Real Estate Stocks Soar

This week, a host of real estate stocks soared in both price and liquidity, riding the wave of the stock market’s strong recovery.

Phat Dat and Dat Xanh Stocks Soar

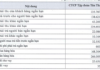

At the close of August 23, Phat Dat Development Joint Stock Company (Ticker: PDR) stock ended at VND 21,600 per share, up 0.93% from the previous session, with a trading volume of nearly 13 million shares.

Over the past week, PDR stock has gained in all five sessions, with a share price increase of 14.9%, or VND 2,800, and an average trading volume of over 15 million shares per session.

Similarly, Dat Xanh Group Joint Stock Company (Ticker: DXG) stock also soared this week, ending higher in all five sessions.

At the end of the August 23 session, DXG stock rose 0.63% to VND 15,900 per share, with a trading volume of over 17.8 million shares.

In the past week alone, the share price of DXG climbed 12.8%, or VND 1,800.

Vincom Retail Stock Soars from Historic Lows

At the close of August 22, Vincom Retail Joint Stock Company (Ticker: VRE) stock ended at VND 19,700 per share, up 4.23% from the previous session, with a trading volume of over 22 million shares – a significant surge compared to the average trading volume of 7.8 million shares in the past ten sessions.

This marked the third consecutive gaining session for VRE stock. Notably, in the past eight sessions, VRE stock recorded only one losing session and one session with no change in share price, while soaring in the rest.

Looking further back, since plunging to a historic low of VND 16,800 per share on August 5, VRE stock has staged an impressive rally, defying the market’s downward correction.

As of the August 22 session close, VRE stock had surged 17.3% from its historic low, or VND 3,400 per share.

However, in the last session of the week (August 23), VRE stock of Vincom Retail fell 1.02% from the previous session to VND 19,500 per share, with a trading volume of over 7.3 million shares.

Nonetheless, the strong growth during the week pushed Vincom Retail’s market capitalization to over VND 44,300 billion.

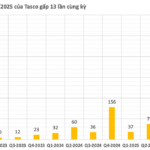

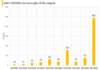

Novaland Stock Soars, Liquidity Surges

After hitting a one-year low at the beginning of the month, Novaland Investment Joint Stock Company (Ticker: NVL) stock has continuously soared in recent sessions, accompanied by a surge in liquidity.

Specifically, at the close of August 23, NVL stock ended at VND 13,200 per share, up 2.33% from the previous session, with a trading volume of over 28.5 million shares.

NVL stock’s recent surge in price and liquidity followed the positive news about the Aqua City project (Bien Hoa, Dong Nai) of this real estate giant.

NVL stock hit its one-year low of VND 11,000 per share on August 5 and recovered slightly in subsequent sessions. Then, on August 16, right after the good news about the Aqua City project being unblocked, NVL stock price soared by 6.7% in that session, along with a surge in liquidity to over 35.4 million shares.

Thus, from its one-year low at the beginning of this month, NVL stock price has rebounded by 20%, or VND 2,640 per share.

Currently, Novaland’s market capitalization has climbed to nearly VND 25,750 billion.

In addition to the above stocks, a host of other real estate stocks, such as DIG, DXS, VHM, and CEO, also soared this week.

Company Related to Ms. Dang Thi Hoang Yen Registers to Buy Nearly 6 Million ITA Shares

In a recent announcement, Tan Dong Phuong Investment, Construction and Development Joint Stock Company registered to buy more than 5.8 million shares of ITA Corporation to increase its ownership. The expected trading period is from August 26 to September 24, through negotiated transactions.

Previously, this major shareholder had purchased nearly 38 million ITA shares in early June, raising its holdings to over 111 million shares (11.84% of capital) as of the present. If the purchase of an additional 5.8 million shares is completed, its holdings will increase to approximately 117 million units, equivalent to 12.46% of the capital.

Regarding connections, Ms. Dang Thi Hoang Yen (a.k.a. Maya Dangelas), Chairman of ITA’s Board of Directors, is currently the General Director of Tan Dong Phuong Investment, Construction and Development Joint Stock Company. Meanwhile, Mr. Nguyen Thanh Phong, CEO of ITA, is the Deputy General Director of this enterprise.

Immediately after this information surfaced, at the close of August 22, ITA stock rose 6.13% to VND 3,980 per share, with a trading volume of nearly 2.4 million shares.

However, in the next session (August 23), ITA stock price fell 1.76% to VND 3,910 per share, with a trading volume of over 518,000 shares.

Thus, it can be seen that ITA stock has not escaped a significant price correction, despite the upward trend in recent trading sessions.

FPT Retail (FRT) Stock Reaches New All-Time Highs

At the close of August 21, FPT Retail Joint Stock Company (Ticker: FRT) stock ended at VND 188,000 per share, up 6.82% from the previous session, with a trading volume of nearly 2.2 million shares.

This marked FRT stock’s highest price since its listing on the stock exchange.

Previously, in the upward trend of recent sessions, FRT stock had continuously reached new peaks.

After standing still in the August 22 session, FRT stock fell 1.17% to VND 185,800 per share in the last session of the week (August 23), with a trading volume of nearly 694,000 shares.

FPT Retail stock has recently attracted strong investment capital due to favorable macro factors and the positive growth momentum of the retail industry.

In addition, investors have high expectations for FPT Retail’s pharmaceutical business segment.

Specifically, in its reviewed semi-annual financial statements for 2024, FPT Retail disclosed the bright business results of the Long Chau chain.

Accordingly, this pharmaceutical chain contributed VND 11,521 billion in revenue to the retailer, up 67% over the same period last year. The pharmaceutical segment currently accounts for 63% of FPT Retail’s revenue. Long Chau’s profit before tax, borrowing, and depreciation (EBTDA) reached VND 491 billion.

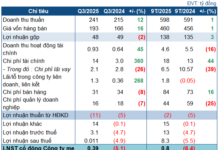

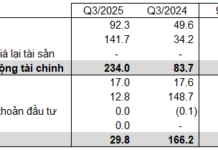

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.