Illustrative image

VietBank, a prominent commercial bank in Vietnam, has announced a new interest rate for deposits, effective July 9, 2024. This move positions VietBank as the latest addition to the list of banks that have increased their deposit interest rates in July.

Specifically, VietBank has raised interest rates by 0.3% for terms ranging from one to six months and by 0.1% for terms between seven and 36 months.

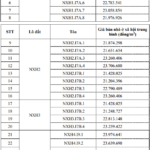

According to the bank’s online deposit interest rate schedule, the highest interest rate offered by VietBank, the one-month term now stands at 3.4% annually, followed by the two-month term at 3.5%, the three-month term at 3.6%, the four-month term at 3.7%, and the five-month term at 3.8%.

The interest rate for the six-month term has climbed to an impressive 4.9%. Meanwhile, terms ranging from seven to ten months enjoy a competitive 4.7% interest rate, and the 11-month term stands at 4.8%.

For longer-term deposits, the 12-month term earns an interest rate of 5.3%, the 14-month term offers 5.4%, and the 15-month term provides a rate of 5.6%.

Online depositors opting for the 16- to 17-month term can expect an interest rate of 5.8%. The highest interest rate of 5.9% is offered for terms ranging from 18 to 36 months.

VietBank’s Online Deposit Interest Rate Schedule

VietBank joins a growing list of banks offering interest rates nearing the 6% mark. Earlier in July, several banks, including Eximbank, NCB, SeABank, BaoVietBank, and Saigonbank, also adjusted their deposit interest rates upward. Notably, some banks have increased their interest rates for deposits under six months to 4.7%, approaching the ceiling rate of 4.75% set by the State Bank of Vietnam.

After reaching historic lows, deposit interest rates began to climb back up in late March and continued to rise in April, May, and June. In June alone, approximately 23 commercial banks raised their deposit interest rates, with many adjusting their rates two to three times.

Analysts attribute this trend to several factors. Firstly, the slow growth in deposits from individuals and businesses in the early months of the year, coupled with recovering credit growth, has prompted banks to offer higher interest rates to attract more deposits and maintain a balanced capital source. Additionally, the State Bank of Vietnam’s interventions through bond issuances and foreign currency sales have impacted the liquidity of Vietnamese dong in the banking system.

In their recently published July strategy report, Rong Viet Securities (VDSC) noted that deposit interest rates had recovered from their lows, with an average increase of 0.3-0.5 percentage points compared to the end of March 2024. However, interest rates remain slightly lower than they were at the end of last year. VDSC believes that an increase in deposit interest rates aligns with expectations regarding exchange rate movements and monetary policy.

Regarding exchange rates, the analysis suggests that pressure on the exchange rate will persist. This is due to the predicted strength of the US dollar, influenced by factors such as interest rate differentials between the US and other countries, expectations of rising inflation if Trump wins the upcoming US presidential election, and prolonged geopolitical risks driving demand for the US dollar as a safe-haven currency. Additionally, foreign currency demand for imports may increase again in the third quarter, further prolonging exchange rate pressures.

Meanwhile, the State Bank of Vietnam has been actively selling foreign currency to stabilize the exchange rate since April 22. It is estimated that the central bank has sold an amount equivalent to approximately 30% of last year’s foreign exchange usage. Looking ahead, VDSC suggests that a potential scenario to both protect foreign reserves and stabilize the exchange rate could involve a policy rate hike of 0.2-0.5 percentage points in the third quarter.

Another factor to consider is the expected recovery in credit growth in the second half of the year. As of the end of June 2024, credit growth reached 4.45% compared to the beginning of the year. While credit growth has been slow in the first half, VDSC anticipates a strong rebound towards the end of the year.

“This, combined with the net withdrawal of money through foreign currency sales, could put pressure on the liquidity of the banking system and interest rate environment in the second half of 2024,” the analysts noted.

However, VDSC does not expect a sudden surge in interest rates as seen in 2022. The macroeconomic context is different, lacking the shock factors that drove credit demand and abrupt monetary policy changes in 2022. Additionally, the pressure on foreign currency outflows is likely to ease significantly if there is a convergence in interest rates, with the Fed cutting rates while the State Bank of Vietnam raises them. Therefore, VDSC predicts a more gradual increase in interest rates, forecasting a rise of 0.5-1.0 percentage points to return to pre-pandemic average levels.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

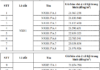

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.