Data from VietstockFinance shows that 19 seafood businesses listed on the stock exchanges (HOSE, HNX, and UPCoM) reported second-quarter financial statements for 2024 with a total revenue of about VND 18.2 trillion, up 22%. Meanwhile, profit fell by 22% to VND 563 billion. There were 14 companies that experienced revenue growth, but only 10 improved in terms of profit.

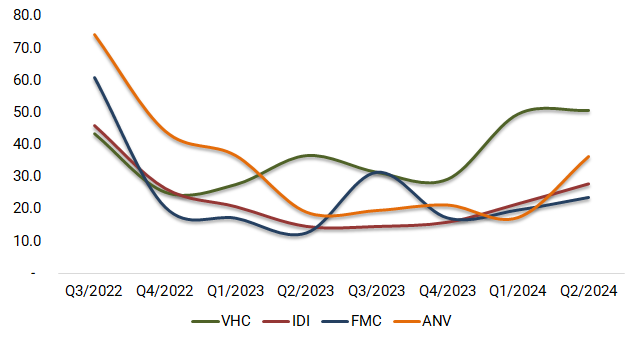

MPC, ASM, VHC, IDI, FMC, and ANV remain the top performers with revenue in the thousands of billions. The revenue and net profit of these six enterprises accounted for 80% and 96% of the industry’s total revenue, respectively.

Transportation costs increased manifold

In the group of enterprises with revenue in the thousands of billions, the most optimistic in terms of profit was probably Nam Viet (HOSE: ANV) with a profit of VND 17.5 billion, while in the same period last year, they suffered a loss of VND 51 billion. Thanks to the increase in output, the revenue in the second quarter was the highest since 2022. Next was the Sao Mai Group (HOSE: ASM), whose revenue and profit increased again after many consecutive quarters of decline.

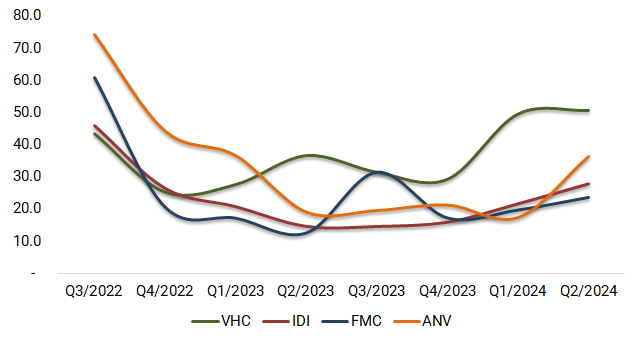

The remaining enterprises saw a decrease in profit despite the increase in revenue due to the impact of transportation costs. Even for ANV, this expense exceeded VND 36 billion, double that of the same period last year.

The deepest profit decline was that of the “tra fish queen” Vinh Hoan (HOSE: VHC) – falling by almost half to VND 314 billion, while revenue increased by 17% to VND 3.1 thousand billion. In addition to the decrease in the selling price of the tra fish product group as explained by the Enterprise, “transportation, storage, and other costs” amounted to VND 50 billion, an increase of 38%; the accumulated first half of the year increased by 56%.

The pressure of high shipping costs caused the profit of Multi-national Investment and Development – IDI (HOSE: IDI) to decrease by 31%, to over VND 15 billion, in the context of revenue remaining stable at VND 1.9 thousand billion and a significant decrease in loan interest.

Similarly, due to the doubling of transportation costs and the absence of anti-dumping tax refund, Sao Ta Food Joint Stock Company (HOSE: FMC) saw a 7% decrease in profit, reaching VND 66 billion; despite a 20% increase in exports, revenue reached VND 1.2 thousand billion.

|

Transportation costs of some leading seafood enterprises (unit: billion VND)

Source: Author’s compilation

|

Minh Phu Seafood Corporation (UPCoM: MPC) recorded a 59% and 202% increase in revenue and net profit in the second quarter, reaching VND 3.7 thousand billion and VND 33 billion, respectively. According to the Enterprise, these results were thanks to the effectiveness of shrimp breeding and commercial shrimp farming activities. However, the pre-tax profit of the “shrimp king” was still 11% lower than in the second quarter of 2023. The difference in deferred income tax expense created the above-mentioned net profit advantage.

|

Q2 Financial Statements of Enterprises with Revenue in Thousands of Billions (unit: billion VND)

Source: VietstockFinance

|

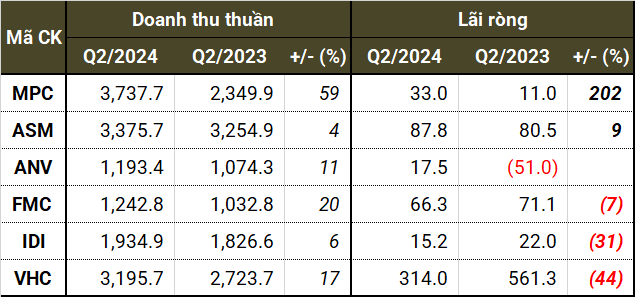

Divergence in smaller-scale enterprises

In the group of smaller-scale enterprises, most experienced revenue growth but profit divergence. THP, SJ1, ABT, KHS, and CCA saw strong profit growth, while CMX, ACL, ICF, JOS, CAD, and AAM saw a decrease in profit or even deeper losses compared to the same period last year.

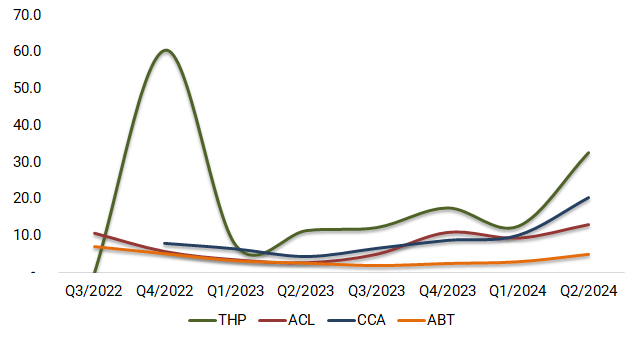

Some enterprises that benefited from favorable conditions in the second quarter were SJ1, ABT, and THP. The revenue of Seafood and Trade Thuan Phuoc (UPCoM: THP) reached VND 897 billion, an increase of 31%; net profit was VND 13.2 billion, up 110%, the highest in many years.

The net profit of Ben Tre Seafood Import and Export Joint Stock Company (HOSE: ABT) reached VND 34 billion, an increase of 19%, second only to the record of VND 39 billion in the second quarter of 2010. Revenue reached VND 159 billion, an increase of 18%. Similarly, the revenue and net profit of Hung Hau Agriculture Joint Stock Company (HNX: SJ1) in the second quarter both increased sharply, by 30% and 236%, respectively, reaching VND 383 billion and VND 9.7 billion. SJ1’s profit was the highest since 2019.

Can Tho Seafood Import-Export Joint Stock Company (UPCoM: CCA) returned to profitability after two consecutive quarters of losses, earning VND 4.7 billion. Revenue increased by 38%, reaching VND 322 billion, thanks to the increasing demand for tra fish as the world economy gradually recovered.

The reason for the return to profitability of An Giang Seafood Import and Export Joint Stock Company (UPCoM: AGF) was due to the gradual recovery of the Chinese economy after the COVID-19 pandemic, as processing units accelerated export volumes, and production increased.

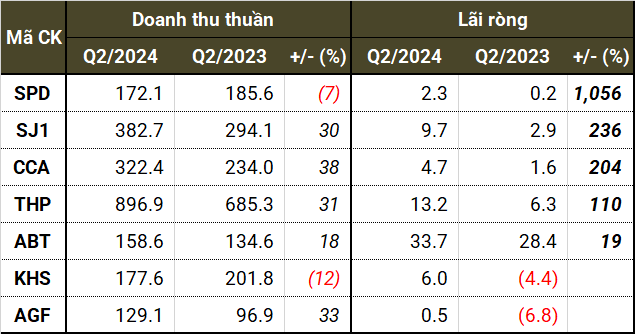

However, these enterprises were more or less affected by transportation costs. For example, THP’s profit was greatly limited by sea freight costs; cumulative for the first half of the year, it increased by 140%, from VND 19 billion to VND 45 billion, with the main fluctuation occurring in the second quarter. CCA’s CNF freight cost in the first six months reached VND 30 billion, triple that of the same period last year. ABT also felt this increase, albeit to a lesser extent.

|

Q2 Financial Statements of Enterprises with Profit Increase (unit: billion VND)

Source: VietstockFinance

|

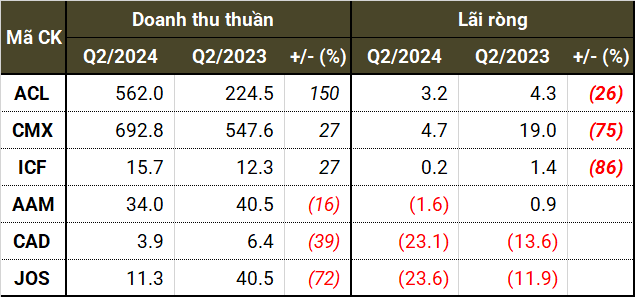

In the group of enterprises with decreasing profits, Cuu Long An Giang Seafood Import and Export Joint Stock Company (HOSE: ACL) saw a 150% increase in revenue, reaching VND 562 billion – the highest ever; loan interest decreased by half to nearly VND 8 billion. The only downside was the increase in transportation costs and other expenses by VND 12 billion in the second quarter and four times that of the same period last year, causing profit to decrease by 26%, to VND 3.2 billion.

High loan interest expenses and foreign exchange losses were the reasons for the sharp decrease in net profit of Camimex Group (HOSE: CMX) to VND 4.7 billion, the lowest in many years, despite a 27% increase in revenue to VND 693 billion.

AAM, JOS, and CAD were the enterprises that experienced decreases in both revenue and profit. In particular, JOS and CAD continued to incur net losses, even heavier than last year.

Due to operating below cost and high loan interest expenses, Minh Hai Export Seafood Processing Joint Stock Company (UPCoM: JOS) incurred a loss of nearly VND 24 billion, approaching the historical level of the second quarter of 2022. JOS has been losing revenue for many years, currently reaching only VND 11.3 billion. Similarly, Mekong Seafood Joint Stock Company (HOSE: AAM) reported a loss of VND 1.6 billion due to higher cost of goods sold than revenue and increased transportation costs.

|

Q2 Financial Statements of Enterprises with Profit Decrease (unit: billion VND)

Source: VietstockFinance

|

|

Transportation Cost Changes of Some Medium-sized Enterprises (unit: billion VND)

Source: Author’s compilation

|

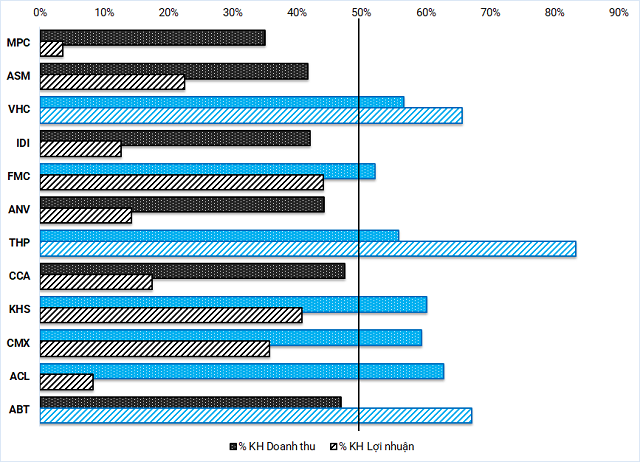

Most enterprises have not achieved their profit targets

After the first half of 2024, about half of the seafood enterprises achieved over 50% of their annual revenue plan. Only three notable enterprises, VHC, THP, and ABT, achieved more than 50% of their annual profit target. Notably, VHC set a lower target compared to 2023.

In the group of enterprises with revenue in the thousands of billions, MPC is still far from the finish line, especially in terms of profit, as net profit has only reached 4% of the full-year target. IDI and ANV have also only achieved 13-14% of their net profit plan.

|

Progress of Seafood Enterprises against Annual Plan after the First Half of the Year

Source: Author’s compilation

|

KBS Securities (KBS) forecasts that the seafood industry will recover in the second half of 2024 when the central banks of the main markets signal lower interest rates, positively impacting consumption. However, KBS believes that there are still many uncertainties from external factors such as anti-dumping taxes, geopolitical tensions causing freight rates to soar, the IUU “yellow card,” and international competition.

In the US market, Vietnamese shrimp is awaiting an official decision on anti-subsidy and anti-dumping duties and is facing fierce competition from Ecuadorian shrimp. The Japanese shrimp market will recover more slowly but could be the next destination for Vietnamese enterprises in the current context thanks to its preference for processed products.

On the other hand, KBS assesses that the US and European markets hold much potential for tra fish in the second half of the year, especially benefiting from the ban on the sale of Russian pollock.

The export price of tra fish is expected to recover slightly in the last months of 2024 due to supply shortages. The reasons include low prices and unfavorable weather conditions, which have discouraged many farmers from restocking. However, the high freight rates for transportation to the US and Europe will significantly affect the profits of enterprises.

Regarding transportation costs, a report by SSI Securities at the beginning of the year stated that geopolitical tensions, especially the escalation in the Red Sea region, could keep freight rates high in 2024. This is partly due to the number of new ship orders currently being at the lowest level in history, only 8% of the existing fleet.

From 1/3, domestic flight ticket prices will increase significantly

Beginning from March 1st, in accordance with the Circular 34 issued by the Ministry of Transport, there will be an increase in the maximum airfare for domestic flights.