**EVNFinance Reports Significant Growth in Interest Income and Total Assets**

Services

|

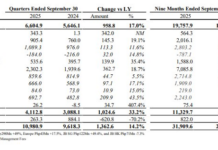

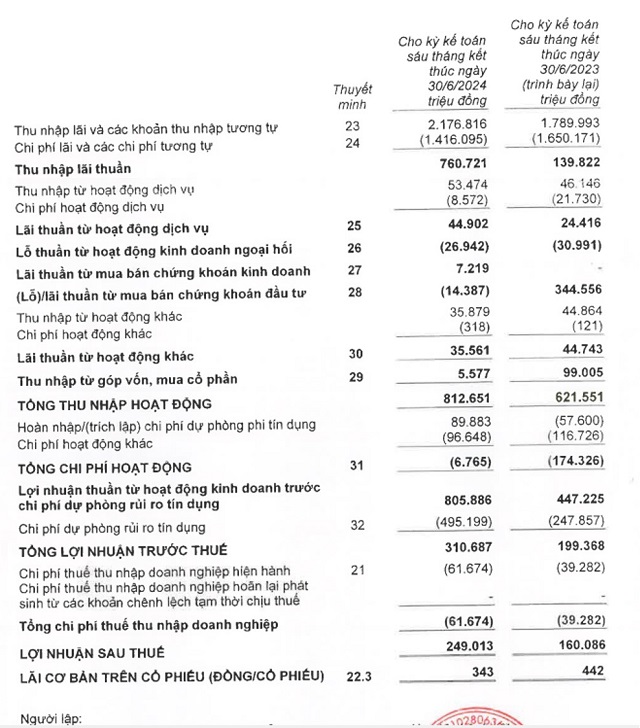

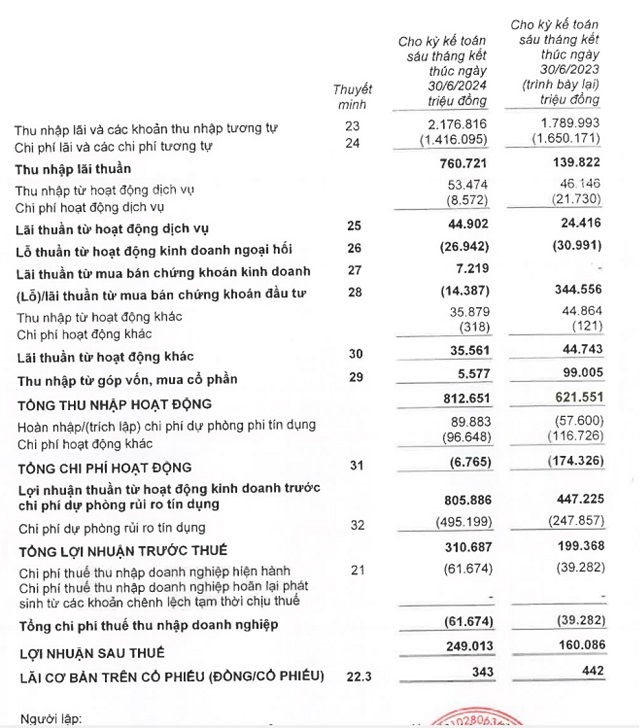

According to EVNFinance’s reviewed business results, net interest income showed remarkable growth, increasing 4.4 times compared to the same period in 2023, reaching VND 760.7 billion. The net interest income ratio improved, contributing positively to EVNFinance’s semi-annual total profits.

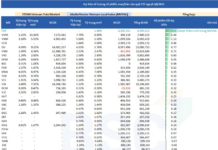

As of the end of the first half, EVNFinance’s total assets reached VND 50,595 billion. Loan balances stood at VND 37,969 billion, accounting for 75% of total assets. In terms of capital mobilization, EVNFinance recorded a growth of 3.5%, including a more than 10% increase in capital raised through the issuance of securities and a nearly 4% rise in deposits from economic organizations compared to the beginning of the year. The capital mobilization balance reached VND 40,753 billion as of June 30, 2024.

Backed by its profitability and balance sheet growth, EVNFinance is expected to sustain its positive business performance in the last six months of 2024. At the 2024 Annual General Meeting of Shareholders, EVNFinance set a pre-tax profit target of VND 585 billion.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.