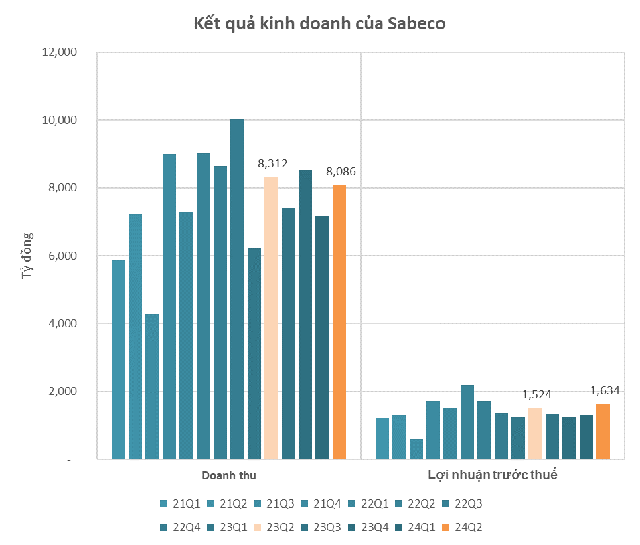

Vietnam’s leading beer, alcohol, and beverage company, Sabeco, has released its financial results for the second quarter of 2024. The company, with the stock code SAB, reported a slight decline in revenue of nearly 3% from the previous year, totaling 8,086 billion VND. However, their gross profit margin improved to 30.1%, a slight increase from the previous year’s figure of nearly 30%.

Sabeco attributed the revenue decline to the strict enforcement of Decree 100 and increasing market competition, which impacted consumption patterns. Despite this, the company’s profit after tax for the quarter rose to 1,248 billion VND, an increase of nearly 8% from the previous year. This marks the second consecutive quarter of profit growth for Sabeco, and the highest profit in the last seven quarters.

The main reason for Sabeco’s improved profitability, despite the revenue decline, is their successful cost-cutting measures. In the second quarter of 2024, the company reduced its financial, sales, and management expenses.

According to the financial statements, Sabeco’s advertising and promotion expenses accounted for the largest proportion of costs in the first half of the year. This expense decreased by 16% compared to the previous year, totaling 1,031 billion VND, and contributed significantly to the company’s profit growth during this period.

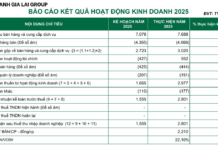

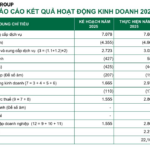

For the first six months of 2024, Sabeco achieved impressive results with a total revenue of 15,270 billion VND and a net profit of 2,246 billion VND, representing a 5% and nearly 6% increase, respectively, from the previous year. With these results, the company has already achieved 44% of its annual revenue target and 51% of its profit goal.

As of June 30, Sabeco’s total assets amounted to 34,154 billion VND, with cash and bank deposits accounting for the largest proportion (68%) of their asset structure, totaling 23,362 billion VND. This significant cash position earned the company 533 billion VND in interest income during the first half of the year, equivalent to nearly 3 billion VND per day. The company’s equity stood at 25,130 billion VND, including 9,823 billion VND in undistributed post-tax profits.

HDBank Investor Conference: Continuing the Path of High and Sustainable Growth

On the morning of February 1, 2024, HDBank (Stock code: HDB) – Ho Chi Minh City Development Joint Stock Commercial Bank, organized the Investor Conference to provide updates on its business performance in 2023 as well as share information on certain directions and prospects for 2024.