Illustration

Mobile phones and their components have become a strategic industry for Vietnam, contributing significantly to the country’s GDP and bringing in billions of USD each month.

According to statistics, in 2010, the export turnover of mobile phones and components accounted for only 3.2% of the total export turnover. However, from 2011 to 2021, the average growth rate of this industry was 34%. Vietnam is currently the second largest exporter of mobile phones in the world.

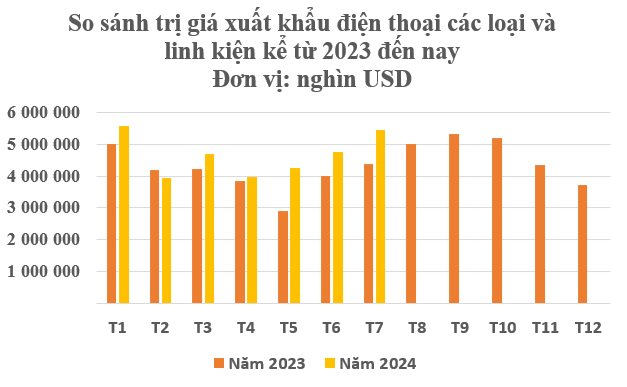

In 2024, according to preliminary statistics from the General Department of Customs, the export turnover of mobile phones and components in July alone reached more than 5.4 billion USD, up 14.8% compared to the previous month. In the first seven months of the year, the industry brought in more than 32.5 billion USD, up 12.7% over the same period last year, continuing to hold the second position in export turnover.

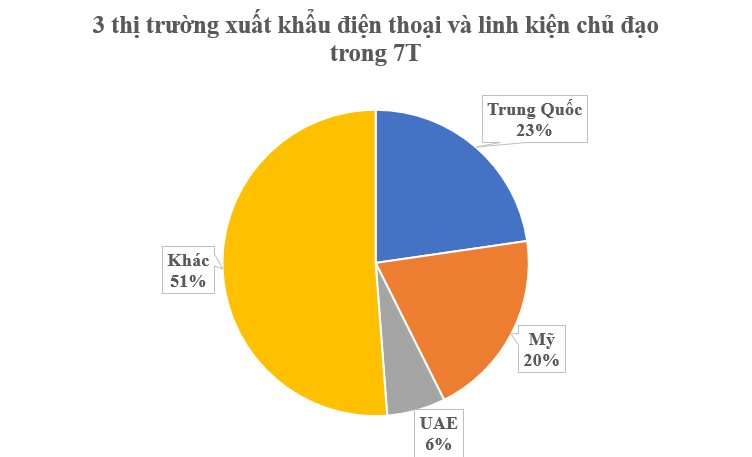

In terms of market, since the beginning of the year, the United States and China have taken turns as Vietnam’s largest importers. In the first seven months, China led with more than 7.3 billion USD, up 3% over the same period last year.

The US ranked second with more than 6.4 billion USD, up 32% over 7T/2023.

Notably, the United Arab Emirates (UAE) has overtaken South Korea to become the third largest importer, with more than 2 billion USD, up 69% over the same period in 2023.

According to Counterpoint Research, mobile phones witnessed the best Q2 growth since 2021. The latest data from research firm IDC recorded a 6.5% year-over-year increase in global smartphone shipments to 285.4 million units in Q2.

IDC stated that AI-integrated smartphones (GenAI) could become the next growth driver after 5G and foldable devices.

Notably, the market share of the top five revenue-generating brands in Q2, including Samsung, Apple, Xiaomi, Vivo, and Oppo, decreased from the previous year, mainly due to pressure from Huawei, Honor, Motorola, and Transsion Group (including Tecno, Infinix, and iTel).

According to DigiTimes, Vietnam may produce 20% of iPads and Apple Watches, 5% of MacBooks, and 65% of AirPods by 2025.

The Ministry of Industry and Trade (MoIT) stated that for the electronics industry, including mobile phone exports and components, it is necessary to promote overseas market development and take advantage of opportunities brought about by FTAs. It is also crucial to implement trade remedies effectively and proactively respond to protectionist tendencies and technical barriers in global markets.

Notably, exports of mobile phones and components to other potential EU member states, such as Hungary, Poland, the Czech Republic, and Slovakia, have increased significantly. At the same time, this industry also needs to focus on creating breakthroughs and expanding new potential export markets in regions such as Africa, Latin America, the Middle East, and India.

HSBC: Vietnam Starts 2024 with Strong Signs of Economic Recovery

After a challenging year of the Quy Mao, HSBC predicts a brighter outlook for Vietnam in the Year of the Giap Thin, as exports surged by 42% in January.