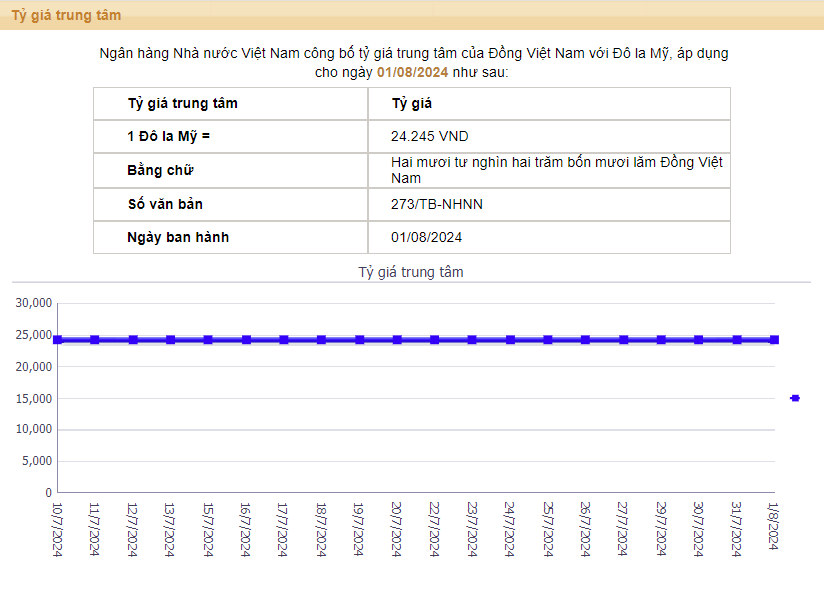

Source: SBV

With a +/- 5% margin, the ceiling exchange rate applied by banks is 25,457 VND/USD, and the floor rate is 23,032 VND/USD.

This morning, the State Bank of Vietnam’s Trading Centre continued to list the buying and selling prices of USD at 23,400 – 25,450 VND/USD.

Meanwhile, many banks have made significant adjustments to their buying and selling prices of the greenback, with a common margin of 50 – 85 VND compared to the previous session.

| USD Exchange Rate | Buy | Sell |

| Vietcombank | 25,020 | 25,390 |

| VietinBank | 25,039 | 25,379 |

| BIDV | 25,065 | 25,405 |

| Techcombank | 24,977 | 25,370 |

| Eximbank | 25,010 | 25,456 |

Specifically, at 9:40 am this morning, Vietcombank listed the buying and selling prices of USD at 25,020 – 25,390 VND/USD, a decrease of 65 VND on both sides compared to the same period yesterday.

BIDV listed the buying and selling prices of USD at 25,065 – 25,405 VND/USD, a reduction of 50 VND on both sides from the previous session.

Techcombank listed the exchange rate at 24,977 – 25,370 VND/USD, an 83 VND drop on both buying and selling sides compared to yesterday.

At Eximbank, the USD/VND exchange rate was listed at 25,010 – 25,456 VND/USD, a decrease of 70 VND on the buying side and 11 VND on the selling side from the previous day.

According to a survey, the lowest buying price of USD among banks is currently at 24,790 VND/USD at NCB, while the highest buying price is 25,240 VND/USD at Hong Leong. On the selling side, the lowest selling price is listed at 25,355 VND/USD at NCB, and the highest selling price is 25,469 VND/USD at OCB.

At the same time, the USD exchange rate in the self-negotiated market in Hanoi is traded at 25,614 – 25,684 VND/USD (buying – selling), a decrease of 38 VND on the buying side and 58 VND on the selling side compared to the previous session.

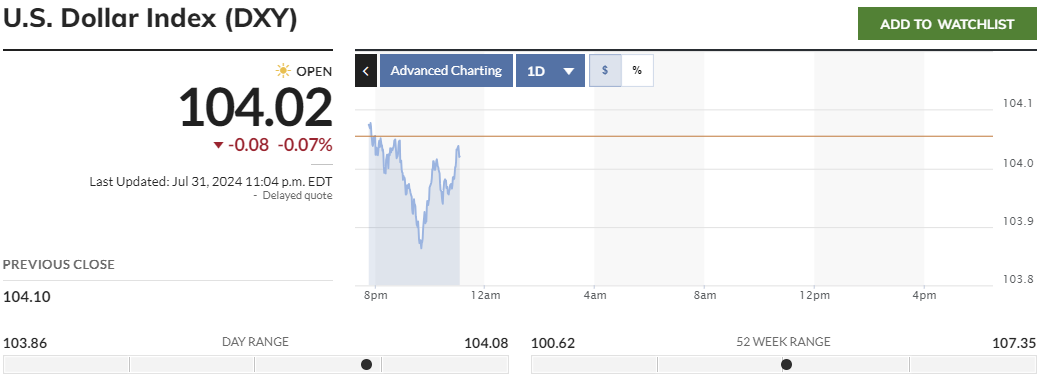

Meanwhile, in the global market, the US Dollar Index (DXY) – which measures the strength of the US dollar against a basket of major currencies, stands at 104.02 points, down 0.07% from the previous session.

Source: MarketWatch

The US dollar extended its decline, with the DXY touching a two-week low after the US Federal Reserve signaled its readiness to cut interest rates in September amid improved inflation data.

The US central bank kept the federal funds rate unchanged as expected and noted that while still high, inflation has eased and is moving towards its 2% target.

The market prices in a 25-basis-point rate cut in September, with over 70 basis points in total easing expected this year.

On the data front, economic indicators, including the ADP report and second-quarter employment costs, suggest a cooling labor market, while investors await the monthly employment report due tomorrow (August 2).

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

New currency exchange service: Rare small denominations

The demand for exchanging small denominations of money increases during the Lunar New Year, but the availability of small bills is limited. The familiar “money exchange kiosks” are also gradually disappearing from this service.