On August 22, the Hanoi People’s Court opened a first-instance criminal trial to try 135 defendants in a case involving “Usury in civil transactions”, “Tax evasion”, and “Extortion” led by a group of Chinese nationals. In addition to the 135 defendants present, the Council also summoned many victims and related persons with rights and obligations, but a large number of them were absent.

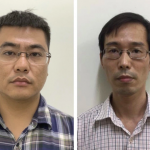

The defendants at the trial

According to the indictment, in October 2017, Li Zhao Qiang (born 1988, Chinese nationality) entered Vietnam and created apps: “Cash Vn”, “Vaynhanhpro”… with the server located in Hong Kong (China). These apps offered loans to Vietnamese customers at high-interest rates, ranging from 43,000 to 60,000 VND per million VND per day (equivalent to an annual interest rate of 1,570% to 2,190%). Li Zhao Qiang’s ring mainly operated in Hanoi but also expanded to many other provinces and cities nationwide.

To organize lending activities, Li Zhao Qiang discussed and hired Nguyen Quang Vu (born 1987, residing in Ba Dinh district, Hanoi) along with several other subjects to establish, manage, and operate a number of companies. In addition, Li Zhao Qiang also brought Zhang Min (born 1986, Chinese nationality) and Liu Dan Yang (born 1992, Chinese nationality) to Vietnam and recruited employees to work in the departments of telesales, credit assessment, debt reminder, and collection.

In case the borrowers defaulted, the group working at Metag Company and DCS Customer Service Company, managed by Zhang Min, would collect the debt by using different phone numbers to send text messages, make phone calls to insult and threaten, or edit and post photos of the borrowers and their relatives on social media to defame and pressure them into repaying.

The entire operation of this criminal ring was directed by two “head” companies: Newstar Vietnam Technology Company Limited and Ngoi Sao Viet Trading Service Company Limited. These two companies managed the operations of branch companies, paid salaries to employees, and were responsible for the credit assessment of all loan applications.

The prosecution alleged that from January 2019 to May 2022, the defendants had engaged in usury, extortion, tax evasion, and illegal profits totaling over 732 billion VND.

The operation model of the usury group in this case as presented in the indictment

During the management of this criminal ring, Li Zhao Qiang deposited money into the bank accounts of Ngoi Sao Viet Trading Service Company Limited to provide capital for lending through apps such as “Cash VN”, “Vay Nhanh Pro”… and let Nguyen Quang Vu manage it. Vu then handed it over to his subordinate, Tran Thi Hang, who was in charge of managing and guiding the operation of 28 employees specialized in inviting and offering loans to customers.

Each new employee was provided with a fixed computer installed with the X-Lite software to make free calls to customers and a script to answer phone calls for each situation. Nguyen Quang Vu’s employees had to memorize the script.

If the customer agreed to borrow money, the employee would ask them to download the app and register to create an account, providing personal information, address, etc. The credit assessment department would then verify and approve the loan.

To recover the loaned money, the defendants divided the debts into groups and applied different methods for each group. For group M1 (overdue for 4 to 9 days), they would make phone calls to insult and threaten. For group M2 (overdue for 10 to 17 days), they would post the customer’s photos on their Facebook accounts or edit photos of the customers being naked, in a coffin, having sex, or being wanted by the police. For group M3 (overdue for 18 to 25 days), they would post edited photos on social media, in the areas around the customer’s house, or go directly to their house to threaten them.

The indictment determined that this ring had lent money to 120,780 customers, with a total loan amount of over 1,607 billion VND at high-interest rates, making illegal profits of more than 732 billion VND. Specifically, the “Vay Nhanh Pro” app made a profit of over 177 billion VND, the “Cash VN” app made a profit of over 547 billion VND, and the “Ovy” app made a profit of over 7.5 billion VND.

In this case, Li Zhao Qiang was identified as the mastermind and leader. However, as Li Zhao Qiang is not present in Vietnam, the Hanoi Police Investigation Agency has issued a domestic wanted notice and is coordinating in the procedure for an international wanted notice. He will be handled by the law when captured.

Investigation into Tax Evasion Suspected in the Case of Fraudulent Real Estate Project in Binh Thuan

As the investigation into the TP Holding case, accused of fraudulent sale of a ‘ghost’ project in Binh Thuan province, is still ongoing, authorities are now also looking into possible tax evasion by this company.

Proposal to prosecute 4 corporate directors for causing a loss of over 16 billion VND in tax revenue

During the process of importing goods for business purposes, Mr. Doan Manh Duong (Director of Tan Dai Duong Company) has been accused of directing the misdeclaration of categories, names, and codes of the goods on the customs declaration in order to reduce the taxes payable. Additionally, he has been involved in facilitating illegal transactions between two other companies in terms of value-added tax invoices.