The IR Awards 2024 nominees in the Small Cap category are listed companies with small and very small market capitalizations, with the total market value of all circulating shares below 1,000 billion VND. These are also excellent enterprises in the stock market, which have gone through two previous survey and evaluation rounds; the “Information Disclosure Survey” round with 708 listed companies and the “IR Awards Nomination” round with 424 enterprises meeting the Information Disclosure Standard, and participating in the IR Awards 2024 voting round.

|

- Voting period: From 00:00 on 01/08/2024 to 24:00 on 14/08/2024

- Online voting link: https://ir.vietstock.vn/binh-chon-dai-chung.htm

- Prize structure: Participating in the voting, individual investors will have the opportunity to win Samsung Galaxy M35 5G phones, VietstockFinance PRO accounts and many other attractive prizes. https://ir.vietstock.vn/giai-thuong-cho-nha-dau-tu-binh-chon.htm

The list of IR Awards nominees in the Small Cap group (the list of enterprises is arranged in alphabetical order of stock codes) is as follows:

- EVE – Everpia Joint Stock Company

- HHP – HHP Global Joint Stock Company (Hoang Ha Paper)

- IVS – Guotai Junan Securities Joint Stock Company (Vietnam)

- NAF – Nafoods Group Joint Stock Company

- NHA – Southern Hanoi Housing and Urban Development Corporation

- PHC – Phuc Hung Holdings Construction Joint Stock Company

- ST8 – ST8 Group Joint Stock Company

- TLH – Tien Len Steel Group Joint Stock Company

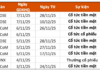

Stock price fluctuations of IR Awards nominees in the Small Cap group in the past year

|

IR Awards 2024 Nominee

IR Awards was founded in 2011 with the aim of creating a meaningful playground to raise awareness of the role and importance of investor relations activities, contributing to improving transparency in the stock market, encouraging the improvement of information disclosure quality, and thereby strengthening investors’ confidence in Vietnam’s capital market. The program is organized by Vietstock, VAFE Association, and FiLi Electronic Magazine.

Summary of selection criteria for IR Awards 2024 nominees:

IR ACTIVITIES

- Achieve the title of “Enterprise Meeting Information Disclosure Standards”

- Stock has good liquidity

- Stock has a good trading status

- Attract foreign investment (*)

- Successfully organize the Annual General Meeting of Shareholders

- Success in attracting analysts (*)

- Have English publications (*)

- Comply with regulations on trading in securities of insiders and related persons of insiders

FINANCIAL TRANSPARENCY

- All financial statements are published with complete components

- Annual and semi-annual financial statements are fully accepted by the auditor

- There is little difference in post-audit after-tax profit (*)

ENTERPRISE GOVERNANCE

- Comply with regulations on corporate governance

- Comply with dividend payment regulations

- Comply with regulations on treasury stock trading

- Governance reports disclose full content

- Annual reports disclose full information

- Annual reports are beautifully presented (*)

- Have a sustainability/ESG report

- Perform internal audit functions

- The Board of Directors has Independent Members

- Not in a loss-making situation while setting an optimistic business plan for the year

(*) Considered separately by market capitalization group