Many banks have started offering free account balance update notifications through their apps, encouraging customers to switch to this service to reduce costs and improve their overall experience.

Along with the encouragement, banks have also adjusted their fee structures, setting a minimum fee threshold for SMS balance update notifications to expedite this transition.

Instead of a fixed fee ranging from 10,000 to 20,000 VND per month, banks will now charge based on the number of SMS messages sent during the month or use a tiered pricing model.

Generally, the lowest fee ranges from 10,000 to 15,000 VND per month (including VAT) for up to 20 SMS messages.

For SMS messages exceeding 20, the cost can be as high as 6,000-700 VND per message. With this new pricing model, customers may end up paying hundreds of thousands of VND per month for SMS Banking if they receive a large number of messages. This is especially true nowadays, as online money transfers and QR code payments have become more common, making a monthly fee of around 100,000 VND quite typical.

This move by banks has prompted a large number of customers to switch to using digital banking apps to manage their account balances and save on costs, as most of these apps offer free transaction and account management fees.

Ms. Binh Minh (32 years old, Hanoi), who runs a small business in Hanoi, shared: “Previously, the bank charged an SMS fee of just over 10,000 VND per month. But now that they charge based on the number of messages received, there are days when I have many customers, and I receive several hundred messages a day, with fees reaching nearly 200,000 VND per month.” As a result, she decided to switch to receiving notifications through the app to save on fees.

In addition to cost savings, users can receive instant notifications through the banking app for any transaction, anywhere and at any time, even when they are abroad, making it easy to monitor and control their account balance.

Another advantage of receiving notifications through the app is the added security of avoiding potential scams and brand name impersonation attempts that often occur via SMS. For example, Mr. Hoai Thanh (25 years old, Hanoi) recently canceled his SMS balance update notification service after reading about SMS scams in the news. He was concerned about the possibility of losing money unintentionally if he continued to rely on SMS notifications.

This transition benefits not only customers but also banks, as they save on the significant costs of paying telecommunications companies. These savings can then be reinvested in upgrading and updating new security technologies and solutions for digital banking.

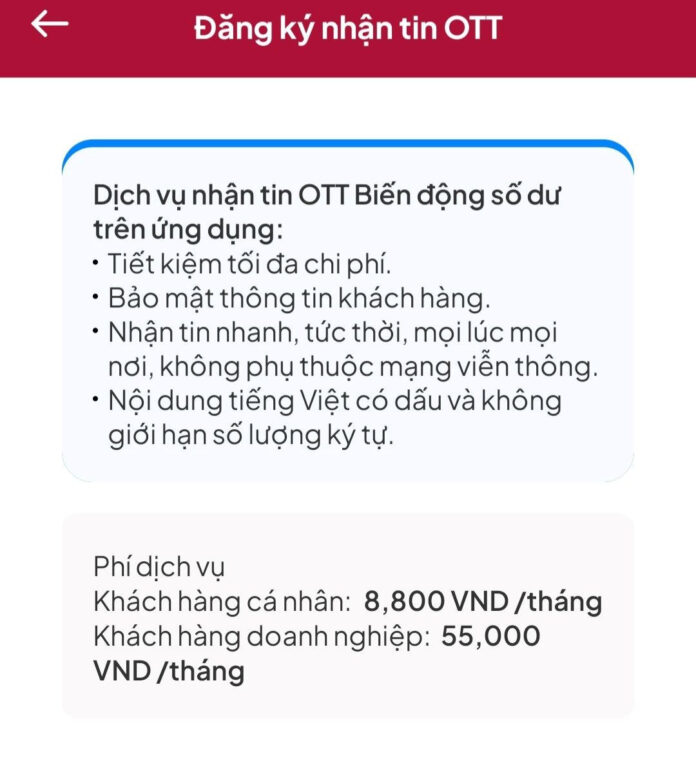

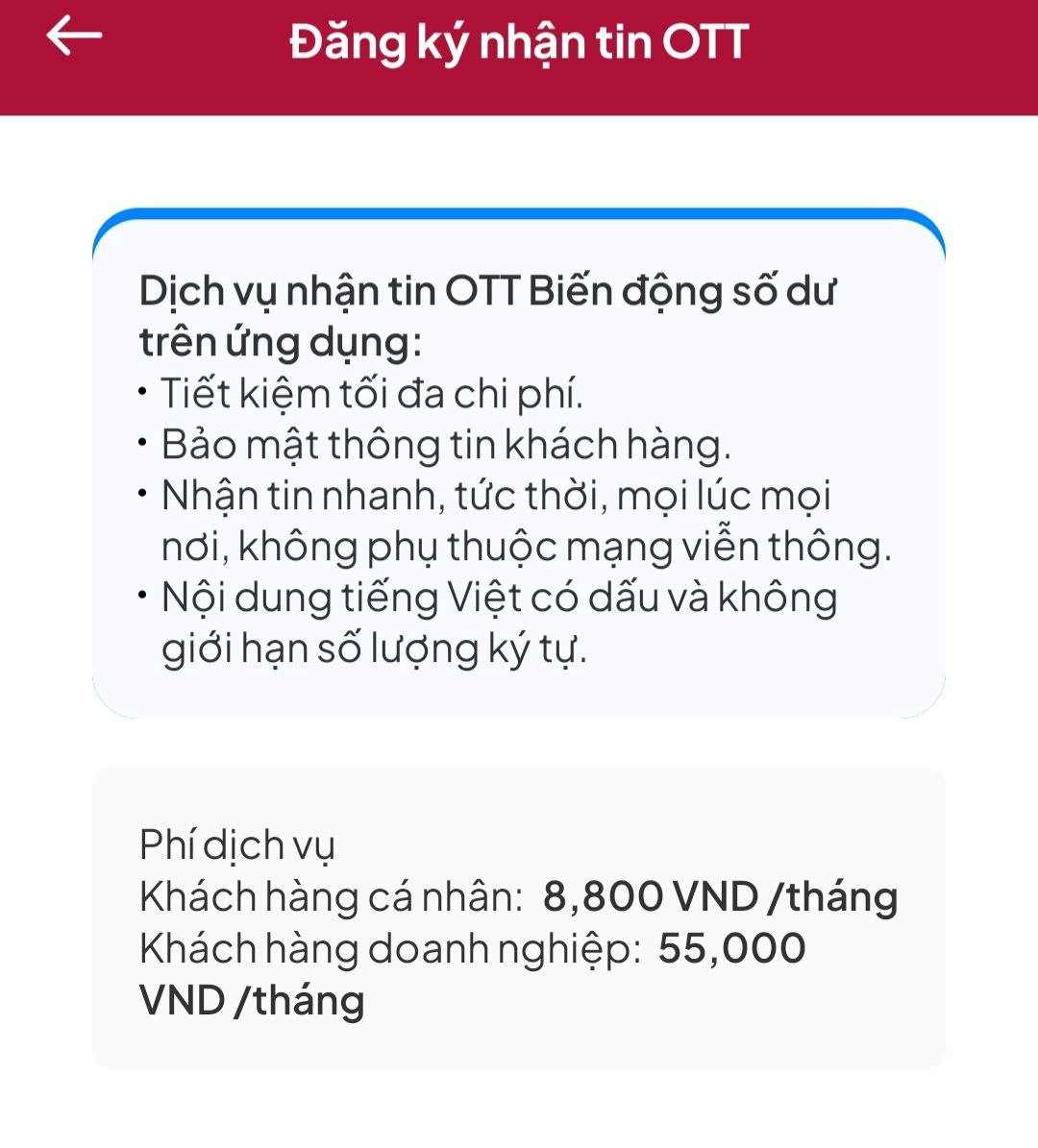

According to a survey, most banks offer free notification services through their apps (also known as OTT). However, some banks, such as Agribank, still charge a fee for this service.

Agribank’s OTT balance update notification service fee

Specifically, Agribank charges a fee of 8,800 VND per month for individual customers and 55,000 VND for corporate customers for its OTT balance update notification service on the Agribank Plus app. This fee includes VAT.

Agribank continues to offer SMS Banking services to customers who have not switched to OTT. The SMS Banking fee is 13,200 VND per phone number per month for individuals and 50,000 VND per account per month for organizations. Additionally, Agribank has stopped sending balance update notifications for transactions below 20,000 VND since June 1, 2024.

Compared to other banks, Agribank’s OTT service fee is higher, but its SMS Banking fee is among the lower end of the market.

The small difference between Agribank’s monthly SMS Banking and OTT service fees makes some customers hesitant to switch, and they continue to use the SMS Banking service.

According to Agribank, the OTT service has many advantages, including the ability for customers to receive information about account balance changes, promotions, and service benefits promptly and conveniently in the Notifications section of the app, without character limits compared to traditional SMS. Additionally, OTT helps customers avoid fraudulent messages from fake brand name senders.

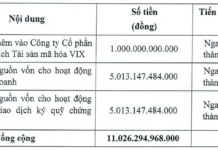

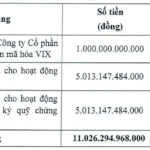

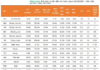

Nam A Bank achieves key targets for 2023, poised for breakthrough in the new year.

With a sustainable development strategy, Nam A Bank (code NAB) has achieved its key targets in 2023, ranking among the top 12 joint-stock commercial banks with the highest growth rate and creating a stable momentum for its new journey.