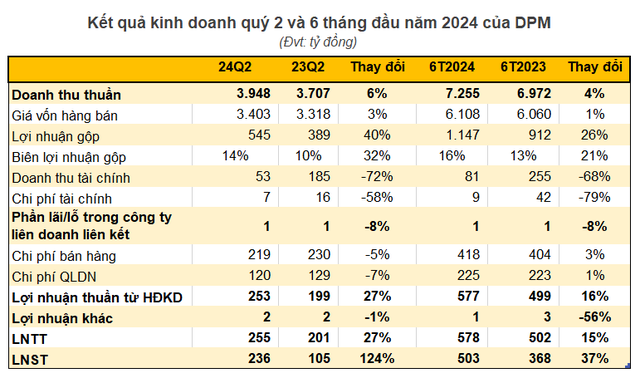

According to the recently released financial report for Q2 2024, PetroVietnam Fertilizer and Chemical Corporation – JSC (Phu My Fertilizer, code: DPM) recorded a slight 6% year-on-year increase in net revenue, reaching VND 3,948 billion. After deducting the cost of goods sold, the company reported a gross profit of VND 545 billion, a significant 40% surge compared to Q2 2023. Concurrently, the gross profit margin improved from 10% in the previous year to 14% in Q2 2024.

In terms of financial activities, financial income witnessed a sharp decline of 72% year-on-year, amounting to VND 53 billion. Additionally, financial expenses were reduced by 58%, totaling approximately VND 7 billion. Phu My Fertilizer successfully lowered selling expenses (down 5%) and administrative expenses (down 7%), amounting to VND 219 billion and VND 120 billion, respectively. Profit from joint ventures and associates remained relatively unchanged, reaching a mere VND 1 billion.

Consequently, the fertilizer company reported a net profit of nearly VND 236 billion, reflecting a remarkable 124% year-on-year growth. The net profit attributable to the parent company’s shareholders stood at approximately VND 231 billion, representing an increase of nearly 129% compared to the same period in 2023.

For the first six months of 2024, DPM recorded net revenue of VND 7,255 billion and a net profit of VND 503 billion, signifying growth of 4% and 37%, respectively, compared to the same period last year.

Looking at the full year 2024, Phu My Fertilizer has set targets for revenue and net profit at VND 12,755 billion and VND 542 billion, respectively. With the results achieved in the first half, the company has accomplished 57% of its revenue target and 93% of its net profit goal.

As of June 30, 2024, Phu My Fertilizer’s total assets stood at VND 15,740 billion, reflecting an 18% increase from the beginning of the year (equivalent to a rise of VND 2,431 billion). This comprised primarily of current assets valued at VND 12,250 billion. Cash, cash equivalents, and deposits exceeded VND 9,700 billion, accounting for 62% of total assets. This figure represents an increase of nearly VND 3,100 billion compared to the start of the year.

On the other side of the balance sheet, the company’s total liabilities amounted to VND 3,758 billion, doubling from the beginning of the year. Short-term borrowings of VND 1,682 billion were incurred during Q2, as there were no such borrowings at the start of the year. Shareholders’ equity reached VND 11,982 billion, and retained earnings as of Q2 2024 stood at VND 3,268 billion.

In the stock market, DPM shares are currently trading at VND 35,300 per share, representing a modest 7% increase since the beginning of the year.