Illustration

Oil Falls to Two-Week Low

Oil prices dropped by 1% to a two-week low as concerns over supply disruptions in the Middle East eased. This followed Israel’s acceptance of a proposal to resolve disagreements that had prevented a ceasefire in Gaza. Additionally, weak economic data from China raised concerns about fuel demand.

Brent crude for October 2024 delivery settled down 46 cents, or 0.6%, at $77.20 a barrel. WTI crude for September 2024 fell 33 cents, or 0.4%, to $74.04 a barrel, while WTI for October delivery declined by 49 cents to $73.17.

OPEC+, which includes the Organization of the Petroleum Exporting Countries (OPEC) and allies such as Russia, noted that global oil demand growth must accelerate in the coming months for the market to absorb the group’s planned supply increase from October 2024.

Saudi Arabia, a key OPEC member and the world’s largest oil exporter, reported that its crude exports fell to 6.047 million barrels per day (bpd) in June 2024, down from 6.118 million bpd in May.

Data from China, the world’s second-largest economy, showed a sharp decline in new home prices in July, a slowdown in industrial output, weaker export growth and investment, and a rise in the unemployment rate.

Concerns about fuel demand in the US, the world’s top economy, weighed on prices, with US heating oil falling to its lowest since May 2023 for a second straight session. US gasoline prices also dropped to their lowest since February 2024.

US Natural Gas Prices Slip 2%

Natural gas prices in the US fell by 2% as forecasts predicted cooler weather over the next two weeks, reducing the need for air conditioning and the amount of gas used by power plants.

The front-month Nymex gas contract for September delivery settled 3.7 cents lower at $2.198 per million British thermal units (mmBtu), having hit a three-week high in the previous session.

Gold Prices Surge Past $2,500

Gold prices soared to a record high, surpassing the $2,500 mark, boosted by a weaker US dollar and expectations that the Federal Reserve will cut interest rates in September 2024.

Spot gold on the LBMA climbed 0.3% to $2,510.35 an ounce after hitting an all-time high of $2,531.6 earlier in the session. Gold futures for December 2024 on the New York COMEX rose 0.4% to $2,550.60 an ounce.

The dollar index fell to a seven-month low, making gold cheaper for buyers with other currencies, while the yield on the 10-year US Treasury note also declined.

According to Aakash Doshi, head of commodities research for North America at Citi, gold prices could reach $3,000 by mid-2025 and $2,600 by the end of 2024.

Aluminum Hits Five-Week High, Copper Falls

Aluminum prices reached a five-week high due to a shortage of alumina, the raw material used to produce the metal, in top producer China. A weaker dollar also spurred buying.

Three-month aluminum on the London Metal Exchange (LME) rose 1.6% to $2,483 a ton, touching $2,506 a ton, its highest since July 11, during the session.

Chinese alumina prices hit a near three-month high as tight supply and strong demand supported prices of the raw material.

Copper prices on the LME fell 0.7% to $9,188.50 a ton, pressured by rising inventories in London, which climbed to their highest since May 2014 at 320,050 tons.

Iron Ore and Steel Rebar Extend Gains

Iron ore futures on the Dalian Commodity Exchange rose, supported by strong steel prices in top consumer China. However, doubts about demand prospects due to the lack of robust stimulus measures capped the gains.

The September 2024 iron ore contract on the Dalian exchange ended 1.21% higher at 710.50 yuan ($99.45) a ton, rising for a second straight session.

Meanwhile, the September 2024 iron ore contract on the Singapore Exchange fell 1.11% to $93.95 a ton after rising in the previous session, as the dollar rebounded slightly.

On the Shanghai Futures Exchange, steel rebar rose 1.93%, hot-rolled coil climbed 1.97%, wire rod added 1.21%, and stainless steel dropped 0.4%.

Japanese Rubber Futures Hit Six-Week High

Japanese rubber futures climbed to a six-week high, supported by higher synthetic rubber prices and global supply disruptions. A weaker yen also provided some support to the market.

The rubber contract for January 2025 delivery on the Osaka Exchange (OSE) rose 4.5 yen, or 1.38%, to end at 331 yen ($2.25) per kg, earlier hitting 332 yen, its highest since July 4.

Rubber futures for January 2025 delivery on the Shanghai futures market rose 175 yuan to 16,325 yuan ($2,285.13) per ton.

The September 2024 rubber contract on the Singapore Exchange gained 0.4% to 174.8 US cents per kg.

Robusta Coffee Climbs to One-Month High

Robusta coffee futures for November 2024 delivery on the LME rose $143, or 3.2%, to $4,619 a ton, after hitting a one-month high of $4,656 a ton.

Arabica coffee for December 2024 on the ICE rose 1.7% to $2.485 a lb, fueled by concerns that dry weather in Brazil could impact crop yields.

Raw Sugar Hits Near Two-Year Low

Raw sugar fell to its lowest in nearly two years, pressured by heavy selling.

The October 2024 raw sugar contract on ICE dropped 0.45 cent, or 2.5%, to 17.57 cents per lb, its lowest since October 2022.

White sugar for October delivery on the LME fell 2.2% to $502.50 a ton.

Soybeans and Wheat Rise, Corn Falls

Soybean and wheat futures on the Chicago Board of Trade (CBOT) climbed on signs of increasing demand.

On the CBOT, soybeans were unchanged at $9.76 a bushel, corn fell 2-1/4 cents to $3.98 a bushel, and wheat rose 4-1/4 cents to $5.56-1/2 a bushel.

Palm Oil Prices Slip

Palm oil prices in Malaysia came under pressure from lower export data and weaker Chicago soybean oil prices. However, gains in Dalian vegetable oil prices limited the decline.

The benchmark palm oil contract for November 2024 on the Bursa Malaysia Derivatives Exchange fell 6 ringgit, or 0.16%, to 3,715 ringgit ($849.14) a ton.

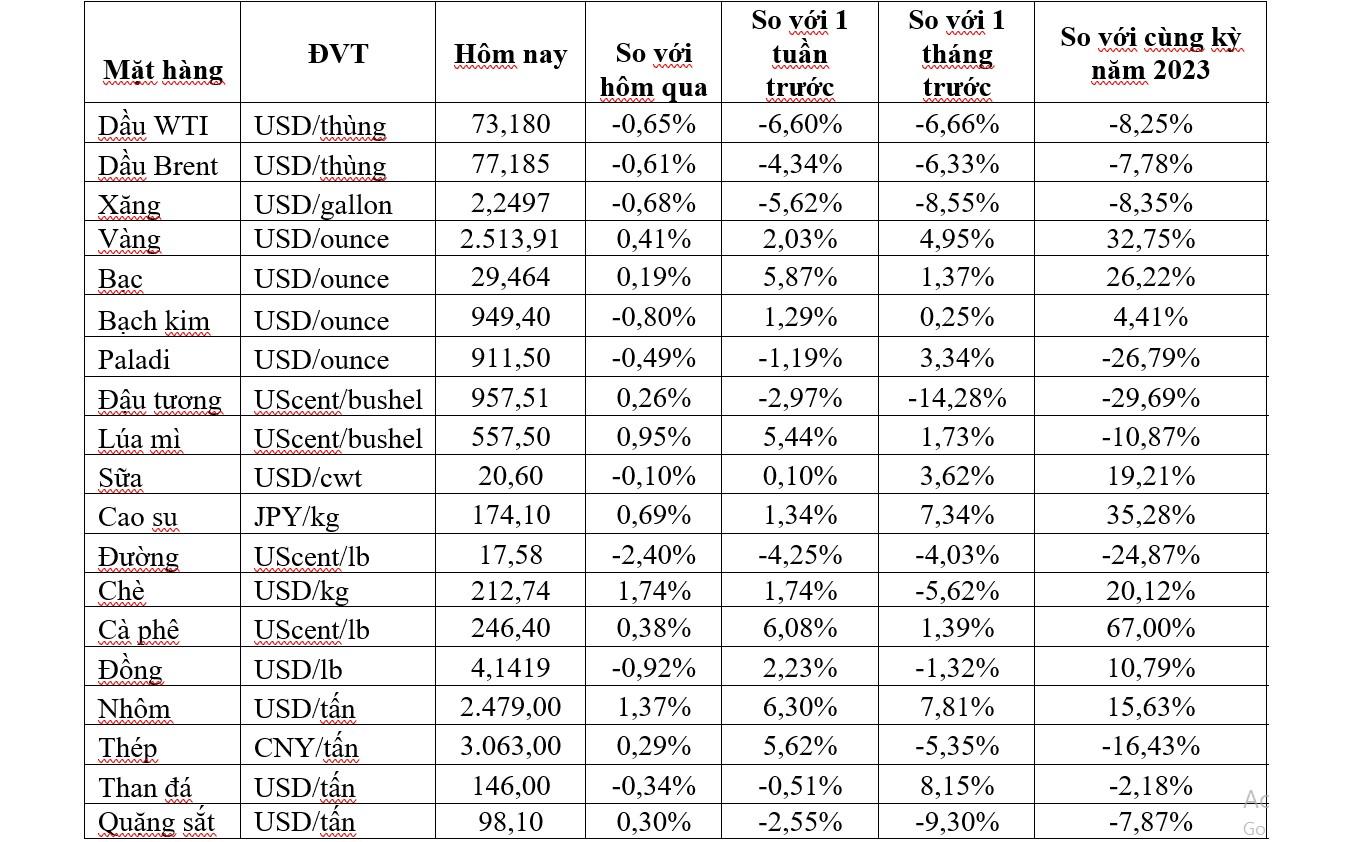

Key Commodity Prices on August 21st

Gold prices surge as Lunar New Year approaches

On the morning of February 1st, the domestic gold price continued to surge with an increase of 500,000 VND/tael, approaching the 78 million VND/tael mark. As Tet holiday approaches, the price of gold tends to rise sharply.

Market Update on February 3rd: Crude oil, gold, copper, iron and steel, and rubber all decline together.

At the close of trading on February 2nd, the prices of oil, gold, copper, steel, rubber, and coffee all saw a simultaneous decrease, with iron ore hitting a two-week low.