Cracking Down on Speculation and Profiteering

In recent times, the Ho Chi Minh City People’s Committee has decided to establish a task force for ensuring security in the gold market, led by the Ho Chi Minh City Police. This task force will be responsible for gathering information on buyers of SJC gold bars, inspecting and examining the compliance of gold buying and selling establishments with legal regulations, and handling organizations and individuals who show signs of speculation and profiteering, thus destabilizing the gold market.

Lieutenant Colonel Le Manh Ha, Deputy Chief of Staff of the Ho Chi Minh City Police, stated that the collection of information on gold buyers and sellers aims to prevent speculation and ensure secrecy, protecting the legitimate rights and interests of the people and jewelry businesses.

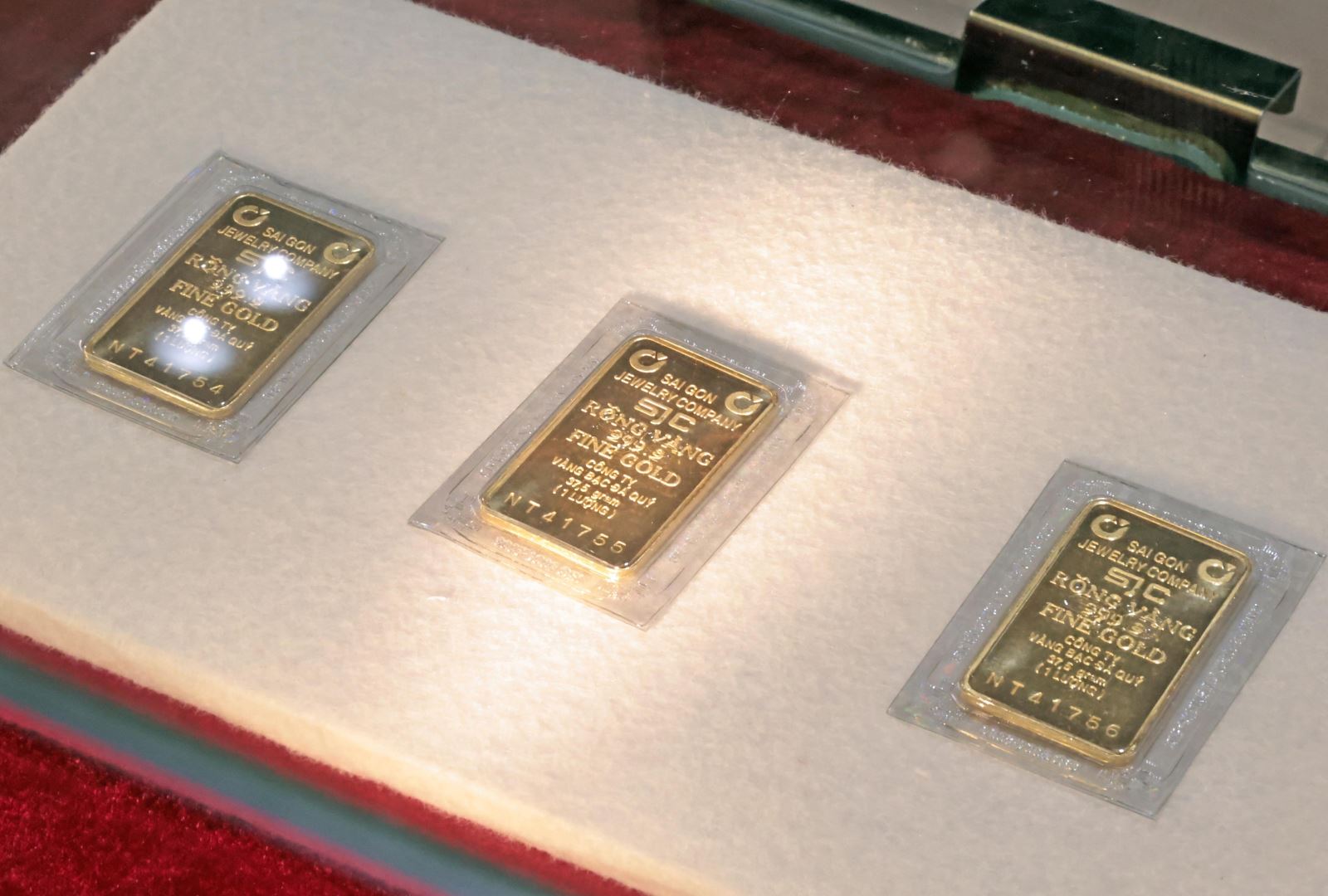

According to Mr. Nguyen Duc Lenh, Deputy Director of the State Bank branch in Ho Chi Minh City, the State Bank has implemented a solution to sell gold directly to the people through SJC and four state-owned commercial banks (Agribank, BIDV, Vietcombank, and VietinBank). This solution aims to enhance state management of the gold market, narrow the gap between domestic and world gold prices, contribute to stabilizing the financial and monetary market, and thereby positively impact socio-economic development. Therefore, buyers of gold bars need to choose the right location and comply with the regulations and requirements in trading activities, such as presenting their ID cards or citizen identification cards, providing buyer information, ensuring invoices and transparency in transactions, etc.

The direct sale of gold by state-owned commercial banks is one of the solutions to prevent market manipulation.

Mr. Dao Xuan Tuan, Director of the Foreign Exchange Management Department (State Bank), emphasized that the coordination between state management agencies in managing the gold market has never been better. The customs and police forces have cracked down on many gold smuggling cases, and the Ministry of Finance and the General Department of Taxation have collaborated on invoice management, all of which have provided valuable support in regulating the gold market.

Moving forward, the State Bank will continue to implement gold market management policies in accordance with the government’s directives and introduce new policies when amending Decree 24/2012/NĐ-CP on gold business management, with a focus on stability and sustainability and a close alignment with market dynamics.

Attorney Truong Thanh Duc, Director of ANVI Law Company, analyzed that the gold market has a close and direct impact on important macroeconomic balances, such as exchange rates and inflation, and therefore, it cannot operate freely like other sectors. It must be tightly controlled. Few countries in the world have economies as heavily influenced by gold as Vietnam. Other sectors, such as aviation, electricity, and even banking, can be left to market forces, but gold is a different story. The visible hand of the state must intervene; otherwise, gold will distort the monetary market and cause instability in the macroeconomy. In the long run, the state needs to take measures to change people’s perceptions about hoarding physical gold. If people’s perceptions do not change, no matter how much gold the State Bank supplies to the market, it will never be enough.

While the state does not encourage people to buy and own gold, it cannot outright ban it. When people hoard physical gold, resources are not channeled into production and business, and money does not circulate to generate more money and stimulate growth. The state needs to find ways to divert people towards other investment and savings channels. Additionally, strengthening anti-money laundering measures in gold bar transactions is an effective solution to make the market more transparent and thereby curb speculation and price manipulation. In the future, ministries and sectors need to coordinate closely to effectively implement existing regulations (anti-money laundering and electronic invoicing) to make the gold market more transparent and stable.

Bringing Transparency to the Gold Market

Many economic experts analyze that the characteristic of the Vietnamese gold market is the absence of a centralized and transparent gold exchange, with people mainly transacting at gold shops and the buying and selling prices set by these shops, leaving buyers and sellers with little to no say in the matter. Over the years, tens of thousands of businesses have registered to trade gold nationwide, but the prices they set are more or less the same, with negligible differences. This is because the market is controlled by “bookies” who have the power to manipulate it.

Mr. Nguyen Van Phung, former Deputy Director of the Tax Policy Department (Ministry of Finance), agrees with this view, adding that the “gold price storms” of the past had the “hand” of some speculative groups taking advantage of the world gold price waves to push up domestic prices for their own gain. Enterprises, business households, and traders who need capital for business would not be so foolish as to put their money into gold. It is only the people with a habit of hoarding gold who do so. In reality, the demand for gold buying among the people is not large enough for the State Bank to sacrifice the country’s foreign exchange reserves to meet their needs. The State Bank has also advised relevant agencies to come up with appropriate solutions for the gold market. Accordingly, to effectively manage the gold market, the government needs to have a comprehensive project that clearly defines the roles and responsibilities of each ministry and sector and establishes an effective coordination mechanism to move towards identifying gold and effectively preventing gold smuggling and bringing these “bookies” to light.

Strictly handle acts of spreading false information to manipulate the gold market.

Dr. Pham Xuan Hoe, Secretary-General of the Vietnam Financial Leasing Association, stated that these “bookies” hold a large amount of smuggled gold across borders and have the power to manipulate the entire gold market, causing the free-market exchange rate to soar as seen recently. There is also the phenomenon of hiring people to queue to buy gold and hiring people to register for online gold purchases from the five units participating in the market stabilization program. “There have been cases of people being hired to queue to buy gold, and large gold shops not having gold to sell, indicating that there is a deliberate hoarding of gold, waiting for the State Bank to stop selling gold for stabilization, so they can create another wave in the market and push up domestic gold prices for profit,” he added.

Dr. Ngo Minh Hai, Vice Principal of the Ho Chi Minh City University of Economics and Finance, suggested that the state should shift its focus to managing quality standards, appraising, and certifying gold bar manufacturers instead of having to sell gold for stabilization as it does now. Specifically, the government needs to clearly define the roles of the State Bank and relevant ministries and sectors in managing gold quality, business conditions, etc.; and recognize gold bar manufacturers that meet national quality standards. For instance, only specialized units of the Ministry of Science and Technology should be responsible for appraising and recognizing gold brands to ensure the gold content and purity.

Many economic experts recommend that the government should aim to establish clear regulations regarding gold rings. If gold rings are considered jewelry, the regulations should stipulate that the gold content must be below 75% or 61%. Producing jewelry with 75% or 61% gold content requires more processing than simply pouring pure gold into a mold and selling it on the market. With such clear regulations, we can curb legal loopholes and gradually reduce the appeal of gold. Once there are regulations in place for both gold bars and gold rings, management agencies should separate the management of the gold foreign exchange market and the domestic gold commodity market.

Associate Professor Dr. Nguyen Thi Mui, a member of the National Advisory Council on Financial and Monetary Policies, suggested that to ensure equality among investment channels, taxing gold purchases and sales is a necessary solution. Taxation on gold investments not only ensures equality among investment channels but also helps stabilize gold prices and the gold market over time. Tax policies for gold should aim to ensure equality among investment channels and create conditions for the stable development of the market, free from the influence of speculative factors.

In the current context, if gold is imported for the production of gold jewelry or for stamping gold leaves and gold blocks for profit, reasonable tax policies are needed to regulate supply and demand. This will contribute to the stable development of the Vietnamese gold market.

After maintaining a price of around 80 million VND per tael for several days, the domestic SJC gold price (as of August 7, 2024) unexpectedly dropped by 800,000 VND to the threshold of 79 million VND per tael. The price of gold rings in the country was also adjusted downward. The selling price of SJC gold bars at Agribank, BIDV, Vietcombank, and Vietinbank was 79 million VND per tael, and gold and jewelry companies also maintained their gold bar selling prices at similar levels.

2023 Remittances Surpass Half of Ho Chi Minh City’s Budget Revenue

As part of the Homeland Spring 2024 program in Ho Chi Minh City, this morning (2/2), the overseas Vietnamese delegation had a tour of the City Hall and met with city leaders.