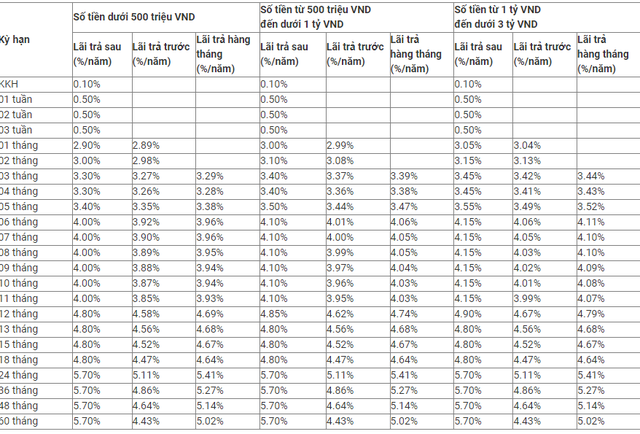

MB Bank’s Latest Savings Interest Rates have been officially adjusted as of today, July 10th.

According to MB Bank’s savings interest rate table for deposits below VND 500 million in the form of

post-paid interest:

The 1-month savings interest rate increased by 0.2% per year, reaching 2.9% per year.

The 3-month interest rate increased by 0.3% per year, climbing to 3.3% per year.

The 6-month interest rate witnessed a 0.2% annual hike, settling at 4% per year.

The 9-month interest rate experienced a modest increase of 0.1% per year, landing at 4% per year.

The 12-month interest rate rose by 0.1% per year, attaining a value of 4.8% per year.

The 24-36-month interest rate witnessed an uptick of 0.1% per year, peaking at 5.7% per year.

For deposits ranging from VND 500 million to less than VND 3 billion, MB Bank implemented an

increase of 0.05% per year for select tenors.

MB Bank’s Latest Savings Interest Rates for Over-the-Counter Deposits

Meanwhile, the savings interest rate table for online customers witnessed an average increase of

0.2-0.4% per year for tenors ranging from 1 to 36 months. Currently, the online savings interest rate

offered by MB Bank for the 24-36-month tenor stands at 5.9% per year.

Since the beginning of July, the market has observed seven banks raising their interest rates,

including SeABank, Eximbank, VIB, BaoVietBank, SaigonBank, VietBank, and MB.

At present, only a handful of banks are offering interest rates in the range of 6-6.1% per year for

24-36-month tenors, such as OceanBank and NCB. MB Bank, PGBank, VietBank, and BaoViet Bank

are jointly offering a rate of 5.9% per year for the same tenor.

International visitors “invade” New Year’s celebration; nearly 3,000 employees of The Gioi Di Dong quit their jobs

Móng Cái border gate welcomes nearly 1,000 entrants on the first day of the year; Feng Shui experts predict the economy in the Year of the Wooden Horse; Over 10,000 tons of rice distributed to residents in 17 provinces for Tet; Approximately 3,000 employees of Thế giới Di động resign… are notable news from the past week.