Illustration.

Oil Falls as Global Stock Selloff Offsets Rising Mideast Tensions

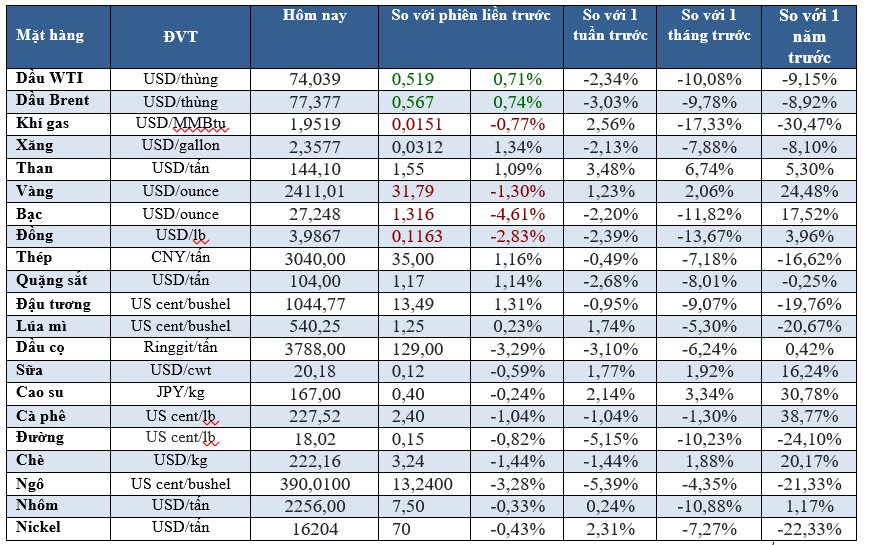

Oil prices declined as a selloff in global stock markets continued, though losses were curbed by concerns that Iran might retaliate for the assassination of a Hamas leader in Tehran, potentially leading to a broader war in the Middle East. Brent crude fell 0.66%, with prices trading around the lowest level since January 2024. WTI crude decreased by 0.79%.

Gold Slides Over 1% on Global Selloff, Recession Fears

Gold prices dropped over 1% as a selloff across global markets and mounting fears of an economic recession hurt demand for the precious metal. After plunging 3.2% earlier in the session, gold slightly recovered, limiting intraday losses to 1.6%. Platinum and palladium also fell as they are used to curb vehicle emissions.

Iron Ore Climbs to Two-Week High on Improved China Economic Outlook

Iron ore futures rose to a two-week high, buoyed by an improved economic outlook for China following strong services data and expectations of further stimulus measures. The most-traded September iron ore contract on the DCE ended the day 1.97% higher.

Copper Hits 4-1/2 Month Low on Weakening Demand Outlook

Copper prices fell to a 4-1/2 month low as the demand outlook weakened in China and the US, the world’s two largest economies. Industrial activity indicators in China have weighed on copper prices on the LME in recent months, with prices dropping 20% since reaching a record high above $11,100 in May.

Raw Sugar Near Two-Year Low, Cocoa Rebounds

Raw sugar futures on ICE fell to a near two-year low as positive production prospects in Asia weighed on the market, along with concerns that dry weather in Brazil could curb output. Cocoa prices, however, rebounded strongly after touching a two-and-a-half-month low, supported by improved prospects for the 2024/25 crop in West Africa.

Rubber, Coffee, and Wheat Also in Focus

Japanese rubber futures rose over 1% due to unfavorable weather in Thailand. Coffee futures declined, with robusta coffee for September falling to a 2-1/2 month low, while arabica coffee for September hit a 1-1/2 month low. Wheat prices fell amid global financial market turmoil and expectations of a large US crop.

Market Update on February 3rd: Crude oil, gold, copper, iron and steel, and rubber all decline together.

At the close of trading on February 2nd, the prices of oil, gold, copper, steel, rubber, and coffee all saw a simultaneous decrease, with iron ore hitting a two-week low.