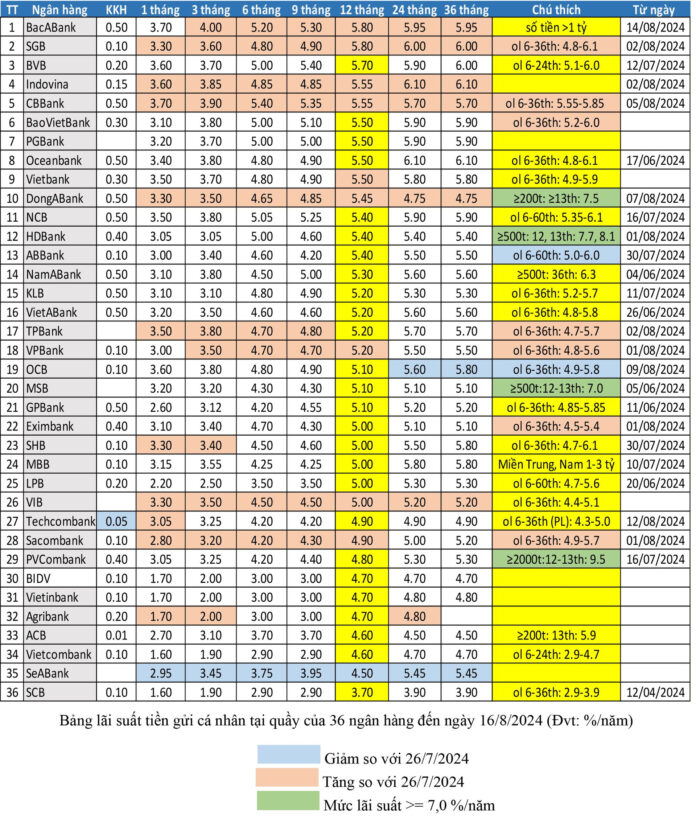

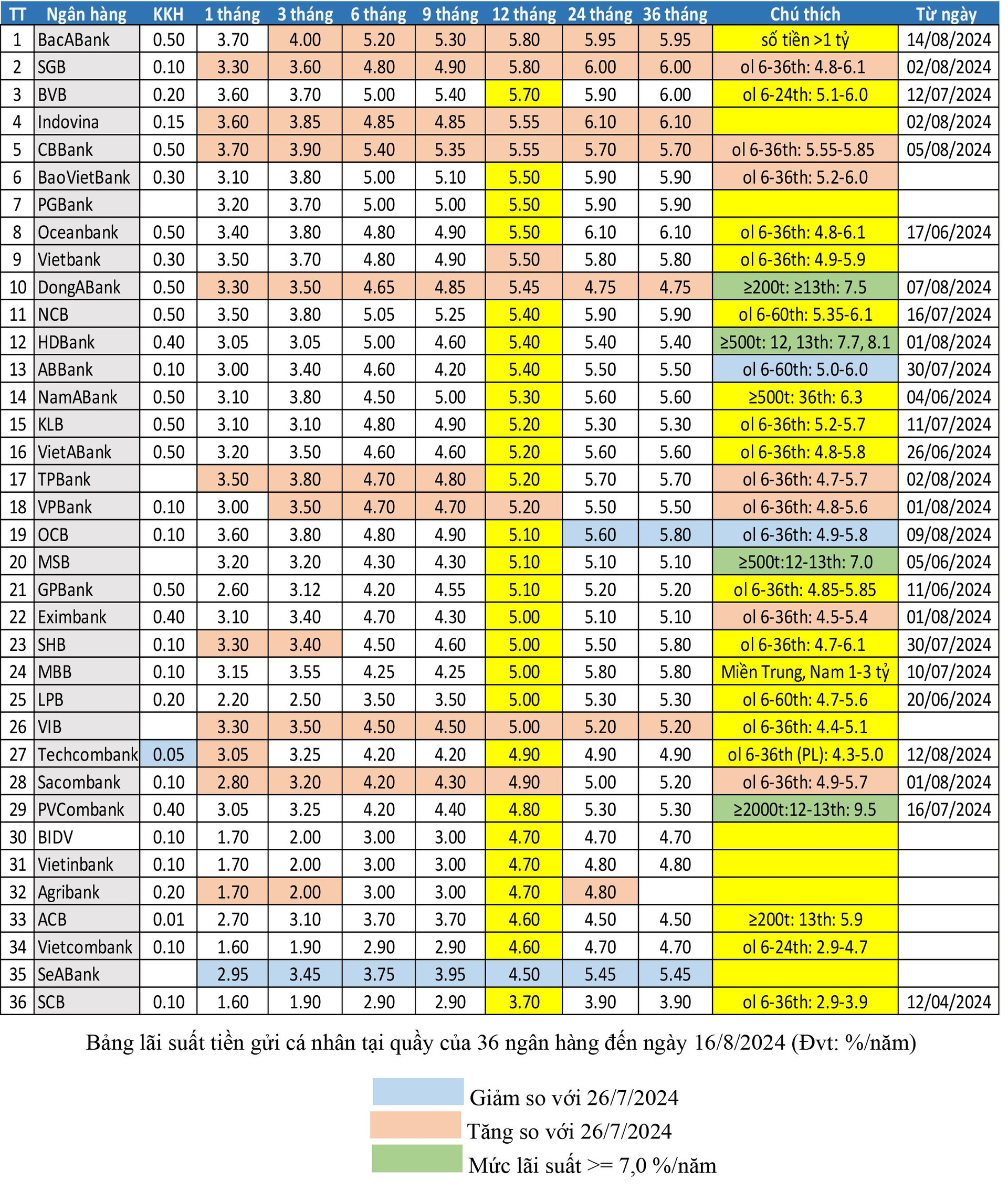

According to statistics from the Ho Chi Minh City Representative Office of the Vietnam Banks Association, in the three weeks from July 29 to August 16, 15 out of 36 banks adjusted their savings deposit interest rates upwards, while four banks lowered their rates.

Among them, DongABank made the most significant increase in savings deposit interest rates, with a 0.9% rise for the 12-month term, bringing the interest rate for this term to 5.45%. This is also the highest deposit interest rate at DongABank.

In addition to the above term, DongABank also adjusted upwards by 0.5% for terms ranging from 1 to 9 months, resulting in interest rates for these terms fluctuating between 3.3%/year and 4.85%/year.

During the surveyed period, Sacombank also increased the 1-month term by 0.5% to 2.8%/year and the 3-9 month terms by 0.4% to a range of 2.8%/year – 4.3%/year. Currently, the highest deposit interest rate at Sacombank is 5.7% for the 24-36 month term for online savings products.

CBBank raised its interest rates by 0.4% for terms ranging from 1 to 12 months, resulting in deposit interest rates for these terms fluctuating between 3.7%/year and 5.55%/year. According to the new interest rate table, the highest savings deposit interest rate at this bank is 5.85%/year for online savings with terms ranging from 24 to 36 months.

The remaining banks made slight adjustments to their deposit interest rates, with increases ranging from 0.1% to 0.3% for terms ranging from 1 to 60 months, applicable to both counter and online deposits.

A few banks, including Techcombank, OCB, SeABank, and ABBank, slightly lowered their interest rates (by 0.05% to 0.25%) for both counter and online savings deposits.

Statistics show that for deposits below VND 200 billion, the highest interest rate in the system is 6.1%/year, offered to online savers with terms ranging from 24 to 36 months. Four banks are currently listing this interest rate, including Saigonbank, SHB, NCB, and Oceanbank.

For the 9-month term, the highest savings deposit interest rate is 5.55%/year. NCB is the only bank offering this rate to online savers.

For the 6-month term, the highest deposit interest rate is 5.55%/year, exclusively offered by CB Bank for online savers.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…