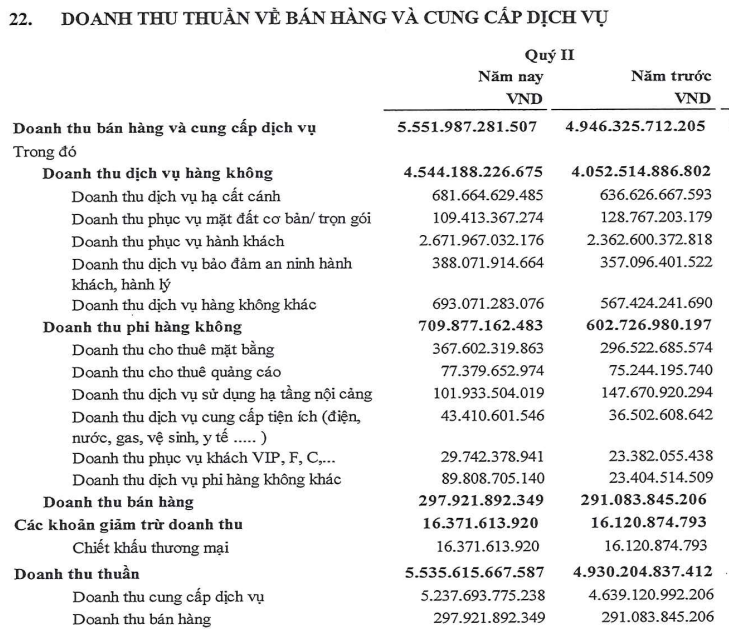

Q2 Business Results for ACV

Unit: Billion VND

Source: VietstockFinance

|

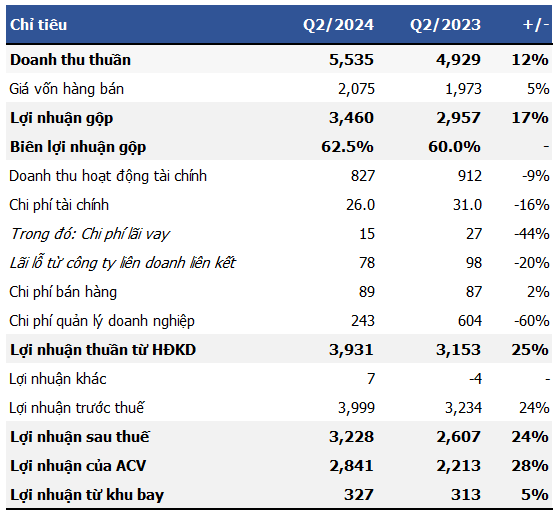

According to the Q2 financial report, ACV recorded a 12% year-on-year increase in net revenue, reaching 5,535 billion VND. Notably, gross profit surpassed 3,460 billion VND, a 17% increase. This resulted in ACV achieving a remarkable gross profit margin of 62.5%.

A closer look at the revenue structure reveals growth in both main segments. Aviation services revenue increased from 4,050 billion VND to 4,550 billion VND, while non-aviation revenue rose from 600 billion VND to 700 billion VND.

At the 2024 annual meeting, CEO Vu The Phiet shared that ACV has shifted its non-aviation segment towards a revenue-sharing business collaboration model with partners providing services at the airport. Mr. Phiet expressed confidence in the strong future growth of this segment.

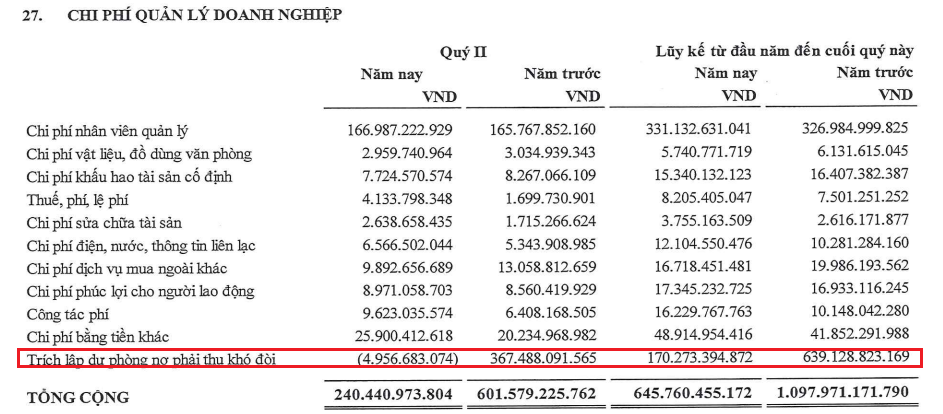

Another notable aspect is ACV’s 60% reduction in management expenses, totaling 243 billion VND. This was largely due to the absence of provisions for doubtful accounts receivable from airlines.

On a less positive note, financial revenue decreased by nearly 80 billion VND to approximately 830 billion VND, mainly due to a decline in interest income.

Finally, ACV achieved a record-high after-tax profit of 3,228 billion VND, a 24% year-on-year increase and the highest in its history. Of this, ACV’s profit was 2,840 billion VND, and the remaining 330 billion VND came from the management of airport areas assigned by the State.

Achieving 81% of Profit Target

The financial picture for ACV becomes even more impressive for the first six months of the year. Net revenue reached nearly 11,200 billion VND, and after-tax profit was 6,150 billion VND, representing increases of 16% and 45%, respectively, compared to the same period last year. By the half-year mark, ACV had accomplished 56% of its revenue target and a remarkable 81% of its profit target for the year.

Explaining these results, ACV attributed the impressive profit increase to the strong recovery of international passengers in the first six months, despite a slight decrease in total passenger volume compared to the previous year. Specifically, the number of international passengers reached nearly 20.3 million, a nearly 40% increase year-on-year. This was accompanied by a significant 27% rise in international aircraft take-off and landing volumes, totaling 126,703 flights.

Cargo transportation activities also played a significant role in ACV’s success. Cargo and mail volumes reached nearly 730,000 tons, a 26% increase year-on-year. International cargo accounted for 498,000 tons, a 21% increase, while domestic cargo reached 231,000 tons, a 36% surge.

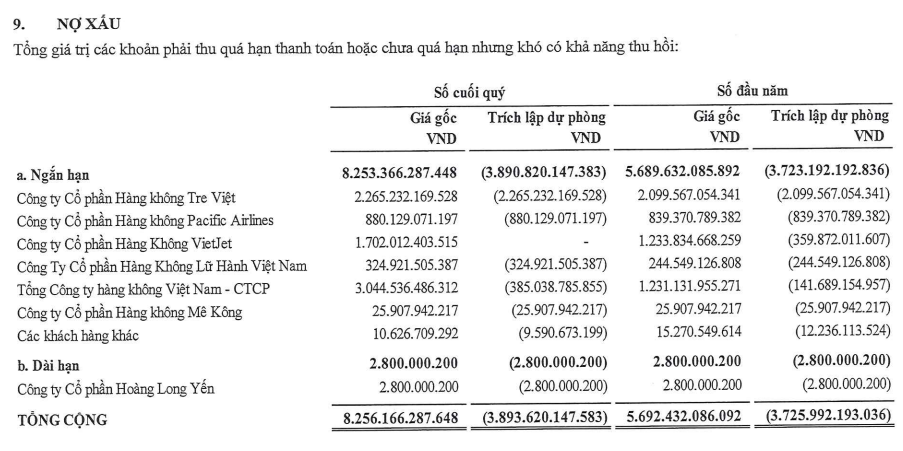

However, ACV’s financial picture is not entirely rosy. As of the end of June, the company’s non-performing loans had increased significantly by 45% from the beginning of the year, reaching 8,256 billion VND. ACV has made provisions of nearly 3,900 billion VND.