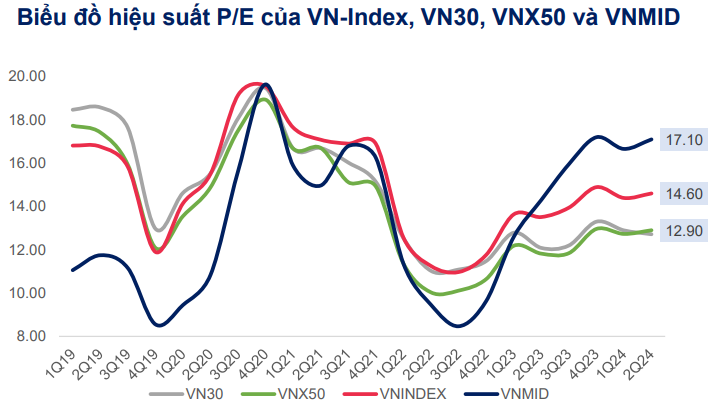

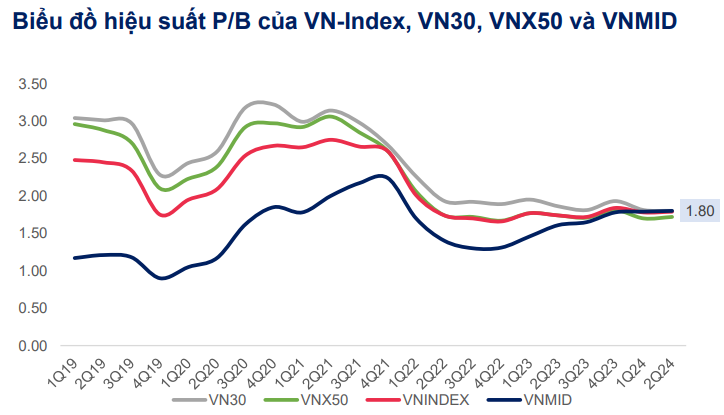

As of June 21, the VN-Index traded at 14.6 times P/E 12 months, 6% higher than the 3-year average (13.8 times) and 14% lower than the 3-year peak (16.7 times in Q4 2021).

However, the recent price increase of mid-cap stocks has pushed the VNMID valuation to 17.1 times P/E, about 17% higher than the VN-Index. Mid-cap stocks are currently trading at P/B levels equivalent to large-cap stocks. Meanwhile, the valuation of large-cap stocks (represented by VN30 and VNX50) is about 11% lower than the market average.

Source: 2024 Mid-Year Investment Strategy Report by MBS Research

|

Source: 2024 Mid-Year Investment Strategy Report by MBS Research

|

“We believe that the valuation of large-cap stocks seems attractive in terms of profit growth potential in the 2024-2025 fiscal year compared to other groups”, MBS Research opined. It also predicted that the VN-Index would reach 1,350 – 1,380 points by the end of 2024, after a 20% profit growth in the 2024 fiscal year and a target P/E of 12 – 12.5 times.

Will Vietnamese fruit and vegetable exports set a new record?

From the beginning of 2024, the export field of vegetables and fruits in Vietnam has received positive signals, with the estimated export turnover of over 500 million USD. With the current market trends, the vegetable and fruit industry is forecasted to set a new record and contribute 6-6.5 billion USD to the agricultural sector in 2024.