Illustrative image

Nam A Bank, a joint-stock commercial bank in Vietnam, has recently increased its deposit interest rates for terms ranging from 1 to 17 months, with the highest adjustment being 0.5% per annum. This is the first time in three months that the bank has made such a change.

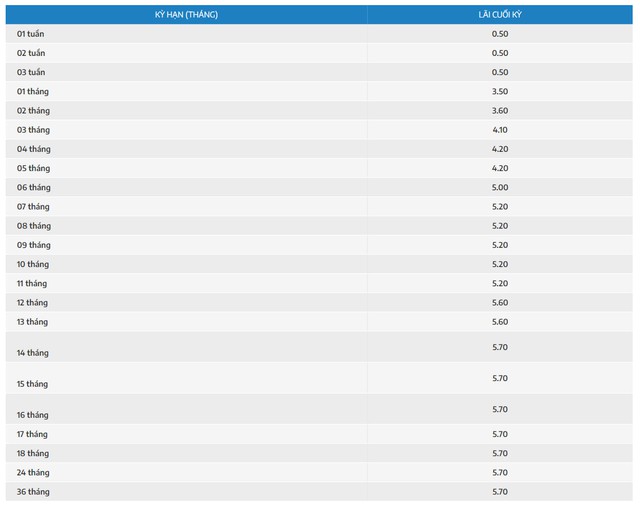

According to the online deposit interest rates at Nam A Bank – the product with the highest interest rates, the 1-month term has increased by 0.4% per annum to 3.5% per annum, while the 2-month term has increased by 0.5% to 3.6% per annum.

The interest rate for the 3-month term has gone up by 0.3% to 4.1% per annum, while the 4-5 month term has seen a 0.2% increase to 4.2% per annum.

Nam A Bank has adjusted the interest rate for the 6-month term, raising it by 0.4% to 5% per annum. The 7-11 month term is now at 5.2% per annum, following an increase of 0.1-0.4%.

The 12-13 month term interest rates have increased by 0.2% to 5.6% per annum. The 14-17 month term has seen a similar increase and is now listed at 5.7% per annum.

Nam A Bank has kept the interest rates for the 18-36 month term unchanged at 5.7% per annum.

Deposit Interest Rates for Online Savings at Nam A Bank

As of the beginning of August, the market has witnessed 16 banks raising their deposit interest rates, including: Agribank, Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, DongA Bank, VPBank, Techcombank, VietBank, SHB, PVCombank, Cake by VPBank, and Nam A Bank.

On the other hand, the market has also recorded three banks that have lowered their deposit interest rates: Bac A Bank, SeABank, and OCB.

Compared to the same period in previous months, the pace of deposit interest rate increases has shown signs of slowing down in terms of both the number of banks and the frequency of adjustments. However, deposit interest rates are still expected to face upward pressure in the last months of 2024.

In a recently published analysis report, MBS Securities stated that in the context of credit growth accelerating at a rate three times faster than that of capital mobilization, banks are aggressively increasing deposit interest rates to enhance the competitiveness of savings accounts compared to other investment channels in the market.

The analytics group predicted that the interest rates on deposits would continue to rise in the second half of 2024 due to the expected increase in credit demand as production and investment are expected to accelerate in the final months of the year.

“We forecast that the 12-month term deposit interest rate of large joint-stock commercial banks may increase by another 0.5 percentage points, returning to the range of 5.2-5.5% per annum by the end of 2024,” the MBS report said.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.