On August 21, iPOS.vn released the Vietnam Food and Beverage Business Market Report for the first half of 2024, based on a survey of nearly 1,000 restaurants/cafes, over 2,300 diners, and 1,307 F&B personnel in Vietnam, ranging in age and profession. The report also references data from market research companies, reputable international sources, and industry experts’ opinions.

As of the end of June 2024, the country recorded approximately 304,700 outlets, a 3.9% decrease compared to 2023 figures. There were at least 30,000 closures nationwide, along with a limited number of new openings.

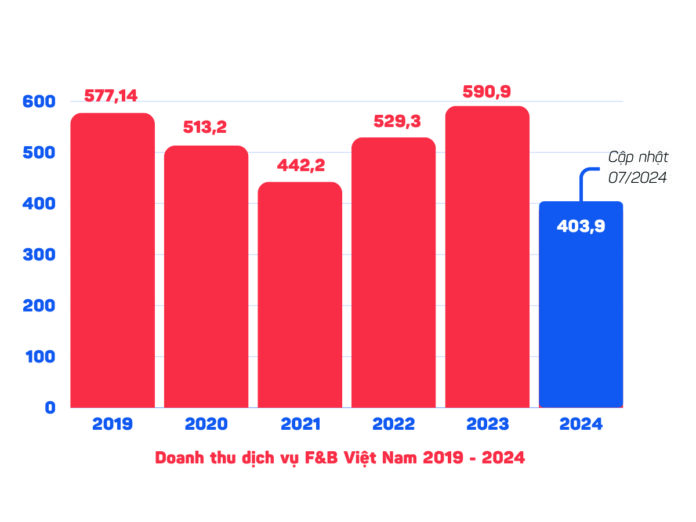

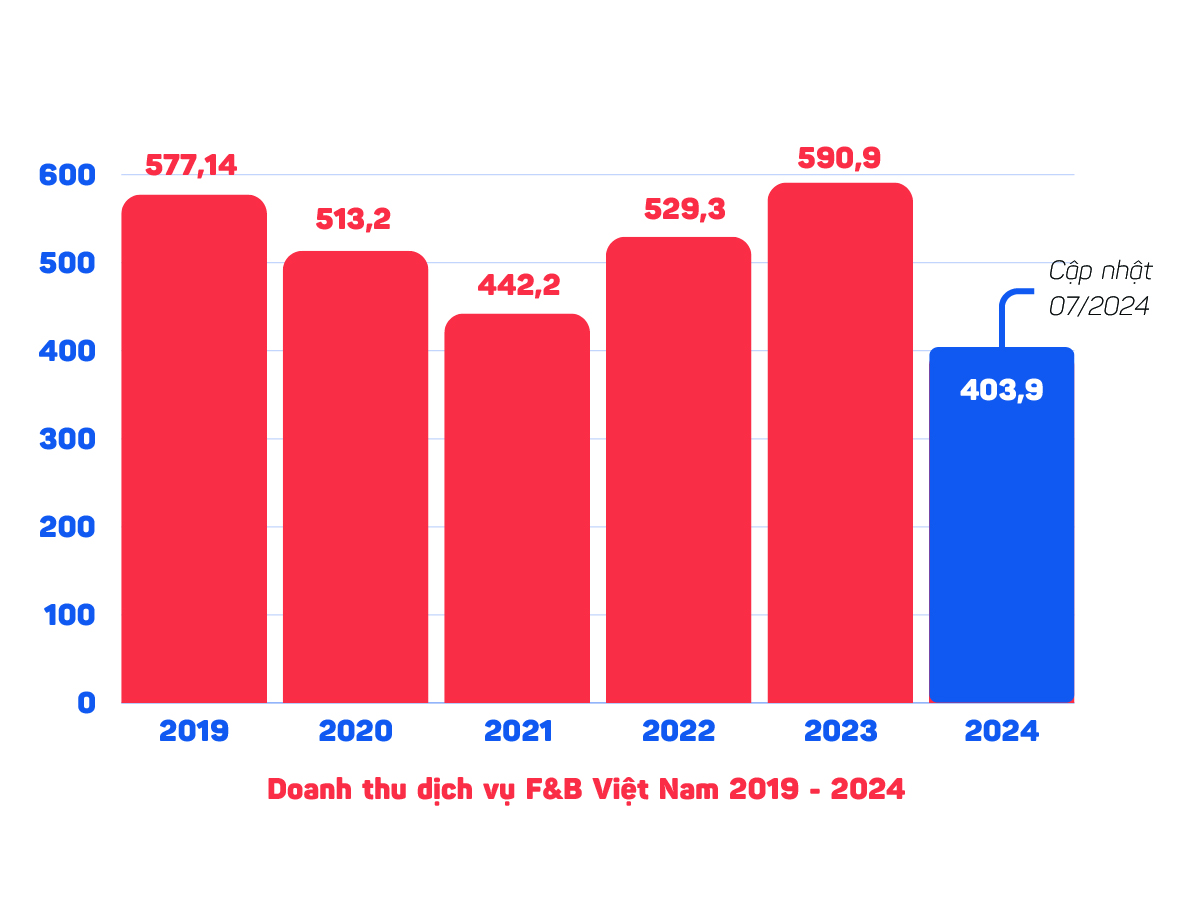

Despite the challenges, the total revenue of the F&B industry surprisingly reached a milestone of 403,900 billion VND, equivalent to 68.46% of the revenue for the whole of 2023.

Source: iPOS.

Looking at the performance of F&B businesses in Vietnam, since the beginning of 2024, their revenue has witnessed significant fluctuations. Although the year started with positive signals, the downward trend became evident by mid-year.

Specifically, the percentage of businesses reporting a decrease in revenue in February reached 43.4%. There was a slight growth in March, followed by a consistent decline until the middle of the year. As a result, businesses are becoming more cautious about their development plans for the remaining six months.

According to the survey, 61.2% of businesses aim to maintain their current scale, while 34.4% plan to expand to new locations. This contrasts with the same period in 2023, when 51.7% of F&B businesses had similar ambitions.

However, the economic challenges have not dampened the Vietnamese people’s love for cuisine. Instead of reducing spending on dining out, many respondents try to maintain their frequency of eating out but plan their expenditures more carefully.

The survey reveals that the high-frequency groups (3-4 times/week and daily) remain almost unchanged from 2023. Simultaneously, the group of customers with a frequency of 1-2 times/week increased by 4.1% compared to the previous year. Overall, loyal customers continue their dining habits, indicating the strong appeal of the F&B industry.

Notably, spending on “coffee shop visits” decreased significantly in the first half of 2024, and the frequency also declined. Although the price range of 41,000 to 71,000 VND per cup became more popular, with an 11.5% growth in the percentage of people choosing this range, the high-end segments struggled. The percentage of people spending over 100,000 VND per cup dropped sharply from 6% to 1.7%.

Commenting on the F&B market situation in the first half of 2024, Mr. Vu Thanh Hung, CEO of iPOS.vn, stated that the strong fluctuations presented significant challenges for the entire service industry, especially the F&B sector.

“However, Vietnamese F&B businesses have demonstrated remarkable flexibility by quickly adjusting their operations, cutting unnecessary costs, and optimizing cash flow. At the same time, their constant creativity in product development has offered unique culinary experiences, attracting a large number of diners,” he added.

This iPOS.vn report also discloses an in-depth study of F&B personnel in Vietnam. Accordingly, the country has approximately 2.89 million F&B workers, but 81.3% of them work part-time. While the industry provides numerous job opportunities, it has not been overly attractive to those seeking long-term careers.

No need to take a Tet holiday, Cotti Coffee chain in China opens 2 stores in Hanoi: “Bloodshed” promotion comparable to sidewalk vendors.

This creates some competitive pressure for other competitors in the market, especially during the Tet holiday season.

“Vietnam’s Top 5 Coffee Shops Set to Make Waves in Singapore: Luckin Coffee, Watch Out!”

In Singapore, the Chinese brand Luckin Coffee has quickly gained dominance through its franchise model, compact spaces, and affordable prices. Meanwhile, Founder …Ka Coffee – a coffee chain that has opened 5 branches in Hanoi and Ho Chi Minh City – has announced that their franchise stores in Singapore will have spacious premises, despite the high rent costs of 200-300 million VND for 80 square meters spread across two floors.

China’s booming investment in Vietnam creates a culinary storm in the F&B market: From spicy coffee and grilled sausage on ice to hand-shaken lemon tea, Mixue and Haidilao are all the rage.

The hottest trend in the F&B industry is happening in the backdrop of a significant increase in Chinese investment capital in the Vietnamese market in 2023. When it comes to the number of projects, China is the leading partner in terms of new investment projects.

Unstoppable beverage trends, who can keep up with the wave?

(KTSG Online) – The F&B market is set to see a wave of new products in the bubble tea and beverage industry by 2023, making it the focal point of each season. While some items have established themselves as brand staples, there are also those that quickly rise and fall. In addition, there is a growing number of “local and international” beverage chains entering the market with substantial investments, indicating that competition goes beyond just following trends.