The stock market closed the trading week of August 12-16 with a dominant recovery trend. VN-Index started the second session of the week with a bullish note, trading sideways for three mid-week sessions before ending a vibrant week on Friday. At the week’s close, the VN-Index gained +28.59 points (+2.34%) to reach the 1,252.23 level.

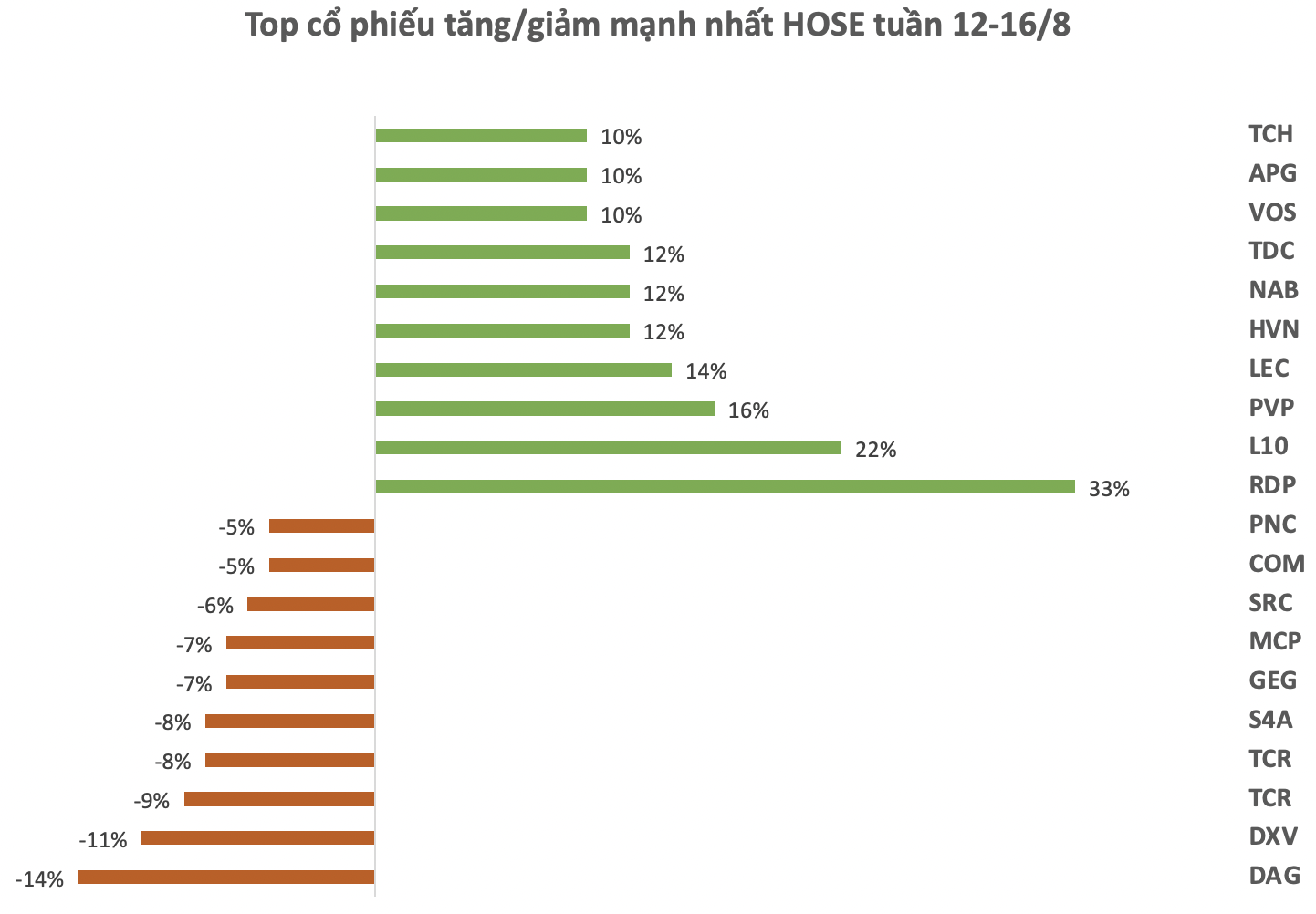

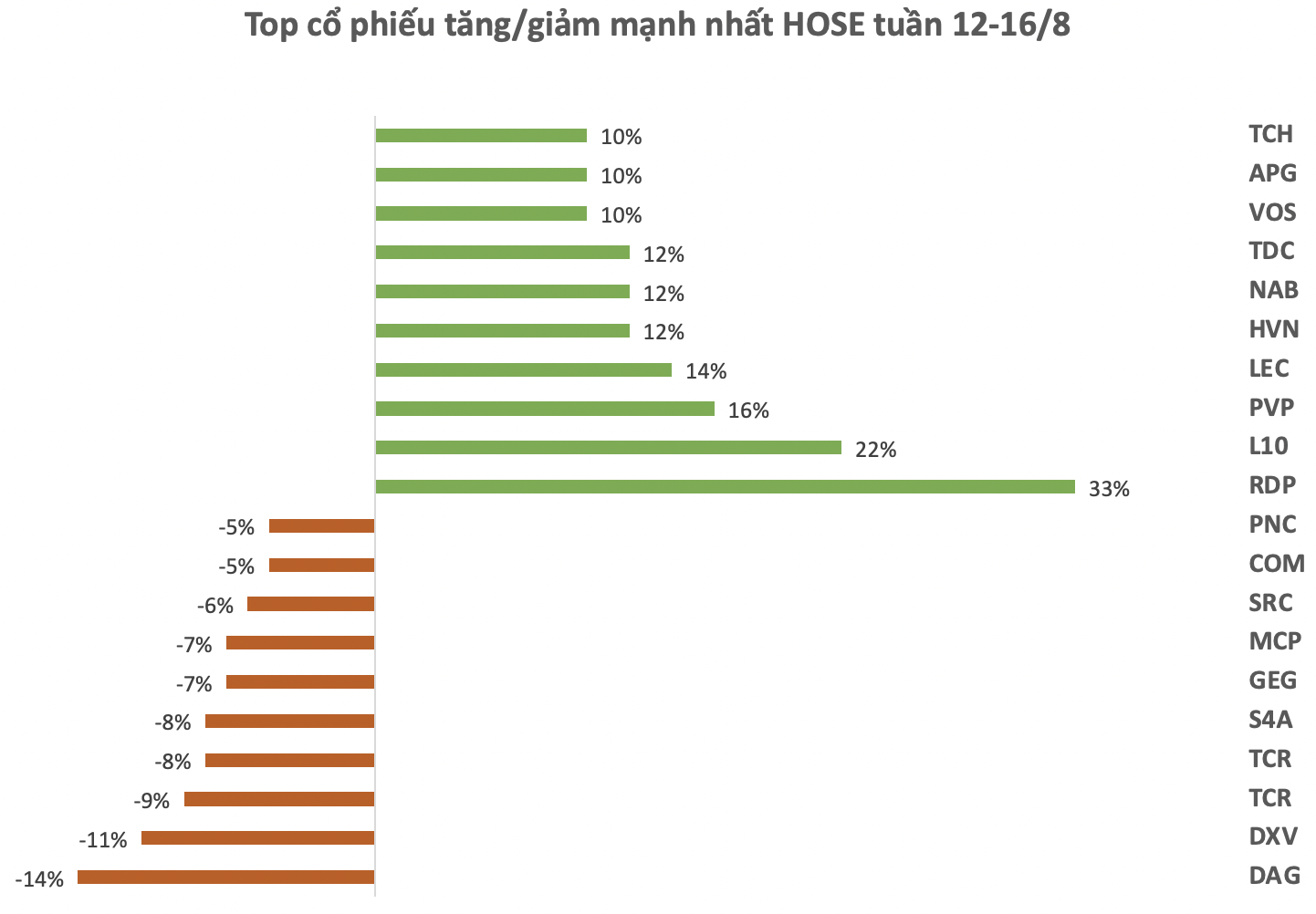

On the HOSE, RDP topped the list of biggest gainers. RDP witnessed five consecutive bullish sessions, with its share price surging 33% to nearly VND3,000/share. Trading in this stock was quite active, with liquidity spiking to over 2 million units in the final session of the week.

The impressive rally in RDP shares occurred despite a lack of positive news related to the company. Notably, the stock had recently experienced a dull trading period, sliding to historical lows, equivalent to a 70% evaporation since the beginning of the year.

HVN also made it to the list of top gainers on the HOSE, surging over 12% after a week. Buying momentum in the stock strengthened after a near 14% decline in the previous week.

In contrast, DAG, DXV, TCR, and S4A faced profit-taking pressure, falling over 7-14% this week.

Among these, DAG witnessed the sharpest decline on the HOSE after being suspended from trading due to continued violations regarding information disclosure.

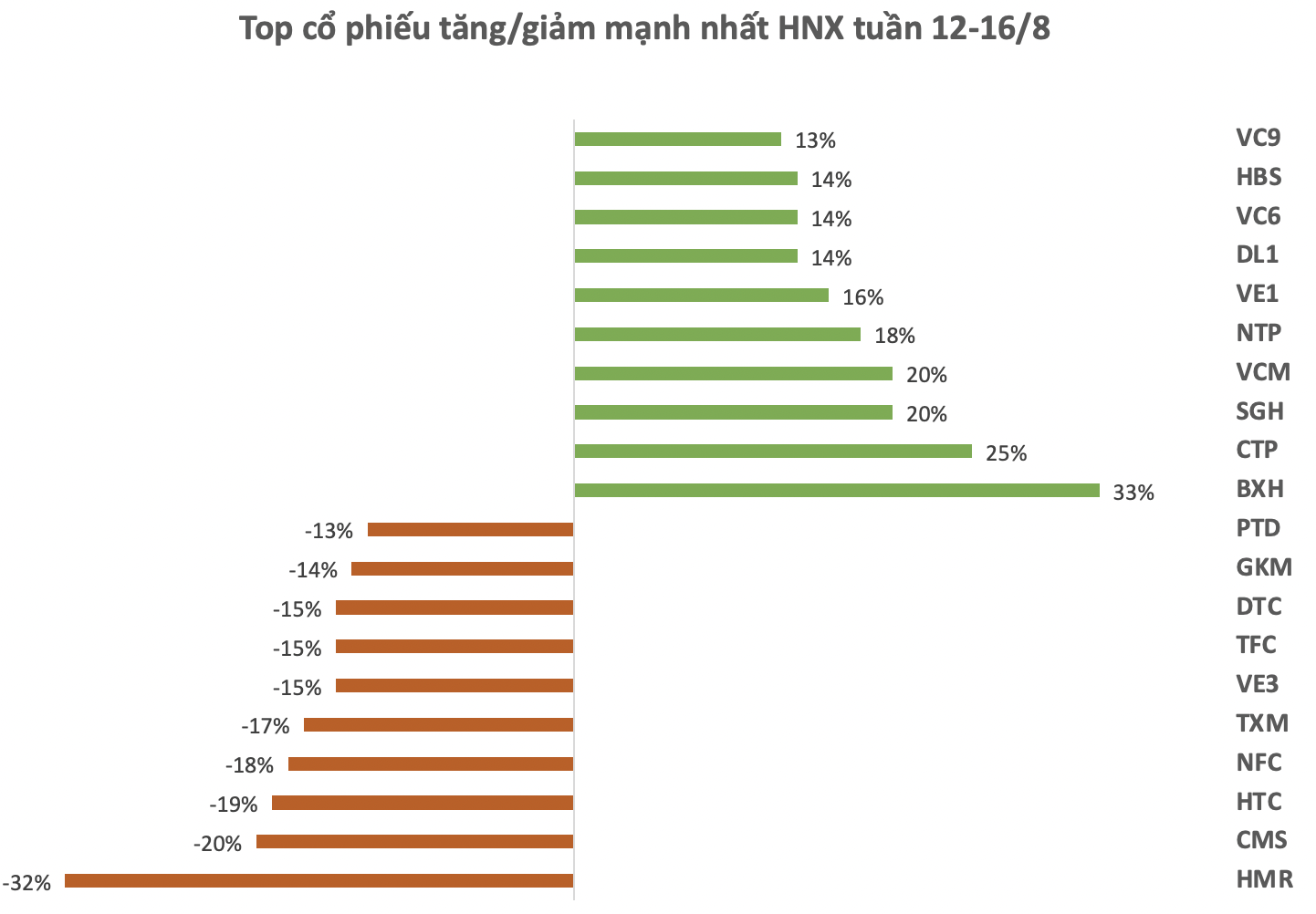

On the HNX, the gainers were mostly small-cap, low-liquidity stocks such as BXH, CTP, SGH, and VCM,…

On the downside, HMR, CMS, and HTC faced profit-taking pressure, declining over 19% in the past week. HMR experienced its second consecutive week of selling pressure, following a nearly 23% drop in the previous week. However, trading was rather subdued, with only a few tens of thousands of units matched, except for an unexpected match of over 0.87 million units on Thursday.

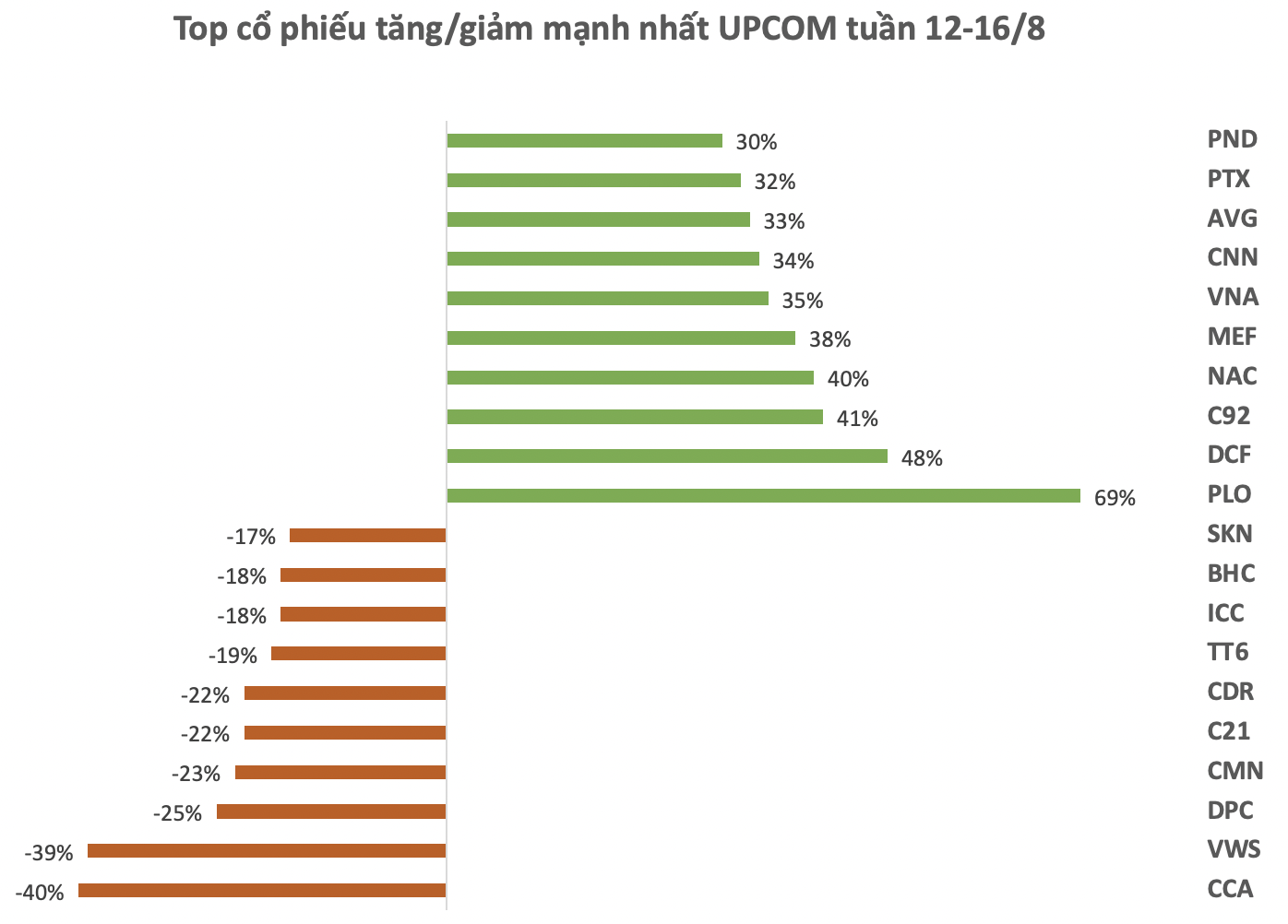

On the UPCOM, PLO led the gains, surging for five straight sessions and hitting the daily limit-up of 5%, pushing its share price to VND5,400. For the week, the stock still recorded a gain of nearly 70%. Despite the strong performance, the trading volume for this stock was meager, with only a few tens of thousands of units traded.

According to our research, Petec Logistics Joint Stock Company is a company operating in the logistics and import-export sector, established in April 2007 by founding shareholders, including Petec Technical and Investment Trading Company, DongA Bank, and Au Lac Transport Joint Stock Company.

In contrast, many stocks on UPCOM also recorded declines ranging from 17% to 40% in the past week.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.