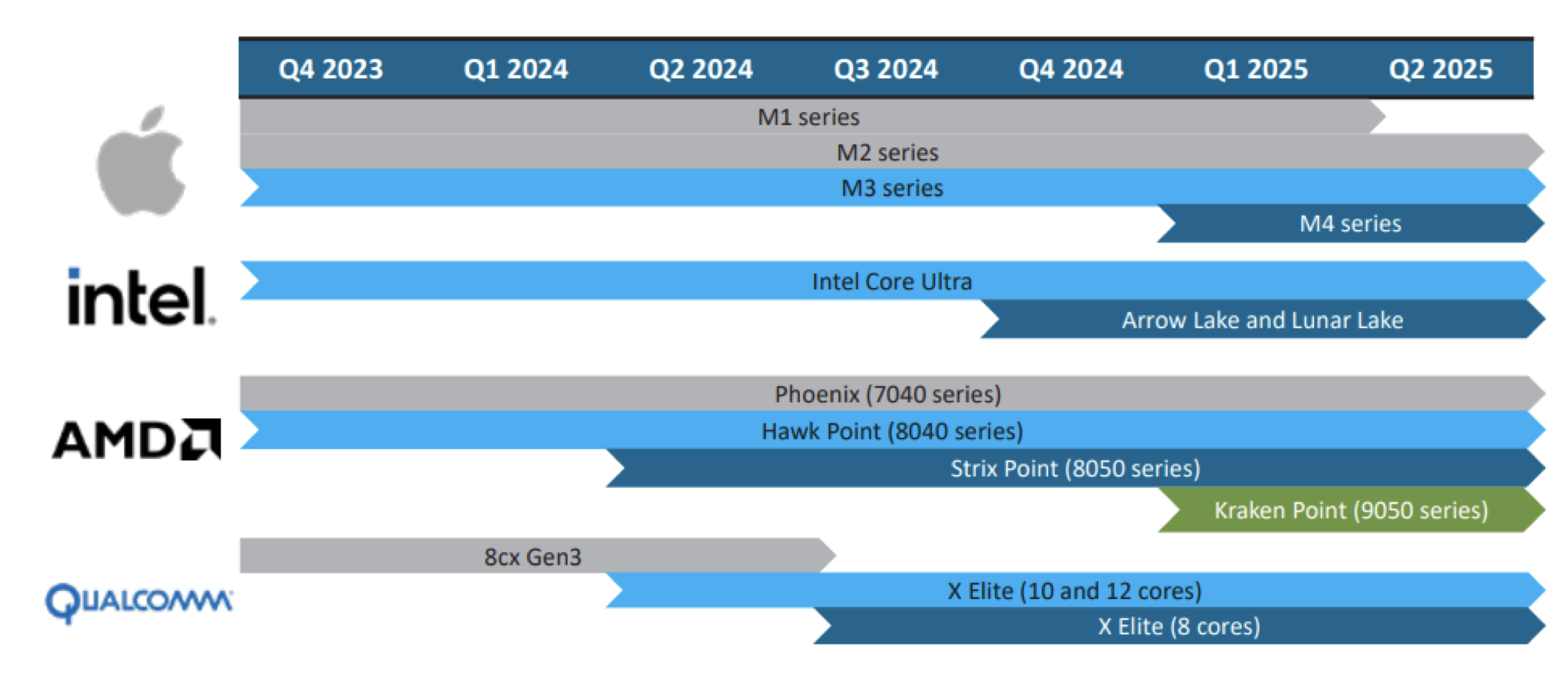

The world is undergoing a technological revolution, and AI is at the forefront, driving a global wave of device upgrades. The leading chip manufacturers, Intel, AMD, Apple, and Qualcomm, are all enhancing their specifications to cater to the new AI applications and trends. By integrating NPUs (Neural Processing Units), these chips can now efficiently handle AI-related tasks, resulting in improved computational capabilities, reduced response times, and, most notably, lower power consumption.

In fact, most computer users today can access cloud-based AI applications right on their personal devices, provided they have sufficiently powerful CPUs and GPUs. However, BVSC believes that the benefits of on-device AI, such as faster response times, lower latency, enhanced security, and the ability to perform AI operations without an internet connection, will be crucial factors for consumers when considering upgrading their current machines.

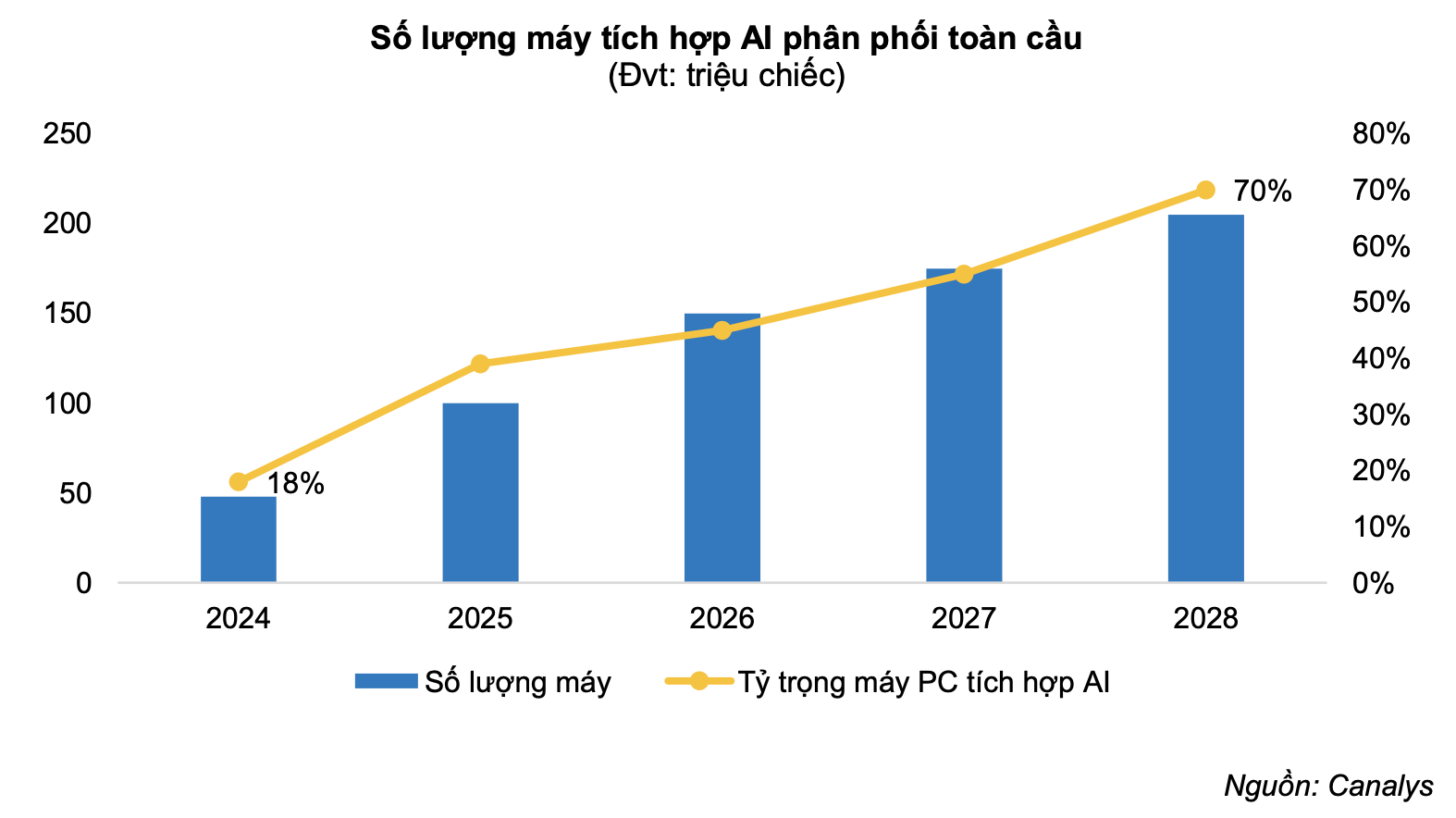

According to Canalys’ research, an estimated 48 million AI-integrated PCs (including desktops and laptops) are expected to be shipped by manufacturers in 2024, accounting for 18% of the total annual shipments. The report also forecasts that this number will rise to 100 million units (40% of total shipments) in 2025, marking the beginning of a new replacement and upgrade cycle for PC users.

Additionally, 2025 will be a pivotal year for the new computer replacement cycle as Microsoft plans to discontinue support for Windows 10. On average, from 2024 to 2028, the compound annual growth rate for AI-integrated PCs is projected to reach 44%, with these machines expected to account for 70% of total shipments in 2028.

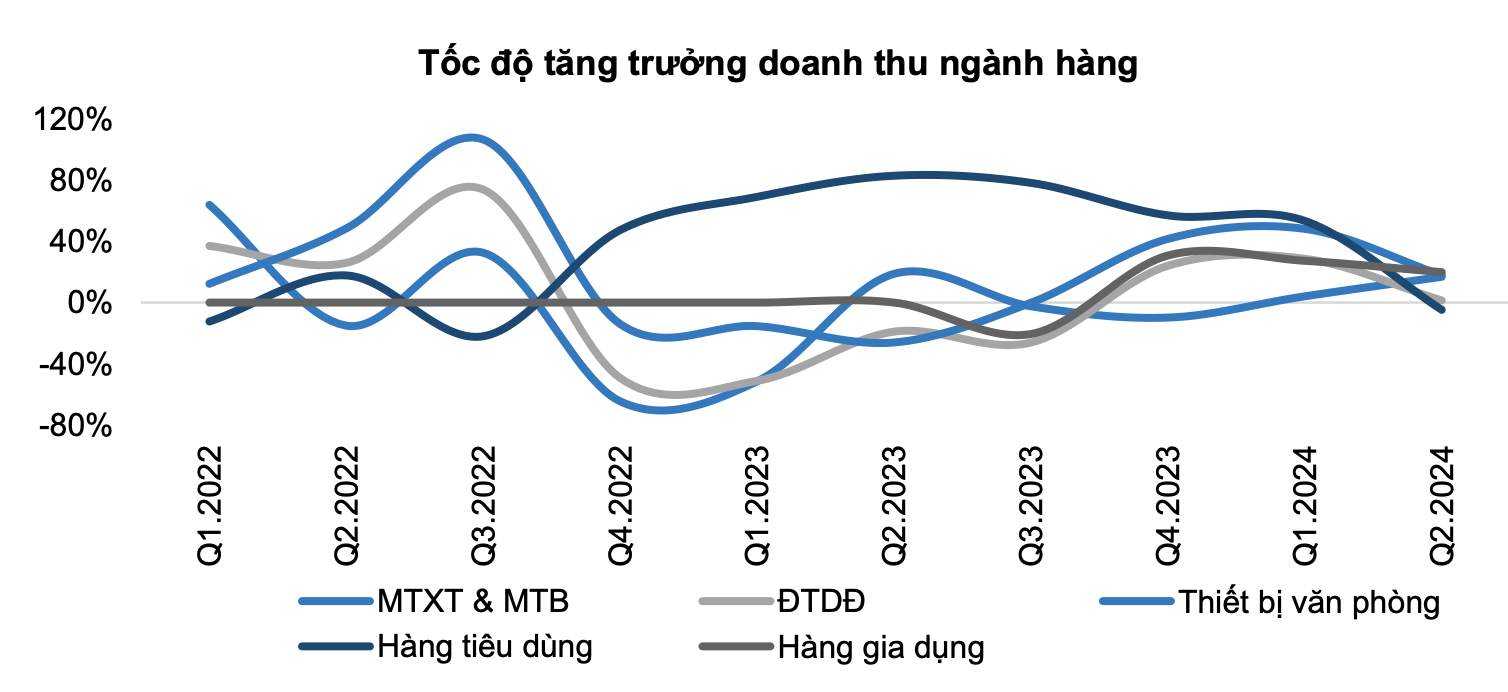

Anticipating Continued Growth in Various Sectors

In the long term, the integration of AI is expected to drive the need for replacements across different industries, creating new growth opportunities for ICT wholesale and retail businesses, including Digiworld (DGW). In the short term, the “back to school” season is anticipated to boost computer sales in the third quarter.

Starting this quarter, Digiworld will begin distributing MSI gaming laptops, a prominent brand in the gaming segment with an 18% market share, further solidifying the growth of this product category. Additionally, Digiworld will also be distributing Xiaomi’s refrigerators and air conditioners.

In the mobile phone sector, BVSC expects the market to pick up in the second half of the year with the launch of the new iPhone series. Moreover, the affordable smartphone segment is performing well as consumers continue to spend cautiously. The average selling price has also increased slightly compared to the previous year, mainly due to the transition from basic phones to smartphones ahead of the 2G network shutdown.

In the personal protective equipment segment, Digiworld estimates that Achison will contribute approximately VND 800-900 billion in revenue for the full year 2024. As for the consumer goods sector, Digiworld expects to add a beverage brand to its portfolio this year. BVSC assesses that the growth rate of this segment will improve in the second half as ABInBev gains additional sales channels.

Regarding Vietmoney, the company is undergoing a restructuring process and redefining its target customer base. It will no longer solely focus on pawnshop services as before. Meanwhile, B2X currently has 18 service centers and plans to expand to at least 30 centers to cover major provinces and cities. Each center is currently generating VND 2 billion in revenue and has reached breakeven with a slight profit.

Given these positive prospects, BVSC projects that Digiworld’s net revenue may grow by 14.1% and 8.4% in 2024 and 2025, respectively, reaching VND 21,474 billion and VND 23,275 billion. Net profit for 2024 and 2025 is forecasted to be VND 456 billion and VND 568 billion, representing increases of 28.6% and 24.7% compared to the previous year.