At the 2024 Annual General Meeting, Mr. Nguyen Ho Nam was appointed as Vice Chairman of Eximbank’s Board of Directors.

Immediately after his appointment at Eximbank, Mr. Nam resigned from his position as Chairman of the Board of Directors of Bamboo Capital and became Chairman of the Strategic Council, as well as devoting time to seeking new directions for the corporation.

Mr. Nam’s appointment as Vice Chairman of Eximbank with an almost unanimous vote (99%) at the meeting demonstrates the absolute trust of the major shareholders, signaling a period of harmony among Eximbank’s shareholders and laying the foundation for the bank to return to its green race.

This 99% figure is very significant and somewhat indicative of the large proportion of shares currently held by the group of shareholders related to Bamboo Capital. According to the Law on Credit Institutions of 2024, the percentage of shareholding in banks by related shareholder groups is 15%.

With the support of major shareholders, will Eximbank return to its peak?

Eximbank was once a leading bank in the system, considered a “star” with hundreds of thousands of billions of dong in assets and mobilizing more than 100,000 billion dong annually.

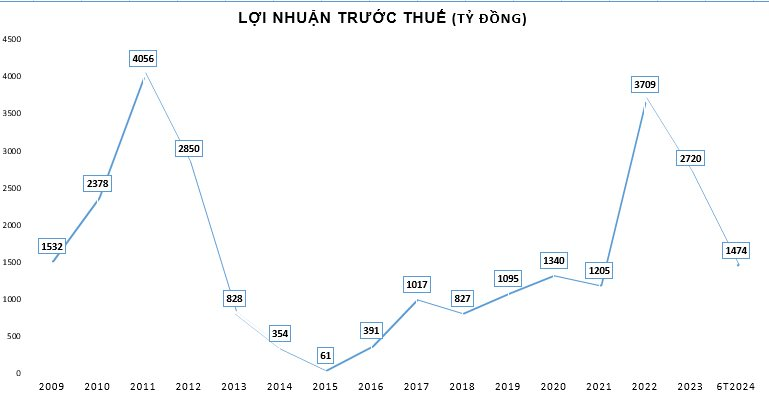

At its peak in 2011, Eximbank ranked 4th in the profit race among banks, only after Vietinbank, Vietcombank, and BIDV. However, since 2011, Eximbank’s financial situation has continuously declined and hit rock bottom in 2015.

From 2015 to the present, Eximbank’s business results have gradually recovered with many positive signals as it welcomes new shareholders, including Bamboo Capital. The financial industry expects a brighter future for this bank due to the internal strength of these major shareholders.

Eximbank’s profit fluctuations over the past 15 years

With the presence of Bamboo Capital’s highest leader, Eximbank will receive indirect support from the ecosystem of this corporation.

Bamboo Capital (HoSE: BCG) is a multi-sector corporation with more than 60 member companies, focusing on renewable energy, real estate, construction, and financial services, and insurance. As of June 30, 2024, Bamboo Capital had equity capital of VND 21,300 billion and total assets of over VND 45,300 billion. Bamboo Capital is currently cooperating with many large partners worldwide, including Singapore Power, Leader Energy (Singapore) Sembcorp, SUS (Shanghai), Power China (China), SK (Korea), GS (Korea), and Hanwha (Korea).

Among them, the “darling” BCG Energy (UPCoM: BGE) under the Bamboo Capital ecosystem is one of the Top 3 energy companies in Vietnam. BCG Energy has a charter capital of VND 7,300 billion and total assets of nearly VND 20,000 billion. In addition to implementing solar, wind, and waste-to-energy projects, BCG Energy is also researching the LNG electricity and electricity storage technology sectors.

With a series of large-scale energy projects being implemented, it is expected that within the next three years, BCG Energy’s total assets will increase to more than VND 70,000 billion, and its power generation capacity will reach nearly 2 GW.

According to assessments, Vietnam is in a process of economic development, and the demand for electricity is growing rapidly year by year. Extreme hot and dry weather conditions have reduced the water levels in hydroelectric plants. In this context, renewable energy is the most potential alternative energy solution to traditional energy, meeting environmental protection and sustainable development requirements.

In a more positive light, with the direct and indirect support of these “giants,” investors can hope for a brighter future for Eximbank, regaining its top position in the private banking sector more than a decade ago.

A Eximbank Board Member Resigns

The resignation of Ms. Le Thi Mai Loan will be approved by the Shareholders’ General Assembly of Eximbank in accordance with the provisions of the law.

Eximbank revamps website interface

The website has undergone a modern and user-friendly interface transformation since 01/02/2024, ensuring an enhanced user experience.