Dragon Capital’s foreign funds have been selling off HSG shares of Hoa Sen Group recently. Illustration

The Dragon Capital fund group has just released a report on the trading of HSG shares of Hoa Sen Group Joint Stock Company.

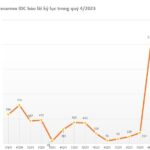

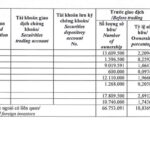

Specifically, the foreign fund sold a total of 3 million HSG shares in the August 21 session, thereby reducing its ownership from 44.26 million shares (7.1849%) to 41.26 million shares (6.6979%).

Of this, Amersham Industries Limited sold 1 million shares; DC Developing Markets Strategies Public Limited Company sold 1 million shares; Hanoi Investments Holdings Limited sold 500,000 shares; and Norges Bank sold 500,000 shares.

Recently, the Dragon Capital foreign fund group has continuously sold HSG shares, thereby gradually reducing its ownership in Hoa Sen Group.

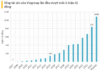

In terms of business results, according to the financial report for the third quarter of the 2023-2024 financial year (from April 1, 2024, to June 30, 2024), HSG recorded revenue of VND10,840 billion, up more than 25% over the same period last year; and after-tax profit reached VND273 billion, nearly 20 times higher.

Accumulated in the first nine months of the 2023-2024 financial year, HSG’s net revenue increased by 24% over the same period to VND29,163 billion; and after-tax profit reached VND696 billion, while it suffered a loss of VND410 billion in the same period last year.

For the 2023-2024 financial year (from October 1, 2023, to September 30, 2024), Hoa Sen Group has set business plans with two scenarios. In the first scenario, the consumption volume is expected to reach 1,625,000 tons, up 13.3% over the same period, with expected revenue of VND34,000 billion, up 7.4% over the same period, and expected after-tax profit of VND400 billion, up 12.33 times compared to the previous financial year.

In the second scenario, the total consumption volume is estimated at 1,730,000 tons, up 20.7% over the same period, with estimated revenue of VND36,000 billion, up 13.7% over the same period, and expected after-tax profit of VND500 billion, up 15.67 times compared to the previous financial year.

Thus, at the end of the first nine months of the 2023-2024 financial year, Hoa Sen Group has completed 174% of the plan to earn a profit of VND400 billion and 139.2% of the plan to earn a profit of VND500 billion.

PV

A “squad” carrying mattresses back home for Tet holidays

In 2023, May Sông Hồng achieved a net revenue of 4,542 billion VND, a decrease of 18% compared to the previous year, and a post-tax profit of over 245 billion VND, experiencing a decline of nearly 28%.

Dragon Capital Acquires Additional 3 Million HSG Shares from Hoa Sen Group

Dragon Capital has recently acquired an additional 3 million shares of HSG, increasing its ownership stake in Hoa Sen Group to over 11.3%.