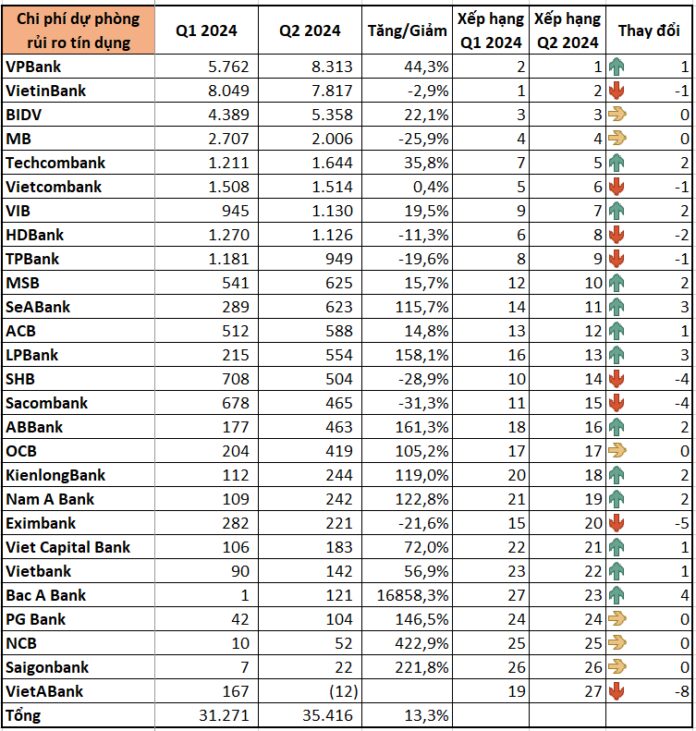

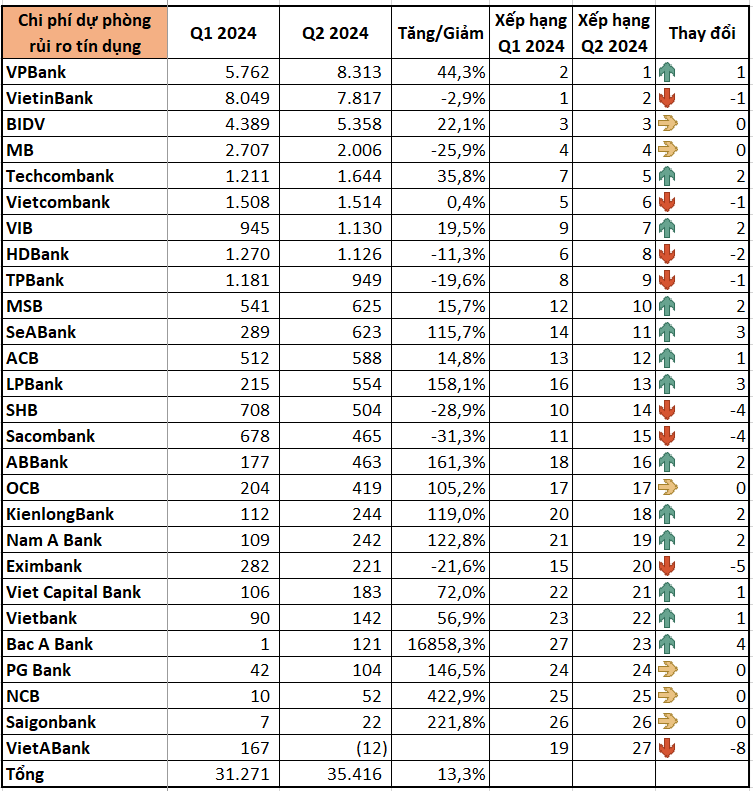

According to financial reports from listed banks, the total credit risk provision expenses for Q2 2024 amounted to VND 35,416 billion for 27 banks, marking a 13.3% increase from Q1 2024 and a 16.8% surge year-over-year.

This figure sets a new record, surpassing the previous peak of VND 34,507 billion in Q4 2022.

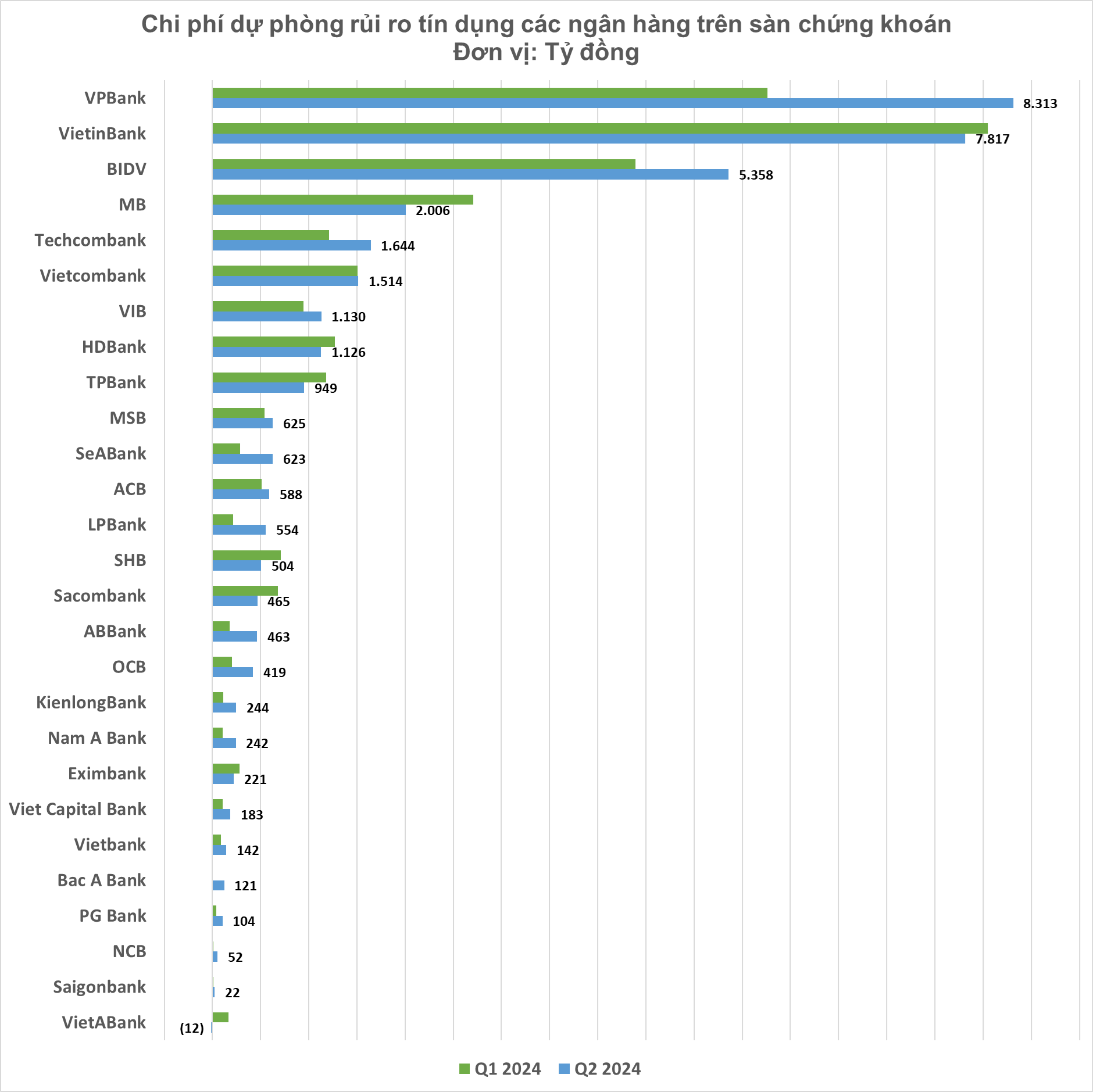

VPBank incurred the highest provision expenses, amounting to VND 8,313 billion, a record high, and reflecting a 44% increase from the previous quarter.

VietinBank, on the other hand, reduced its provision expenses by 2.9% from the previous quarter, totaling VND 7,817 billion, which helped improve its ranking.

BIDV ranked third with VND 5,358 billion, a 22% increase from the previous quarter. The provision expenses of VPBank, VietinBank, and BIDV far exceeded those of other banks.

Specifically, MB, Techcombank, Vietcombank, VIB, and HDBank recorded provision expenses ranging from VND 1,000 to 2,000 billion in the past quarter. Notably, Techcombank’s provisions stood at VND 1,644 billion, a 36% increase from the previous quarter.

It is worth mentioning that several banks in the middle of the rankings, including SeABank, LPBank, ABBank, OCB, and KienlongBank, saw their provision expenses more than double compared to the previous quarter.

Conversely, some banks managed to reduce their provision expenses, with notable decreases observed at TPBank (20%), SHB (29%), Sacombank (31%), and Eximbank (22%).

VietABank stood out as the only bank that did not need to set aside provision expenses; instead, it reversed VND 12 billion.

How is FE Credit doing in 2023?

According to MBS, in the cumulative year of 2023, FE Credit achieved operating income of 17,756 billion VND, a decrease of 13.8% compared to 2022, and a pre-tax loss of 3,529 billion VND. However, the financial company has recorded a positive pre-tax profit in two consecutive quarters and the asset quality shows signs of bottoming out.