In SCG’s recently published document regarding their Q2 business performance and the first half of 2024, the Thai conglomerate revealed a pre-startup loss of 4,814 million Baht (including depreciation and interest expenses) for the Long Son Petrochemical Complex project, equivalent to approximately 3,390 billion VND.

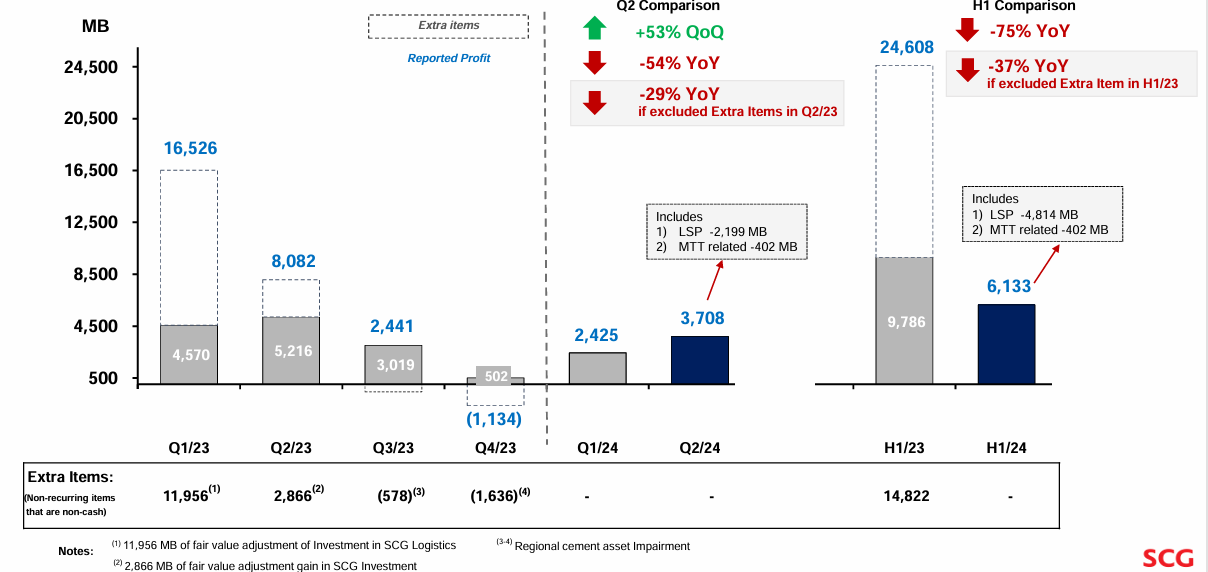

According to SCG’s disclosure, the conglomerate’s profit in Q2/2024 was 3,708 million Baht (over 2,600 billion VND), a decrease of 54% from the same period last year and a 29% drop when excluding extraordinary income. The loss from the Long Son Petrochemical Complex project amounted to 2,199 million Baht (over 1,500 billion VND).

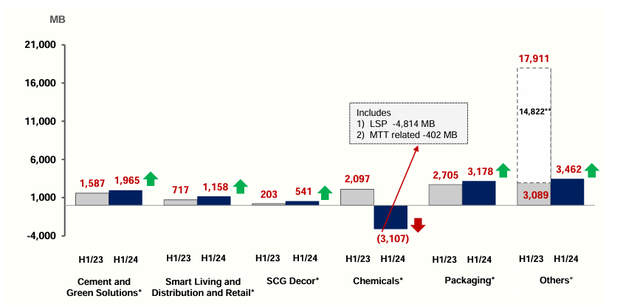

For the first six months, SCG’s profit was 6,133 million Baht (over 4,300 billion VND), a decrease of 75% from the same period last year and a 37% drop when excluding extraordinary income. Among SCG’s business segments, chemicals were the only segment to incur a loss due to the impact of the Long Son Petrochemical Complex’s loss and the MTT incident.

SCG also revealed that, according to their plan, the Long Son Petrochemical Complex project will restart the entire complex and proceed with test runs and commercial operations in October, with the speed determined by global demand.

Previously, on March 22, 2024, SCG announced that the Long Son Petrochemical Complex had encountered an unexpected technical issue during the test run. The complex was shut down from March to June for maintenance, modifications, and operational and management standard enhancements.

The Long Son Petrochemical Complex is invested by Long Son Petrochemicals Co., Ltd. (LSP) – a wholly-owned subsidiary of SCG Chemical (SCGC).

The Long Son Petrochemical Complex project was granted an investment certificate in July 2008, with an initial investment capital of 3.77 billion USD, which later increased to 4.5 billion USD and eventually reached 5.4 billion USD in the final phase.

This is the first and largest integrated petrochemical complex in Vietnam, spanning an area of 464 hectares of land and 194 hectares of water surface (for the seaport system). It is also the only Thai project in Vietnam with an investment of over 1 billion USD, accounting for more than 30% of the total registered investment capital.

Once operational, the complex will produce approximately 1.4 million tons of resin pellets annually – the raw material for manufacturing various plastic products used in daily life. The products from the complex are expected to replace imported polyolefins and enhance the competitiveness of downstream manufacturers in the domestic market.

The Long Son Petrochemical Complex is anticipated to have a significant spillover effect on the development of the petrochemical industry and downstream industries such as automobiles, electronics, electrical equipment, packaging, and other service sectors in Ba Ria – Vung Tau province and the key economic region of the South.

LSP’s leadership shared that the complex is expected to generate approximately 1.5 billion USD in revenue in 2024, contributing around 150 million USD in taxes to Ba Ria – Vung Tau province. Additionally, nearly 1,000 Vietnamese employees are expected to work at the complex.

SCG is one of the leading conglomerates in Southeast Asia, operating in three main business segments: Cement-Building Materials, Chemicals, and Packaging. SCG is no stranger to the Vietnamese market, having executed numerous M&A deals, big and small, over the past decade.

SCG began expanding its operations into Vietnam as a strategic country in 1992. Despite its relatively recent entry into the Vietnamese market, the conglomerate has completed over 20 M&A transactions, including deals worth several hundred million USD. One of the most notable acquisitions was the takeover of Prime Group, along with other well-known names such as Binh Minh Plastic, Duy Tan Plastic, Bien Hoa Packaging, and Tin Thanh Packaging…

Vietnam is currently the foreign market that contributes the highest revenue to SCG, with sales in the first six months of 2024 amounting to 23,733 million Baht (over 16,700 billion VND).

At the time of licensing in 2008, Long Son Petrochemicals Co., Ltd. (LSP) was a joint venture between SCG (holding 53%), Thai Plastic and Chemicals Company – also under SCG (holding 18%), Vietnam National Oil and Gas Group (PVN) (18%), and Vietnam National Chemical Group (Vinachem) (11%).

In 2018, when the Long Son Petrochemical Complex project officially broke ground, SCG acquired PVN’s remaining 29% stake, thus holding 100% ownership and becoming the sole investor in the project.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.