| Quarterly Financial Results for TAL |

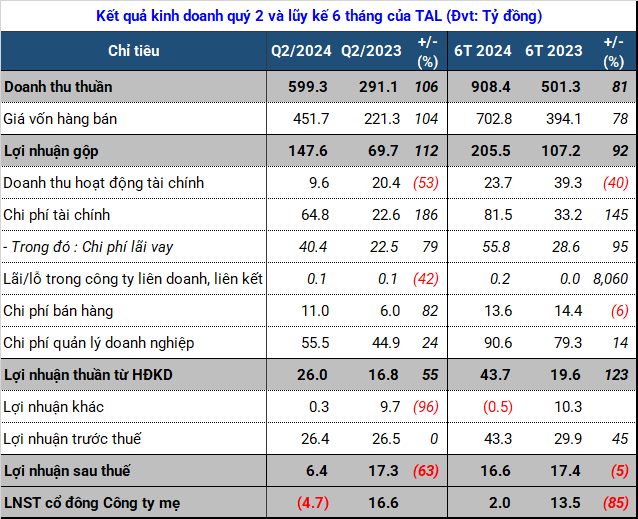

In the second quarter, TAL witnessed a significant surge in revenue, doubling that of the same period last year. This impressive growth was accompanied by a notable increase in gross profit, which reached 147 billion VND, attributed to a smaller rise in cost of goods sold.

However, there were also some setbacks. For instance, finance-related income witnessed a sharp decline, dropping to nearly 10 billion VND, less than half of the previous year’s figure. On the expense side, financial costs spiked by 186% to 65 billion VND, with interest expenses almost doubling to over 40 billion VND.

The substantial revenue growth also led to notable increases in selling and management expenses, which rose by 82% and 24% respectively, totaling 11 billion VND and 55 billion VND. Additionally, TAL did not record any profit from other sources during this period.

As a result, the real estate company suffered a net loss of 4.7 billion VND in the second quarter, a stark contrast to the 16.6 billion VND profit recorded in the previous year. This disappointing performance resulted in a meager net profit of nearly 2 billion VND for the first six months, reflecting an 85% decrease. TAL has only achieved 3% of its annual profit target so far.

On a more positive note, revenue for the first half of the year showed a promising increase of 81%, reaching 908 billion VND. This growth was primarily driven by a 2.3-fold increase in real estate transfers, totaling 539 billion VND. The company has achieved 30% of its annual revenue target.

Source: VietstockFinance

|

As of June 30, 2024, TAL‘s total assets stood at nearly 9.7 trillion VND, a slight decrease from the beginning of the year. Inventory, which accounted for approximately 38% of the company’s assets, remained largely unchanged at 3.7 trillion VND. Cash and cash equivalents, however, saw a significant drop, halving to 146 billion VND.

In the second quarter, real estate inventories continued to decrease for projects such as Alacarte Ha Long, which saw a reduction of 39 billion VND from the previous quarter, leaving 116 billion VND in inventory. The N01-T6 Doan Ngoai Giao project also witnessed a substantial decline, leaving just over 10 billion VND in inventory, a decrease of 47 billion VND.

Short-term receivables remained relatively stable at 1.4 trillion VND, while other short-term receivables increased by 169 billion VND to 238 billion VND. This increase was mainly due to bid deposits for projects, totaling 159 billion VND. Receivables from long-term loans, on the other hand, decreased by 513 billion VND to 318 billion VND.

There were minimal fluctuations in the construction work in progress for various projects, except for the Dong Van 3 – Ha Nam industrial park project, which saw a significant increase from 22 billion VND to 409 billion VND, mostly during the second quarter. Payables remained steady at over 1.1 trillion VND, but the amount of capital contributions and profit-sharing for real estate projects decreased by 197 billion VND to 888 billion VND.

During this period, the real estate company increased its ownership in Yen Binh Investment and Services Joint Stock Company from 74% to 84% by acquiring a 12.3 billion VND stake from another shareholder. This subsidiary primarily focuses on construction finishing, installation of water supply and drainage systems, and air conditioning for construction projects.

TAL also established a new subsidiary, Taseco Hai Phong Joint Stock Company, with a chartered capital of 20 billion VND. The company is expected to hold a 50.5% stake in this subsidiary, which operates in the real estate sector, although it has not yet contributed capital.

At the beginning of July, TAL‘s Board of Directors decided to dissolve Hai Ha Trading Joint Stock Company as the company no longer intended to pursue business operations. Hai Ha, located in the new urban area of Bac Dai Lo Le Loi, Dong Hung district, Thanh Hoa city, Thanh Hoa province, specialized in real estate investment and trading. As of the end of the second quarter, TAL held a 35% stake in Hai Ha, with an investment value of approximately 7.8 billion VND.

The leadership of TAL recently approved a maximum borrowing limit of over 1 trillion VND from the Vietnam Foreign Trade Joint Stock Bank (Vietcombank) – Hanoi Branch. The borrowing term is set for a maximum of 3 years.

In May, the company also decided to borrow more than 1.7 trillion VND over a 5-year term from the Vietnam Industrial and Commercial Bank (Vietinbank) – Hanoi Branch and the Vietnam Bank for Investment and Development (BIDV) – Transaction Office 1 Branch. These funds are intended for the implementation of the project to invest in the construction and business of infrastructure of the Dong Van 3 supporting industrial park, east of the Cau Gie – Ninh Binh expressway.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.

Surging Profits from Associated Joint Venture, Nam Long (NLG) Reports After-Tax Profit of over 800 billion VND in 2023

According to NLG, the primary revenue for the entire year came from the sale of houses and apartments, from two major projects Izumi and Southgate. Additionally, in the third quarter, NLG also had the Mizuki project, which was a significant handover project.