China’s Big Spending on Tech

China is disbursing billions of dollars to technology startups and many other small businesses without collateral, all through intellectual property pledging. According to the FT, Beijing’s “big-spending” move aims to restore lending demand and stimulate the sluggish economy.

Official data from the China National Intellectual Property Administration (CNIPA) showed that new intellectual property-backed lending surged 57% in the first half of 2024 compared to the same period last year, reaching RMB 419.9 billion (USD 58.8 billion). This follows a 75% increase in 2023 to RMB 854 billion.

This type of lending is typically used by struggling companies without valuable assets in the West. Now, it is becoming more popular in China as policymakers try to restore sluggish credit growth in the world’s second-largest economy.

Beijing sees the promotion of intellectual property-based lending, such as patents, trademarks, or even geographical indications recognizing the special status of regional products, as part of its strategy to boost small innovative companies.

“Small and medium-sized enterprises need to grow on a large scale and especially need significant financial support during the startup and growth stages,” said Shen Changyu, head of the CNIPA.

Han Shen Lin, China region director at consulting firm The Asia Group, said that as China’s stock market fluctuated and venture capital activity remained relatively subdued, smaller banks stepped in—thanks to the government’s recognition of intellectual property rights as a legitimate source of capital.

“I see this as a plan to pump money into tech companies,” Lin said.

State news agency Xinhua reported that China granted 921,000 patents in 2023, a 15% increase from the previous year.

Unsecured Lending for the Unsecured

Gao Huasheng, a professor at the School of International Finance at Fudan University, said the push for intellectual property financing aims to support companies lacking tangible assets such as land or machinery.

He added that the China Intellectual Property Administration is offering “interest subsidies to encourage banks to issue similar loans.”

“The initial purpose was to support high-tech startups, but in practice, the policy could be applied more broadly,” Gao noted, adding that efforts are also underway to create a large-scale auction market for intangible assets in case of defaults.

Government regulations also provide more powers for non-performing loans in the intellectual property financing portfolio and exempt bank employees from personal liability if they follow the correct procedures in the event that the loan situation turns sour.

Beijing Guoxinda Data Technology, a tech company that uses big data to evaluate real estate projects for bank clients, said it borrowed RMB 8 million under this program with a promise of interest repayment.

“The loan is like the icing on the cake,” said a representative of an anonymous company, comparing it to their existing operations. They plan to use the funds to scale up.

However, the FT also found that companies facing liquidity issues in many other sectors are also using this program.

Yichun Xianghe Agriculture Technology Development Co, a rice processing conglomerate in Heilongjiang Province, borrowed RMB 10 million after facing liquidity problems due to the pandemic and adverse weather conditions.

Another company, Yichun Xingshun Woods, a wood processing company in the same region, received RMB 4 million after rising raw material costs squeezed their working capital.

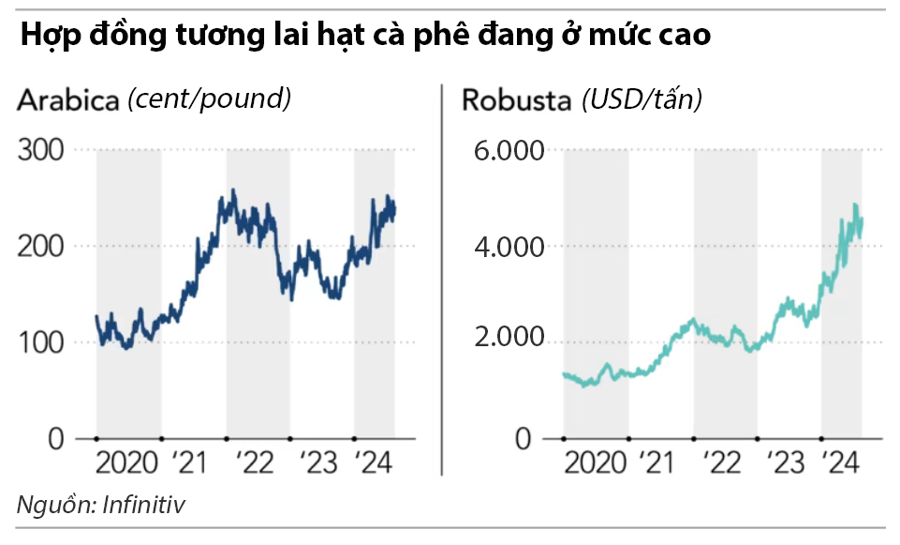

Earn money fast like Dang Le Nguyen Vu: Trung Nguyen Legend in Shanghai opens in less than a year and already profitable?

Being open for just 9 months, Mr. Dang Le Nguyen Vu revealed in an interview that Trung Nguyen Legend in Shanghai “is profitable already, despite the heavy investment!”