The market has fully reflected the Q2 business results, while the news of the Middle East conflict has sent the VN-Index spiraling downwards. The index lost its footing at the start of the session, with selling pressure intensifying towards the end, resulting in a steep decline of nearly 25 points to close at 1,226.96.

Stocks were engulfed in a sea of red, with 423 tickers plummeting while only 45 managed to stay afloat. No sector remained in positive territory. Notably, telecommunications services plunged by 11.25%, primarily due to a 14.63% drop in VGI and a 6.44% fall in ELC. The financial sector followed suit with a 4.49% loss. Several other sectors witnessed average declines of 2-3%, including Construction Materials down 3.24%, Transportation decreasing by 2.39%, and Retail contracting by 2.16%. Consumer Goods and Real Estate also took a hit, falling by 3.02% and 2.63%, respectively. Banks didn’t escape the rout, shedding 1%.

The top stocks dragging the market down included GVR, which wiped out 1.55 points, and FPT, erasing 1.35 points. Among banks, MBB, BID, and VPB combined to knock off more than 3 points. On the flip side, VCB single-handedly tried to prop up the index, clawing back 2.04 points, but it wasn’t enough to reverse the downward trend.

On a positive note, market liquidity across the three exchanges surged to a high of 24,600 billion VND in matched orders, indicating a significant presence of bargain hunters. Foreign investors turned net buyers, with a slight net purchase of 119.7 billion VND. Specifically, in matched orders, they net bought 69.2 billion VND.

Foreign investors’ main net purchases in matched orders were in the Food & Beverage and Retail sectors. The top stocks they net bought included VCB, VNM, MWG, MSN, DBC, BID, GMD, PLX, PVD, and VCI.

On the selling side, their main net sales in matched orders were in the Financial Services sector. The top stocks they net sold included FPT, SSI, VIX, CTG, VPB, HDB, PDR, CTR, and FUESSVFL.

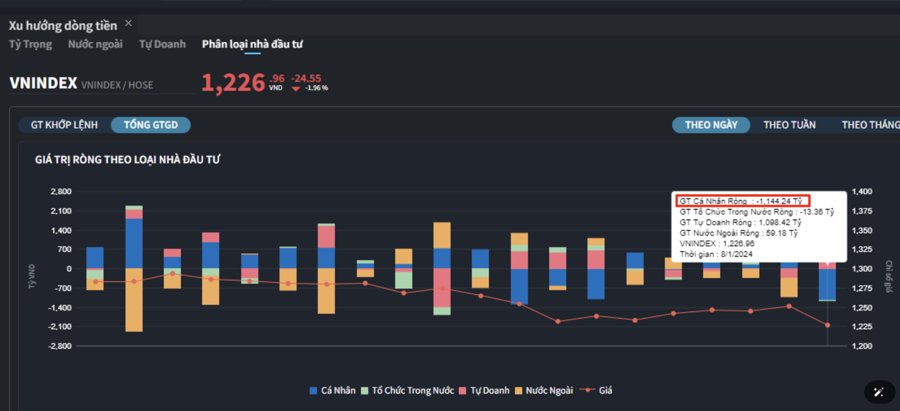

Individual investors net sold 1,144.2 billion VND, with net selling of 1,161.9 billion VND in matched orders.

In terms of matched orders, they net bought 7 out of 18 sectors, mainly in Financial Services. Their top net purchases included FPT, SSI, HAH, VIX, NKG, TCH, BCM, BAF, PDR, and CTR.

On the net selling side in matched orders, they net sold 11 out of 18 sectors, primarily in Banks, Food & Beverage, and Real Estate. Their top net sales included VCB, VNM, MWG, MSN, TCB, MBB, PLX, PNJ, and GMD.

Proprietary trading accounts net bought 1,098.4 billion VND, with net purchases of 1,161.9 billion VND in matched orders.

Focusing on matched orders, proprietary trading accounts net bought 16 out of 18 sectors. The sectors with the largest net purchases were Banks, Food & Beverage, and Real Estate. The top net purchases for these accounts today included TCB, FPT, VNM, SBT, MBB, VIC, PNJ, HVN, HPG, and VPB. The top net sales were in Media & Publishing. The top stocks net sold included FUEVFVND, E1VFVN30, FUEVN100, GAS, TLG, NTL, FUEDCMID, FUESSV50, FUESSV30, and FUEMAV30.

Domestic institutional investors net sold 13.4 billion VND, with net sales of 69.2 billion VND in matched orders.

Drilling down to matched orders, domestic institutions net sold 10 out of 18 sectors, with the largest net sales in Real Estate. Their top net sales included HPG, BCM, HAH, FPT, NKG, ACB, BAF, FUESSVFL, FUEVFVND, and NLG. The sector with the largest net purchases was Banks. The top net purchases included STB, MBB, PLX, VCB, GEX, NAB, TPB, BID, GMD, and MSN.

Block trading value today reached 1,388.6 billion VND, a decrease of 42.9% compared to the previous session, contributing 5.7% to the total trading value.

Notable block trades occurred between foreign institutions in large-cap stocks (MWG, VHM, PNJ, CTG, ACB, MBB) and CMG.

Additionally, individual investors continued to trade in the Banking sector (MSB, CTG, TCB) and KOS.

Money flow allocation shifted away from Banks, Steel, Food & Beverage, Retail, Oil & Gas Production, and Gasoline Distribution, while increasing in Real Estate, Securities, Chemicals, Software, Warehousing & Logistics, Aquaculture & Seafood, Textiles, Oil & Gas Equipment & Services, and Water Transportation.

Specifically, in matched orders, money flow allocation increased in mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in large-cap (VN30) stocks.