The Ministry of Finance is drafting amendments to the Tax Administration Law. It proposes to include a provision guaranteeing taxpayers compensation for damages caused by tax authorities or their officials, in line with state compensation regulations.

The Ministry also suggests including a clause regarding taxpayers’ compensation claims related to interest payments owed by tax authorities, as per the State Compensation Law of 2017.

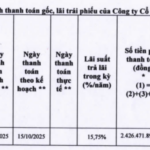

According to the State Compensation Law, interest rates for late payments, in the absence of an agreement, are governed by the Civil Code at the time of accepting the compensation request. The 2015 Civil Code sets this rate at 10%, half of the maximum limit.

Based on these regulations, businesses and individuals who experience tax refund delays may be eligible for compensation at a rate of 10% per annum.

In the first seven months of this year, the General Department of Taxation issued 10,494 decisions on VAT refunds, totaling VND76,355 billion, a 107% increase compared to the same period in 2023.

People and businesses processing VAT refunds. Source: VGP

In 2023, several businesses reported delays in VAT refunds. The Vietnam Timber and Forest Product Association requested the Ministry of Finance and the General Department of Taxation to address these issues to ease businesses’ financial constraints and enable them to take on new contracts.

In response, the General Department of Taxation acknowledged certain challenges in VAT refunds for export activities, particularly in the timber industry. Some businesses were found to have used illegal invoices to legitimize large refund claims.

According to the Compensation Regulations issued by the General Department of Taxation in 2023, tax authorities are required to compensate individuals and businesses in cases of unlawful administrative fines, preventive measures, enforcement of administrative penalty decisions, taxes, fees, or charges, as well as unlawful tax collection, tax refunds, or land use levies.

Affected individuals and businesses can submit their compensation claims to the tax authorities, including a request letter, identification documents, and relevant evidence. The claim should clearly state the damaging actions of the official, the causal link between the damage and the actions, the extent of the damage, and the requested compensation.

Upon receiving the claim, the head of the tax authority has five days to initiate the compensation process.

Hanoi Reveals Over 2,000 Organizations and Individuals Defaulting on Tax Payments

The Hanoi Tax Department has recently made public information on taxpayers who still owe tax and other revenue to the state budget by the closing date of December 31, 2023. The published list includes 2,238 taxpayers with a total outstanding amount of over 993 billion dong.

Minister of Transport inspects Dien Chau – Bai Vot Expressway before deadline

“In the spirit of resolving rather than evading issues, we must present solutions to launch the Dien Chau – Bai Vot Expressway project, making it operational for public use by the upcoming 30/4-1/5 holidays,” directed the Minister of Transport, Nguyen Van Thang.