Chinese Electric Vehicles Are About to Flood Southeast Asia

According to the South China Morning Post, amidst pressure from tariffs in Europe and the US, many Chinese electric vehicle (EV) companies are gearing up to venture deeper into Southeast Asia, where the EV market size is nearing the $100 billion mark.

In May, the US imposed a 100% tariff on EVs imported from China. Chinese EV manufacturers are the latest casualties of the US-China trade war.

The European Union (EU) has also decided to impose tariffs of up to 38% from July 4 on three Chinese EV manufacturers: SAIC, Geely, and BYD. The decision came after an investigation found that Chinese automakers had benefited from Beijing’s “unfair support,” threatening the EV industry in Europe, where cars made by European companies can cost up to three times more than their Chinese counterparts.

Chinese EV companies are facing challenges in Western markets. Image: SCMP

Facing difficulties in Western countries, many Chinese automakers are shifting their focus to the Southeast Asian market, where the growing middle class promises to drive the trend towards EV adoption. BYD, Xpeng, and Geely have been pumping billions of dollars into Indonesia, Thailand, and Malaysia to expand their market share.

According to a report by EY-Parthenon, revenue from EV sales in Southeast Asia is expected to reach between $80 billion and $100 billion by 2035, a significant increase from the mere $2 billion in 2021.

Meanwhile, according to Counterpoint Research, EV sales in Southeast Asia in the first quarter of 2024 more than doubled from the same period last year, in contrast to a 7% decline in gasoline vehicle sales over the same period.

This is positive news for Chinese manufacturers, as over 70% of EVs sold in Southeast Asia come from Chinese automakers, with BYD leading the pack.

The Southeast Asian market is attracting Chinese EVs. Image: MarkLines

A Fierce Price War Could Ensue

With the domestic Chinese market slowing down, some automakers like Neta and Geely have announced plans for the Southeast Asian market, including introducing additional new models. Similarly, in a move to expand its presence in Southeast Asia, BYD is preparing to build a $1 billion factory in Indonesia, expected to begin operations in 2026.

While there are positive moves to attract consumer interest, high prices could be a hindrance for Chinese automakers in expanding their market share in the Southeast Asian EV market.

When Neta’s new and affordable V-II model was launched at the Jakarta EV motor show, the car was priced at around 200 million Indonesian rupiah (over $12,000) for the base model, which is 60 times the average monthly wage in Indonesia.

Chinese cars are not cheap. Image: HappeningBKK

In Malaysia, about 832,000 cars were registered last year, of which more than 300,000 were affordable models from domestic automakers Proton and Perodua. These cars were sold at an average price of 35,000 ringgit ($7,400), which is less than a third of the price of BYD’s most affordable electric car, the BYD Dolphin, which is priced at 99,900 ringgit.

A fierce price competition could unfold in Southeast Asia, similar to what happened in China. Image: SCMP

The push by Chinese companies into the Southeast Asian market could lead to a price war, according to Jiayu Li, a senior analyst at Global Counsel, a Singapore-based consulting firm.

“Fierce price competition among Chinese motorcycle manufacturers soon led to cost-cutting and compromised product quality, allowing Japanese motorcycle manufacturers to regain market share. Since then, motorcycle manufacturers have dominated the Southeast Asian market and maintained their market share at over 90%,” said Jiayu Li, citing the price competition in the Southeast Asian motorcycle market in the 2000s as an example.

Some analysts say the outlook in Southeast Asia may not be as rosy as Chinese EV manufacturers hope. Government incentives are said to be insufficient to encourage consumers to switch from gasoline to electric vehicles.

Chinese cars will need more campaigns to attract consumers to switch from gasoline to electric. Image: Motomobi

However, Wang Yanchen, CEO of the market research firm Shanghai Metals Market, said that all markets are now important to Chinese EV manufacturers, but emphasized that Southeast Asia has long-term growth potential and could be a goldmine for these companies to tap into.

“Southeast Asia is a developing market, and accessing this market is an important strategy for Chinese companies. Therefore, this market could become a ‘promised land’ for Chinese EV companies,” Wang stressed.

Petrovietnam and PVcomBank collaborate with Hanoi City to organize an artistic light show featuring 2,024 drones

Welcoming the Year of the Rat 2024, Petrovietnam, PVcomBank, together with Hanoi City People’s Committee and Tay Ho District People’s Committee, are organizing a dazzling light show called “Hanoi Art Light Festival – Thang Long Shining” on the eve of Lunar New Year. This will be the largest drone performance ever seen in Southeast Asia up until now, with a total of 2,024 unmanned aerial vehicles (drones) illuminating the night sky.

VinFast: Making its Move to Thailand – The Electric Car Paradise in Southeast Asia

VinFast is currently hiring for several positions to prepare for its business expansion in Thailand.

Vietnam Economy 2024: Reaching New Heights

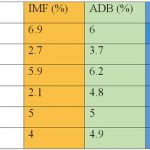

Vietnam has set a target to achieve an economic growth rate of 6-6.5% in 2024 – the Year of the Dragon. Our goal is within reach when compared to the growth forecasts of reputable global economic organizations such as the International Monetary Fund (IMF), the World Bank (WB), and the Asian Development Bank (ADB). Just like a cable car system, Vietnam’s economy has only one direction – moving forward, aiming for even greater heights.