On August 5, the Hanoi Tax Department issued an administrative penalty for tax violations against Dat Phuong Joint Stock Group Corporation (HOSE: DPG) for an amount of over 23 million VND due to incorrect tax declaration, resulting in an underpayment of taxes.

Consequently, the company is required to pay an additional corporate income tax of nearly 117 million VND and a late payment fee of 16.5 million VND. The total amount of tax-related penalties imposed on DPG is nearly 157 million VND. The deadline for settling these issues is August 15, 2024.

This is not the first time that Dat Phuong has faced tax-related penalties. The construction company has a history of similar violations, with tax penalties of nearly 235 million VND in early 2023 and approximately 94 million VND in early 2022.

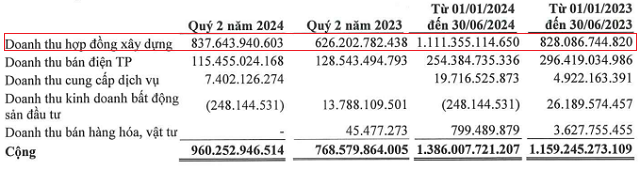

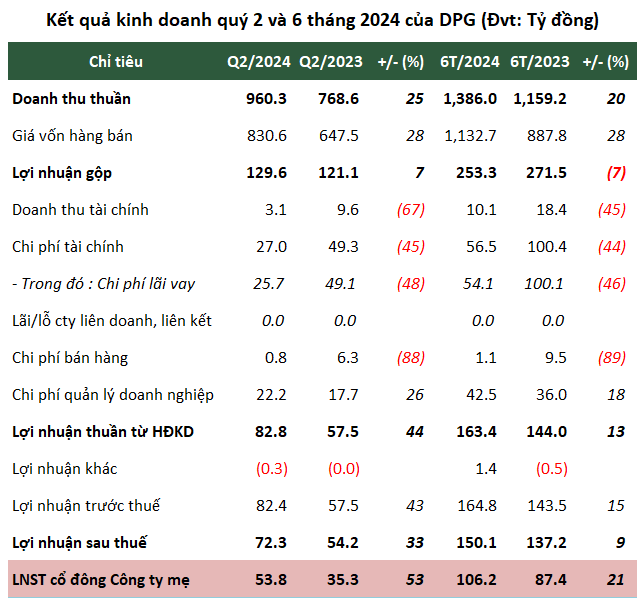

In terms of business performance, for the second quarter of 2024, Dat Phuong reported a revenue of over 960 billion VND and a net profit of nearly 54 billion VND, representing a 25% and 53% increase, respectively, compared to the same period last year. The majority of the revenue was generated from construction contracts totaling nearly 838 billion VND, a 34% increase, while revenue from electricity sales exceeded 115 billion VND, a 10% decrease.

Source: DPG

|

Dat Phuong attributed the decrease in revenue and gross profit in the electricity production sector for the second quarter of 2024 to unfavorable hydrological conditions. Additionally, the stagnant real estate market and weak consumer demand resulted in no revenue or profit contribution from this segment.

However, the company’s profit increased due to a reduction in expenses, particularly financial costs. Total expenses for the period amounted to 50 billion VND, a 32% decrease, including interest expenses of nearly 26 billion VND, a 48% decline compared to the previous year.

For the first six months of 2024, Dat Phuong recorded a revenue of 1,386 billion VND and a net profit of over 106 billion VND, representing a 20% and 21% increase, respectively, compared to the same period in 2023. With a target of achieving 4,566 billion VND in revenue and a net profit of more than 254 billion VND for the full year, the company has accomplished 30% and 42% of these goals, respectively.

Source: VietstockFinance

|

Despite the positive financial results, DPG’s total assets as of June 30, 2024, decreased by 8% compared to the beginning of the year, amounting to nearly 6,146 billion VND. This includes cash and cash equivalents of nearly 814 billion VND, a 43% reduction, and short-term financial investments of approximately 72 billion VND, a 67% decrease.

Meanwhile, inventory increased by 10% to over 1,258 billion VND, mainly comprising production and business costs related to the construction segment (570 billion VND) and the real estate segment (nearly 631 billion VND). Incomplete construction costs also rose by 11% to 487 billion VND, largely associated with urban area development projects.

As of June 30, 2024, DPG’s total liabilities stood at over 3,662 billion VND, a 16% decrease from the beginning of the year. This reduction was primarily due to a 12% decline in financial debt, which amounted to over 2,236 billion VND and accounted for 61% of total liabilities. Additionally, short-term prepayments from customers decreased by 25% to nearly 955 billion VND, representing 26% of total liabilities.

Thanh Tú

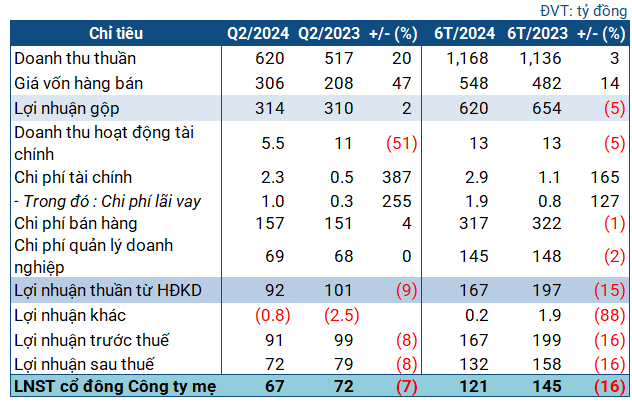

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.