The market is cautious ahead of the futures expiry, with a significant narrowing of the fluctuation range on very low liquidity. In today’s session, the two matching floors traded just over VND 11,600 billion, the lowest in three weeks, despite impressive net foreign buying.

Liquidity edged up in the afternoon but failed to change the lackluster situation that has persisted since the beginning of the week. The HoSE floor added about 15% from the morning session, reaching VND 5,798 billion but still down 8% from yesterday’s afternoon session and the lowest in the last 14 afternoon sessions. Including HNX, afternoon trading reached VND 6,205 billion, up 14.8% from the morning session.

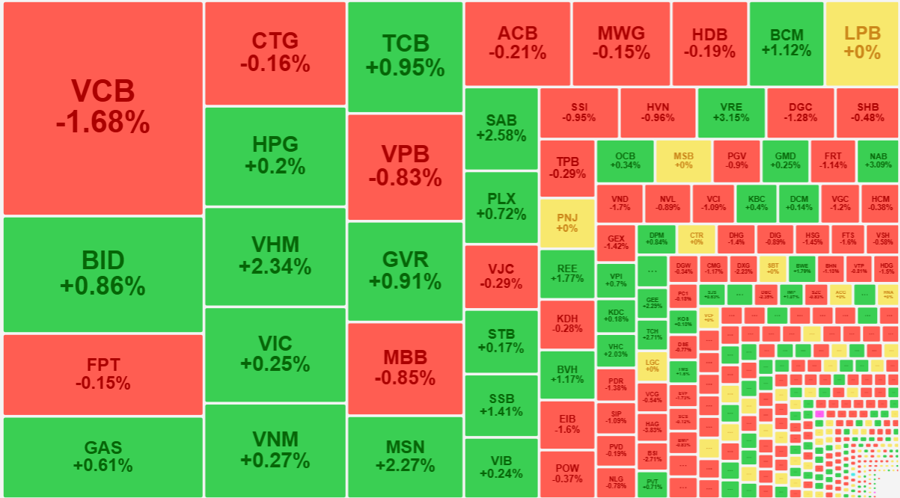

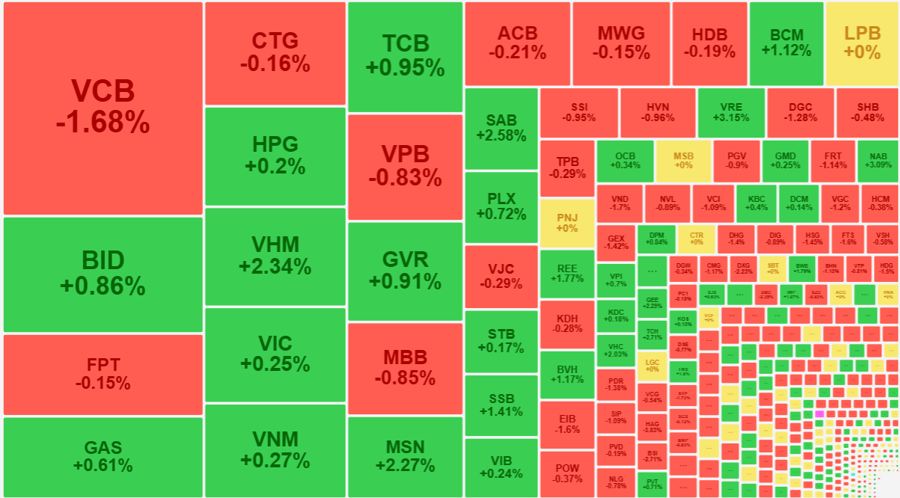

The performance of the blue-chips group this afternoon failed to maintain its strength from the morning: MSN slipped slightly by about 0.26%, still up 2.27% from the reference price. The BID pillar slid quite strongly by 0.74%, up 0.86% at the close. PLX even plunged by nearly 1.8%, still up slightly by 0.72%. VCB, VIC, and HPG also weakened significantly from the morning session. VCB closed down 1.68%, taking away more than 2 points from the VN-Index. This basket had up to 19 codes falling, with only 9 codes improving.

Fortunately, some pillars improved in the afternoon session: First of all, VHM must be mentioned, which continued its efforts to soar in the last 30 minutes of the morning session. This pillar closed at a reference price of up to 2.34%, meaning that in the afternoon alone, it increased by another 1.09%. VHM’s liquidity was quite large, matching 257 billion VND in the afternoon, the second highest in the VN30 basket. These stocks also “dethroned” BID and MSN to become the strongest point-pulling stock, bringing 0.92 points to VN-Index. TCB also had an excellent afternoon session, up 1.19% from the closing price in the morning and escaped the downtrend, closing at a reference price of 0.95%. Liquidity at TCB was also quite high, reaching VND 169.8 billion, bringing the daily total transaction to VND 249.9 billion, entering the Top 10 codes with the highest liquidity in the market.

The VN30 basket weakened in the afternoon, but the pillars that increased in the morning also fell in price. If it weren’t for VCB’s price crash, the VN-Index could still have closed above the reference price. This index closed down 0.06 points with 163 gainers and 243 losers. VN30-Index was the only large-cap index still in the green, up slightly by 0.13% with 17 gainers and 13 losers. VRE, SAB, MSN, VHM, SSB, BVH, and BCM were still up more than 1% from the reference price.

The group of securities stocks today witnessed a strong selling pressure lowering prices. Only DSC, SBS, SHS, TVS, and TCI remained in the green in the group, while 20 other codes fell deeply by more than 1%, including some blue-chips such as VND, VCI, FTS, and BVS. Some codes in this group appeared with large liquidity, namely VIX with VND 201.1 billion, down 2.2%; VND with VND 114.1 billion, down 1.7%; and VCI with VND 107.2 billion, down 1.09%.

A notable highlight in the afternoon session was the strong and unexpected disbursement of foreign investors. Similar to previous afternoon sessions, this block increased its purchases by nearly three times in the morning session, adding another VND 1,629.1 billion while selling an additional VND 918.6 billion. As a result, the net balance reached VND 710.5 billion, while the morning session still recorded a slight net sell-off of VND 467 billion.

Foreign investors disbursed heavily into KDC with VND 461.3 billion, MSN with VND 218.7 billion, and HDB with VND 197.8 billion. However, most of these transactions were through agreements, so they did not affect the matched prices on the floor. In addition to the above three codes, there were also TCH +51.2 billion, FPT +45.9 billion, HVN +33.5 billion, VRE +31.7 billion, STB +31 billion, VNM +29.9 billion, GMD +25.5 billion, and CTG +22.7 billion. On the selling side, there were HPG -94 billion, VNM -46.3 billion, FRT -44.5 billion, TCB -41.9 billion, DGC -33.4 billion, PVD -23.5 billion, and LPB -22.5 billion.

The sharp drop in liquidity today may be due to investors’ caution ahead of the upcoming futures expiry. However, like the morning session, the price fluctuation range was not strong. Specifically, the group that increased by more than 1% had only 51 codes, accounting for 20.2% of the total matched value on the HoSE floor. On the downside, 101 codes fell by more than 1%, with liquidity accounting for 24.5%. Thus, the majority of stocks still fluctuated within the daily supply and demand limit.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.