The LICOGI Board’s decision, made on August 15th, will come into effect as soon as the competent authority issues the amended Business Registration Certificate for the Corporation.

As a result, the LICOGI Management Board now comprises of General Director Phan Thanh Hai and two Deputy General Directors, Nguyen Thanh Hop and Nguyen Anh Dung.

Mr. Phan Thanh Hai (born in 1972), a Hanoi native, holds a Bachelor of Engineering in Manufacturing Technology. He currently represents Dong Khu Investment and Real Estate Trading Co., Ltd. (referred to as Dong Khu Company), which owns 31.5 million LIC shares, equivalent to 35% of the capital. Mr. Hai does not personally own any shares.

Mr. Hai is also the Vice Chairman of the LICOGI Board of Directors, the Chairman of the Board of Directors of Dong Anh Investment, Construction and Building Materials JSC (a subsidiary in which LIC holds nearly 52% capital), and the Vice Chairman of the Board of Directors of Bac Ha Hydropower JSC (an associated company in which LIC holds over 41% capital).

LICOGI, formerly known as the Foundation Construction and Infrastructure Engineering Corporation, was established in 1995 as a state-owned enterprise and transformed into a joint-stock company in 2014. Its main business activities include construction installation, industrial and building materials production, and real estate and infrastructure development. The corporation is headquartered in Thanh Xuan District, Hanoi. As of June 30, 2024, LICOGI had 13 subsidiaries and 7 joint venture and associated companies, mainly operating in the fields of construction installation and real estate.

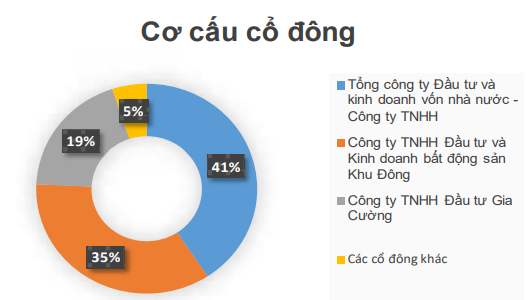

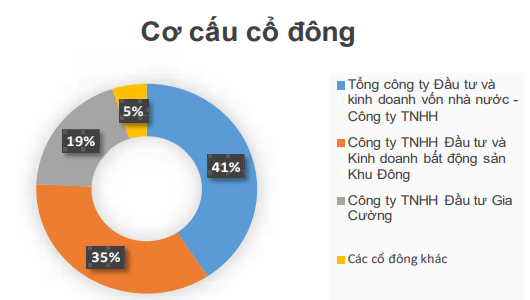

LICOGI’s charter capital is currently 900 billion VND. The State Capital Investment Corporation (SCIC) holds over 36.6 million shares (40.71%), Dong Khu Company owns 35%, and Gia Cuong Investment Company holds 19.24%.

Source: LICOGI’s 2023 Annual Report

|

In terms of business performance, LIC averaged more than VND 2,100 billion in revenue per year over the last five years (2019-2023). Profitability fluctuated, improving from a net loss of VND 69 billion in 2019 to a net profit of VND 93 billion in 2021, before returning to a net loss of VND 1 billion in 2023.

| LICOGI’s Financial Performance over the Past 5 Years |

In the first six months of 2024, revenue reached nearly VND 860 billion, a 4% decrease compared to the same period last year. However, the net loss narrowed to nearly VND 38 billion, an improvement from the net loss of nearly VND 50 billion in the first six months of 2023, due to increased investment income from joint ventures and associated companies, as well as reduced cost of goods sold and financial expenses.

The lackluster business performance has led to an increase in LICOGI’s accumulated loss as of Q2 2024, reaching over VND 661 billion, resulting in a decrease in equity to VND 365.5 billion.

As of June 30, 2024, LIC’s total assets exceeded VND 4,221 billion, a decrease of VND 93 billion from the beginning of the year. Correspondingly, its total liabilities decreased by VND 39 billion to below VND 3,856 billion, including loans amounting to VND 1,865 billion.

Since mid-May, the LIC share price has been trading sideways in the VND 19,000/share range for a month before surging to its highest peak of the year at VND 32,000/share in late June, an increase of more than 68%. Subsequently, the LIC share price reversed and is currently trading around VND 23,000/share.

| LIC Share Price Movement since the Beginning of 2024 |

The End.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.