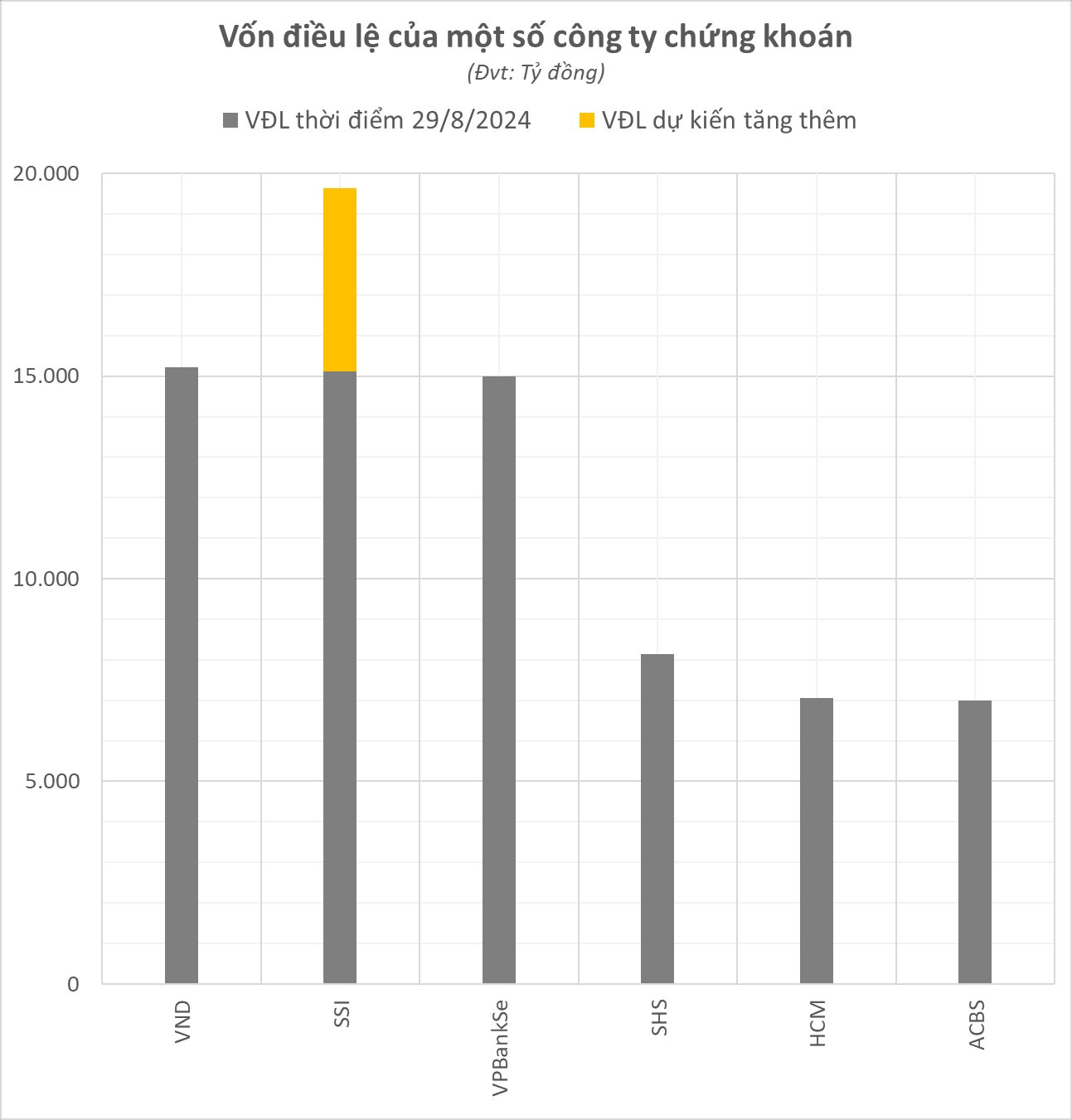

Securities Corporation SSI Joint Stock Company (code SSI) has just announced that it has received a Public Offering Registration Certificate from the Chairman of the State Securities Commission. The company plans to issue more than 453 million new shares. If successful, SSI’s chartered capital will increase from VND 15,111 billion to VND 19,645 billion, thereby regaining its position as the leading securities company in terms of chartered capital.

Specifically, SSI plans to issue more than 302 million bonus shares to increase capital from owned capital sources, while offering to sell 151 million shares to existing shareholders. The distribution time is within 90 days (from August 28, 2024).

In terms of business results, in 2024, SSI set a target for its consolidated revenue to reach VND 8,112 billion. The goal for consolidated pre-tax profit is VND 3,398 billion, up 19% over the previous year.

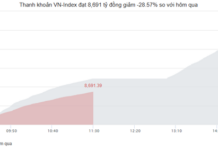

In the first half of the year, operating revenue reached VND 4,280 billion, up 35% over the same period in 2023. This securities company reported a pre-tax profit of 2,002 billion VND, up 51% over the same period, completing 59% of the full-year target.

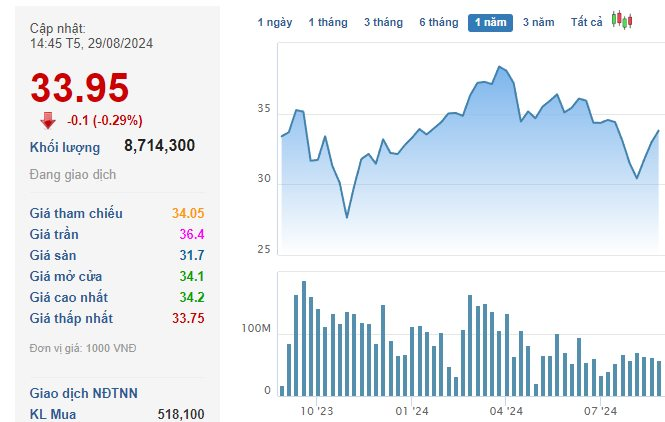

In the market, SSI shares closed at VND 33,950/share on August 29, up 3.5% since the beginning of the year.

The race to increase capital in the securities industry is heating up again. Before SSI, VNDirect has just completed a public offering and dividend payment with a total volume of more than 304 million shares. The chartered capital after the issuance increased to nearly VND 15,223 billion, making it the securities company with the largest chartered capital in the market.

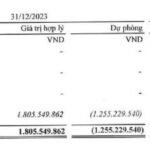

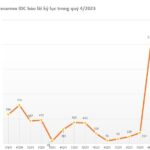

CapitaLand seals deal for over VND 18 trillion project, earns record profit of VND 2 trillion in Q4 2023, still owes Singapore giant over VND 2,700 trillion.

By the end of 2023, this real estate company achieved a total revenue of 8,204 billion VND and a net profit of 2,441 billion VND, representing a year-on-year growth of 23% and 43.6% respectively.