Services

|

VPBank’s financial might acted as a springboard for the company to enter the top 10 providers of margin in the market. Now, with its advanced trading technology and professional brokerage team, the company has climbed into the top 20 in terms of market share. However, it is the diversity of its ePortfolio offerings that is the key to driving its asset management business forward.

To meet the diverse investment tastes and capital allocation needs of its clients, VPBankS must continuously expand its basket of ePortfolios. To achieve this, the company’s team of experts constantly researches, develops investment strategies, and constructs these ePortfolios.

Each investment portfolio launched by the company is a culmination of decades of knowledge and experience from three teams of specialists: market analysts, investment strategy architects, and portfolio risk managers.

Two key areas of focus are investment strategy formulation and risk management. The experts utilize market information to create flexible investment strategies that clearly reflect the goals of each client. Meanwhile, VPBankS’ risk management experts establish tools and processes to control risks, catering to the specific risk appetites of different investor groups.

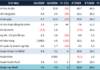

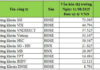

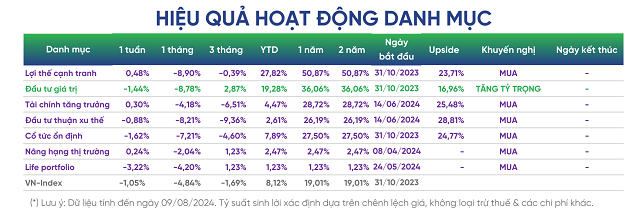

As a result, VPBankS has introduced seven ePortfolios in less than a year since the official launch of this product. Each portfolio has distinct characteristics, including recommended holding periods, expected returns, risk tolerance levels, and stock selection criteria.

VPBankS’s ePortfolio offerings. Source: VPBankS

|

For instance, the Competitive Advantage portfolio is built around a growth and value investment strategy, focusing on companies with a competitive edge, stable operations, high profit margins, and robust financial health. This portfolio suits medium- to long-term investors with a moderate risk appetite and a holding period of more than one year.

In line with this strategy, the Competitive Advantage portfolio includes stocks of leading companies in various sectors, such as PVT (marine transportation), DGW (electronics wholesaling), FPT (technology), VCB (banking), and CTR (telecommunications construction). Over a one-year period, this portfolio has outperformed the market, delivering returns of over 50%, significantly surpassing the market’s 20.3% gain, and rewarding investors who chose it with substantial profits.

For investors seeking a more conservative, low-risk approach, the Stable Dividend portfolio is a prudent choice. This portfolio’s strategy targets companies with stable business operations and a consistent track record of high dividend payouts. VPBankS’s experts have constructed this portfolio to include stocks of companies like BMP, DPM, VCS, SCS, and GMD.

This Stable Dividend portfolio has also delivered impressive returns, generating nearly 30% in profits over the past year, outpacing the VN-Index and far surpassing returns from many other investment avenues.

In addition to these portfolios, VPBankS’s ePortfolio offerings include several other strategies that cater to different investment approaches or themes in the market, such as Value Investing, Trend Following, Market Upgrade, or Life Portfolio.

The transparency and clarity in philosophy, strategy, and portfolio construction empower VPBankS’s ePortfolio clients to fully understand their investment journey and destination.

Even for novice investors (F0) with no prior stock market experience, this transparency, scientific approach, and professionalism serve as a compass in their pursuit of financial prosperity and, ultimately, financial freedom.

|

With VPBankS’s ePortfolio product, individual investors can now access investment tools and strategies that were previously available only to large investment funds and professional institutions.

Moreover, to enhance investment performance, VPBankS’s experts periodically review and rebalance these investment portfolios. The results of these rebalancing exercises and weekly and monthly updates are regularly published at: https://www.vpbanks.com.vn/eportfolio

Aligned with its positioning as “the one-stop destination fulfilling all customers’ financial investment service needs,” VPBankS meticulously prepares each product and service to cater to a large volume of customers, especially amidst the surge in market demand and scale.

NCB appoints new Deputy CEO, enhances human resources quality

National Citizen Bank (NCB) has recently announced the appointment of Ms. Vo Thi Thuy Duong as the Deputy General Director and Director of the Human Resources Management Division.