In a recent move, NVL has decided to reduce its capital contribution in two of its subsidiaries, namely Nova Princess Residence and Nova Rivergate. At Nova Princess Residence, NVL will decrease its capital contribution from 229.7 billion VND to 79.92 billion VND while maintaining a 99% ownership stake. This reduction in capital will also lower the subsidiary’s chartered capital from 300 billion VND to 80 billion VND.

A similar strategy is being employed at Nova Rivergate, where NVL is reducing its capital contribution from 799.2 billion VND to nearly 776.3 billion VND, retaining a 99.77% ownership interest. Consequently, Nova Rivergate’s chartered capital will decrease from 801.1 billion VND to 778 billion VND.

NVL has cited three primary reasons for this decision. Firstly, the subsidiaries have already completed and delivered their respective real estate projects to customers. Secondly, these companies have no immediate plans to initiate new projects. And lastly, the reduction in capital will not alter NVL‘s ownership stakes or impact the subsidiaries’ operational cash flow and debt repayment capabilities.

A brief overview of the two subsidiaries in focus: As per NVL‘s 2023 annual report, Nova Princess Residence is the developer of the Kingston Residence project in Phu Nhuan District, Ho Chi Minh City. This mixed-use development, encompassing an area of 4,604 square meters, was delivered in Q4 2017. On the other hand, Nova Rivergate is the developer of the similarly-themed Rivergate Residence project in District 4, with an area of 7,069 square meters, which began its delivery process in Q3 2017.

Rivergate Residence (left) and Kingston Residence (right) projects

|

In other news, on August 16, the NVL Board of Directors approved borrowing plans from two other subsidiaries: Joint Stock Company for Real Estate Investment and Development – Thuan Phat and Binh An Tourism Company Limited. NVL intends to borrow 111.1 billion VND from Thuan Phat and 40.2 billion VND from Binh An, with both loans carrying a 5-month term and an interest rate of 4.7% per annum.

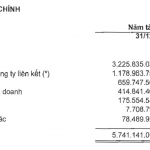

As of June 30, 2024, NVL‘s total debt to related parties remained unchanged from the beginning of the year at 58.5 billion VND, and neither Thuan Phat nor Binh An were included in this figure. Binh An has a chartered capital of 297 billion VND, while Thuan Phat’s chartered capital stands at 2,516 billion VND. Notably, Thuan Phat is not listed as the developer of any projects, whereas Binh An is currently developing the Morito subdivision within the expansive NovaWorld Ho Tram project, spanning over 21 hectares.

Novaland reduces conversion price of USD 300 million international bonds to VND 40,000/cp; 2.3 times the market price

This is the fourth time that Novaland has changed the conversion price of the mentioned bond tranche.