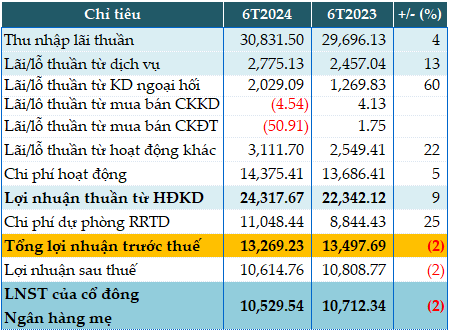

In the first half of 2024, Agribank recorded a gross interest income of nearly VND 30,832 billion, a 4% increase compared to the same period last year.

Service income reached over VND 2,775 billion, a 13% increase, due to reduced payment service charges. Foreign exchange activities yielded a profit of more than VND 2,029 billion, a significant 60% increase, attributed to higher earnings from currency-related financial derivatives.

Despite a loss in securities investment activities, other operations made up for it with a 22% increase in profit compared to the previous year, totaling nearly VND 3,112 billion, due to higher earnings from recovered principal debts.

Consequently, the bank’s net profit from business operations reached VND 24,317 billion, a 9% increase year-on-year. During this period, Agribank increased its credit risk provision by 25%, allocating VND 11,048 billion. As a result, pre-tax profit stood at VND 13,269 billion, a slight 2% decrease.

|

Agribank’s Business Results for the First Half of 2024. Unit: Billion VND

Source: VietstockFinance

|

As of the second quarter, Agribank’s total assets increased by 2% from the beginning of the year to over VND 2 quadrillion. Specifically, funds deposited at the State Bank of Vietnam decreased by 18% to VND 18,864 billion, while trading securities increased to VND 108 billion from nearly VND 11 billion at the beginning of the year. Loans to customers also increased by 3%, totaling over VND 1.59 quadrillion…

On the funding side, deposits from other credit institutions surged to VND 13,168 billion, a sixfold increase from the beginning of the year. Customer deposits slightly increased by 1% to over VND 1.83 quadrillion. The bank no longer recorded financial derivatives and other financial liabilities, which stood at nearly VND 1,629 billion at the beginning of the year.

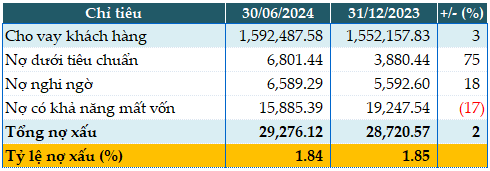

As of June 30, 2024, Agribank’s total non-performing loans amounted to VND 29,276 billion, a 2% increase from the beginning of the year. The non-performing loan ratio to total loans slightly decreased from 1.85% to 1.84% during this period.

|

Agribank’s Loan Quality as of June 30, 2024. Unit: Billion VND

Source: VietstockFinance

|