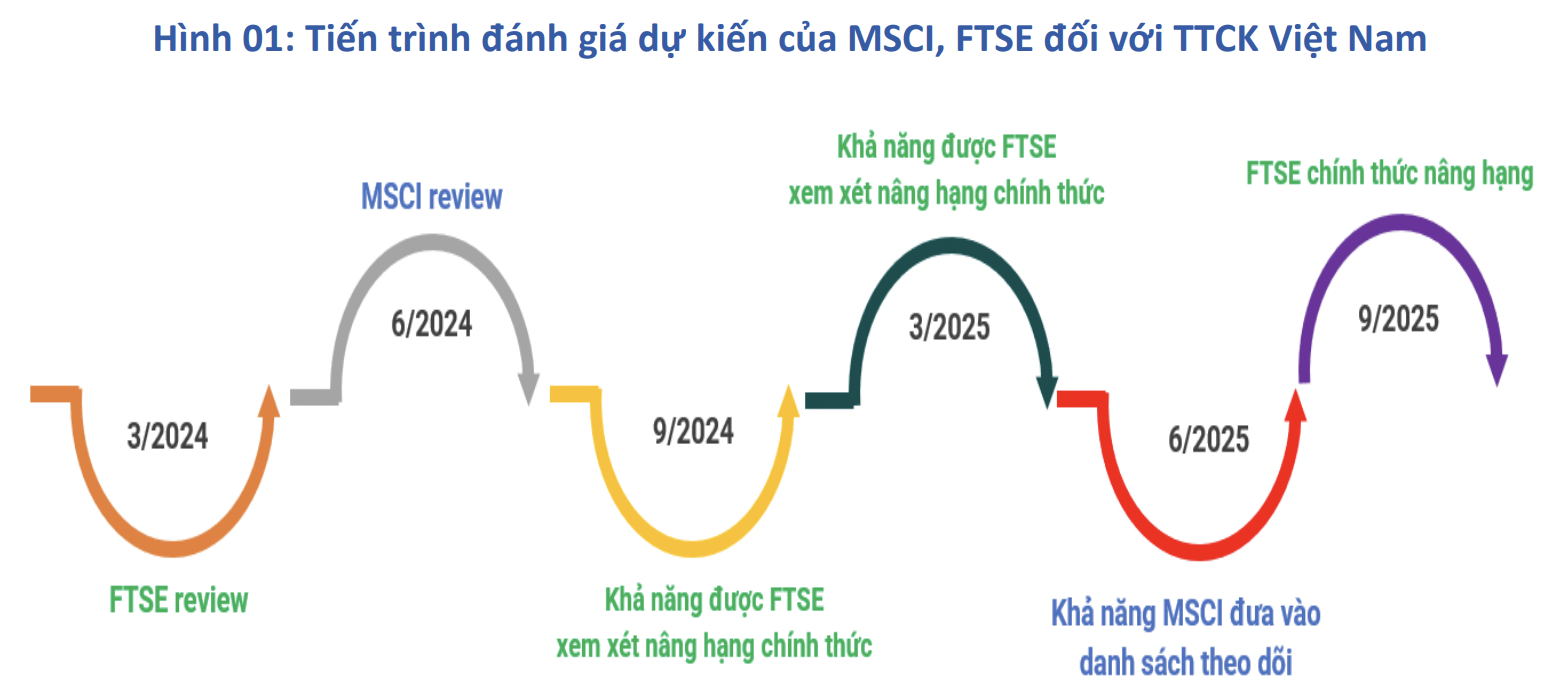

According to MSCI and FTSE Russell, Vietnam is currently classified as a Frontier Market and has met some criteria for classification as an Emerging Market, although there are still certain conditions that need to be addressed.

Specifically, Vietnam has met the majority of FTSE criteria (7 out of 9) for Secondary Emerging Market classification. However, it has only met 9 out of 18 criteria for MSCI’s stricter and less flexible classification standards.

FTSE is still evaluating two remaining criteria, “Delivery versus Payment (DvP) Cycle” and “Settlement – Costs Related to Failed Trades”. Currently, the practice of pre-funding transactions to ensure safety is common in Vietnam, so failed trades are not an issue. As a result, the “Settlement – Costs Related to Failed Trades” criterion is not being assessed. However, the Securities Commission of Vietnam is currently seeking solutions to remove the pre-funding requirement and implement the KRX trading system – both of which FTSE Russell highly values.

In a recent update, BIDV Securities (BSC) reported insights from the leaders of the Securities Commission, who believe that the pre-funding requirement is the biggest obstacle to market upgrade. They also highlighted the significant challenges faced by companies and regulatory bodies in meeting the upgrade criteria, as they need to ensure the market’s ability to withstand risks. In 2023, the Ministry of Finance, the Securities Commission, and the Stock Exchange have made considerable efforts to overcome difficulties and achieve the upgrade goal, such as actively collaborating internationally, organizing investment promotion conferences, working with other securities commissions, stock exchanges, and international rating agencies. They are also working on the KRX system and seeking solutions to pre-funding requirements.

BSC stated that if Vietnam is upgraded to an Emerging Market by MSCI and FTSE, there will be an estimated $3.5-4 billion of new investments in Vietnamese stocks. This estimate is based on the assumption that the proportion of new investments in Vietnamese stocks will be around 0.7%, similar to the proportion of Philippine stocks (classified as Secondary Emerging Market by FTSE) in current fund portfolios.

As of November 30, 2023, Bloomberg data shows that there are currently 491 funds with a total size of $956 billion (including 180 ETFs with a size of $421 billion and 311 open funds with disclosed size of $533 billion) invested in newly classified markets by MSCI and FTSE. The proportion of funds referencing MSCI (87%) is higher than those referencing FTSE (13%).

According to BSC’s estimate, in the event that MSCI and FTSE upgrade Vietnam to an Emerging Market, approximately $3.5-4 billion will flow into the Vietnamese stock market. This estimate is based on the assumption that the proportion of new investments in Vietnamese stocks will be around 0.7%, which is equivalent to the proportion of Philippine stocks (classified as Secondary Emerging Market by FTSE) in current fund portfolios.

Which stocks will attract investment?

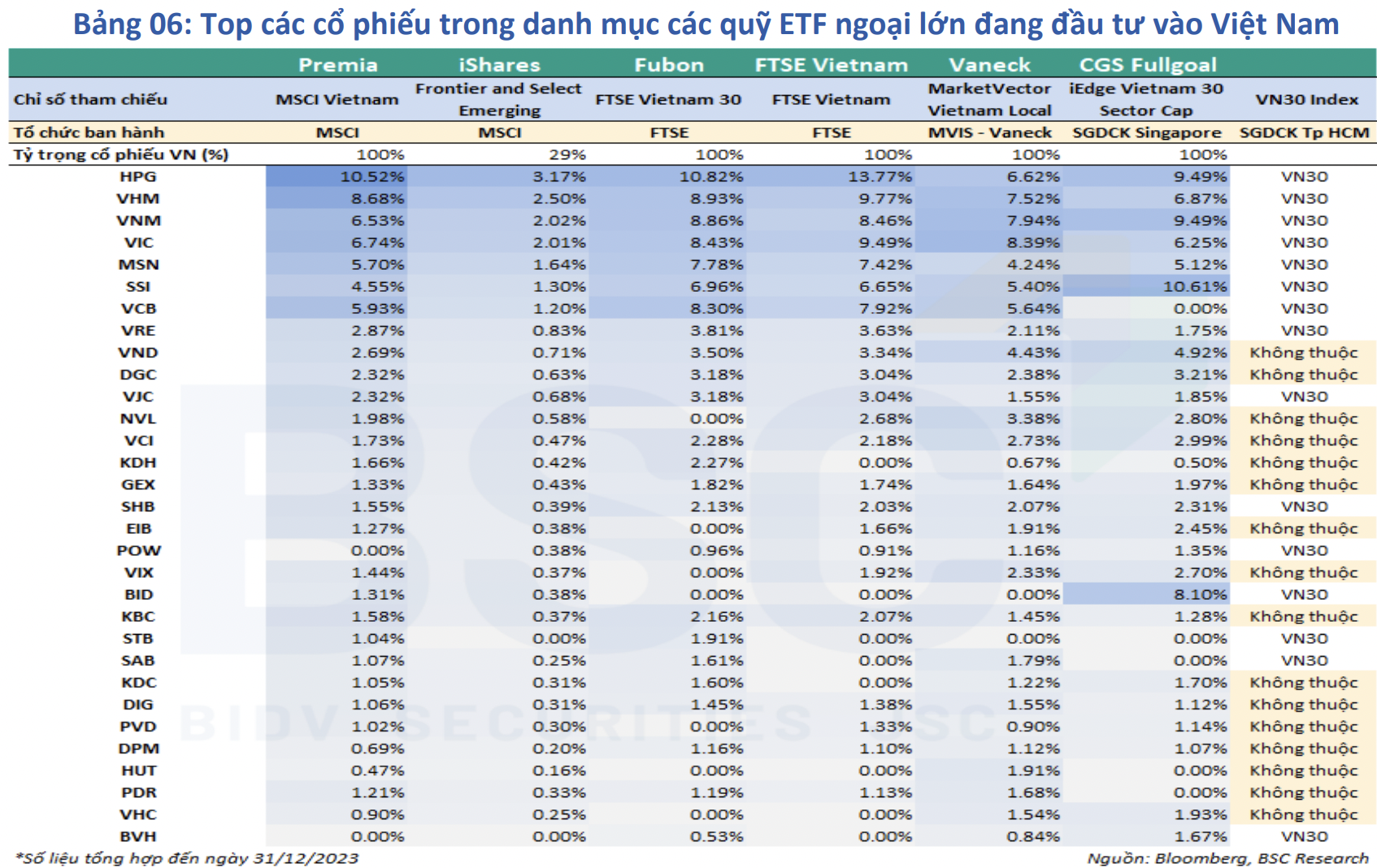

BSC also identifies that in addition to large-cap stocks in the VN30-Index issued by HoSE, other stocks that meet the liquidity, market capitalization, and foreign ownership criteria should be noted in the event of an upgrade.

BSC Research has compiled a list of 31 stocks from 6 foreign ETFs currently holding Vietnamese stocks, including 15/30 VN30-Index stocks: HPG, VHM, VNM, VIC, MSN, SSI, VCB, VRE, VJC, SHB, POW, BID, STB, SAB, BVH.

For stocks that are already maxed out on foreign ownership limits, foreign investors can indirectly invest through the CCQ ETF VN-Diamond or NVDR products in the future (if available).

Overall, BSC believes that Vietnam has been included in FTSE’s watchlist for an upgrade to a Secondary Emerging Market since September 2018. Recently, FTSE has also made positive comments about Vietnam’s efforts in resolving remaining obstacles. FTSE Russell emphasizes the importance of completing appropriate roles and responsibilities according to the new regulations as the next important step while continuing to encourage the Stock Exchange and the Securities Commission to provide clearer guidance on the steps and timeline of implementation.

Market upgrade is the first step towards improving the quality of market participants and aligning with international standards. However, it is necessary to build a strong foundation to withstand regular assessments by FTSE and MSCI, as past experiences have shown that many countries have been upgraded but later removed from the lists due to failing to meet the criteria.