In the fast-paced modern world, owning a car has become an aspiration for many, offering convenience and comfort for daily commutes. However, not everyone can afford to pay the full price of a vehicle upfront.

Understanding this, many banks have stepped up to offer auto loans with attractive interest rates, making it possible for individuals with modest incomes to become car owners. Opting for a car loan not only fulfills the immediate need for transportation but also offers relatively simple procedures for collateral and full repayment.

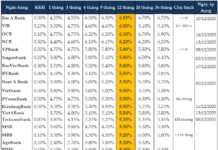

According to surveys, interest rates for auto loans typically range from 6.5% to 9% per annum during promotional periods. Following closely behind are commercial banks, offering promotional interest rates as low as 6.99% per annum, as seen with Eximbank’s current 6-month promotion. State-owned banks tend to offer slightly higher rates, averaging around 7.5% per annum. Borrowers can weigh their options based on their financial capabilities and preferences.

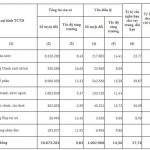

As of August, the surveyed commercial banks offered auto loan interest rates ranging from 5.8% to 13% per annum, with loan tenures varying from 5 to 10 years, and specific conditions outlined by each bank.

Shinhan Bank also offers competitive interest rates with three loan packages. Their rates range from 7% per annum, fixed for the first 6 months, to 8.9% fixed for 18 months, with a maximum tenure of 8 years. However, compared to the previous two banks, Shinhan Bank’s low-interest rate period is relatively short, so borrowers should carefully consider their options.

OCB is also offering promotional loan packages for customers looking to purchase a car or meet personal consumption needs, with interest rates starting at 7.99%. To take advantage of these promotional rates, customers only need to use three of OCB’s products or services, such as VietQR, Credit Cards, OMNI accounts with an average minimum balance of 10 million VND per month, premium account numbers, term deposits with a minimum balance of 100 million VND, or other cross-selling products.

Additionally, commercial banks like Sacombank, MB, and MSB continue to offer interest rates ranging from 7.5% to 10% per annum, depending on the tenure and specific conditions of each bank.

It’s important to note that promotional interest rates are usually valid for a limited time, often just 3 to 6 months. After this period, the rates may be adjusted to match deposit rates or become floating rates. Therefore, borrowers should carefully review the loan terms and conditions before signing any contracts to avoid unexpected increases in monthly payments that could exceed their financial capabilities.

By offering competitive interest rates and flexible loan packages, banks are empowering individuals to achieve their dream of car ownership while also ensuring they make informed financial decisions.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.

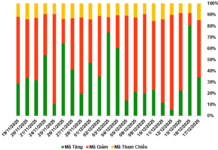

Reflecting on a year of free-falling interest rates

Savings interest rates in 2023 witnessed a race to the lowest levels in 20 years, dropping from a peak of 12% per year for the 12-month term in early 2023 to below 5% per year by the end of the year. Let’s take a closer look at the unprecedented interest rate developments of the past year with Tiền Phong.