Tan Tao Group Shunned by Auditing Firms

Tan Tao Investment and Industry Corporation (ITA) has requested the State Securities Commission and the Ho Chi Minh City Stock Exchange (HOSE) to allow a delay in publishing its 2023 audited financial statements, 2023 annual report, and 2024 semi-annual reviewed financial statements.

In its announcement, Tan Tao revealed that it had previously sent three reports to the State Securities Commission and HOSE, requesting a postponement in publishing its 2023 audited financial statements and 2023 annual report due to unforeseen circumstances.

On June 24, 2024, the company provided a written explanation for the unforeseen circumstances, but has not received a response from the State Securities Commission. Meanwhile, HOSE has decided to place ITA shares on restricted trading starting July 16, 2024.

Despite Tan Tao’s best efforts to communicate and persuade all auditing firms, all 30 companies approved to audit public interest entities in the securities sector in 2023 have refused.

Tan Tao attributed this to the State Securities Commission’s suspension of four auditors who conducted the 2021, 2022, and 2023 semi-annual reviewed financial statements for Tan Tao. This has made other auditing firms reluctant to take on the company as a client.

Tan Tao expressed its hope that the State Securities Commission and HOSE would “protect businesses and investors” by allowing the company to temporarily delay publishing its 2023 audited financial statements, 2023 annual report, and 2024 semi-annual reviewed financial statements until it can find an auditing firm and complete the audit.

“We request the State Securities Commission and HOSE to support and issue an official document allowing auditing firms to provide services to Tan Tao Group,” the company said.

Tan Tao is still actively seeking to engage and persuade auditing firms to perform the 2023 audited financial statements and 2024 semi-annual reviewed financial statements,” the company emphasized.

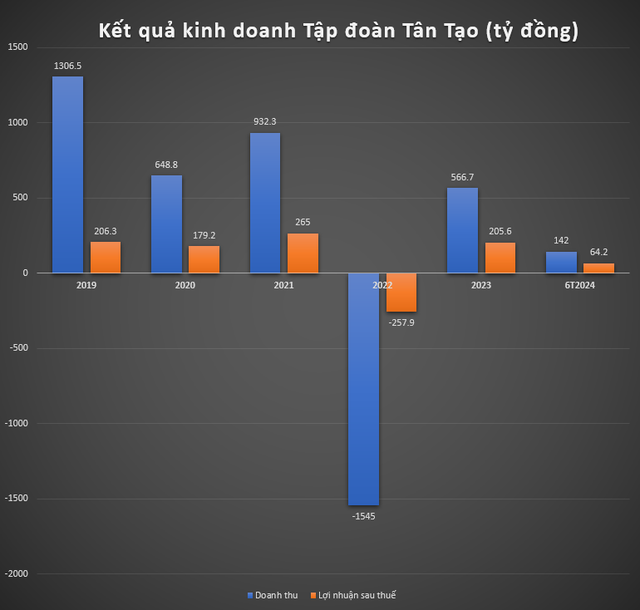

Tan Tao’s Business Performance

In terms of business performance, according to Tan Tao’s consolidated financial statements for the first six months of 2024, as of June 30, 2024, the company’s net revenue from sales and services was over VND 142 billion, unchanged from the same period last year.

Financial income for the first six months decreased significantly, reaching VND 327 million, a decline of nearly 84% compared to the previous year. The company also recorded a loss of nearly VND 1,548 billion, a decrease of 68% compared to the same period.

Graphics: PL

The company’s total pre-tax profit was over VND 70.2 billion, a significant increase of 46.25% compared to the previous year. After-tax profit increased by 65%, reaching VND 64.2 billion.

According to plans, in 2024, the company’s total revenue and income will be VND 530 billion, with a pre-tax profit of VND 222 billion and an after-tax profit of VND 178 billion. Thus, the company has achieved 36% of the profit plan for the whole year.

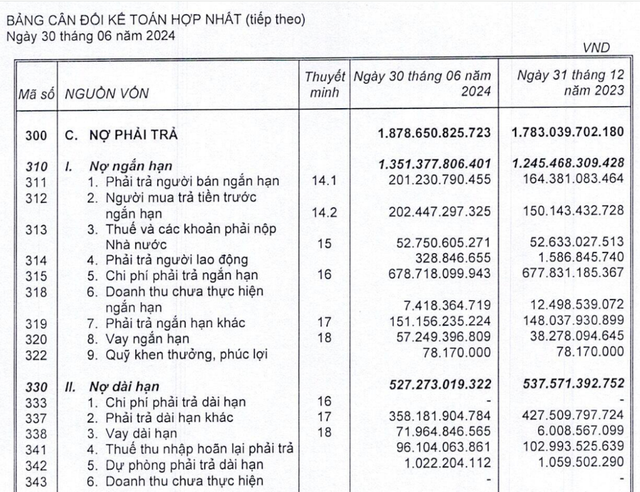

In the first half of this year, the company’s cash and cash equivalents surged, more than doubling compared to the previous year, reaching over VND 102 billion. Most of this amount is in the form of bank deposits, totaling VND 101.4 billion.

Tan Tao’s inventory remained almost unchanged from the previous year. Total inventory was nearly VND 3,586 billion, including land use rights for projects used as collateral for bank loans.

Bank Pays Lunar New Year Bonuses to Staff, Many Receive 4.5 Months’ Salary

This morning, on February 2, 2024 (or the 23rd of the twelfth month on the lunar calendar), a bank headquartered in Dong Da District, Hanoi, rewarded its employees for the Lunar New Year. Many individuals received bonuses equivalent to 4.5 months’ salary, while some received even more. Everyone was rewarded without exception.

Flexible Mechanisms and Solutions to Enhance the Stock Market in Vietnam

There is a real-life example of the flexibility in handling HOSE order congestion incidents that demonstrates the concentration, collaboration, technology investment, and resources of the company… can accelerate the stock market to meet the criteria of FTSE and MSCI in the upcoming evaluation periods.

Business Penalized with 350 Million VND Fine, Speak Up

The State Securities Commission has recently announced three penalties against businesses, all of which have violated information disclosure regulations. One of the businesses has been fined 350 million VND for failing to register securities trading and deliberately causing disturbances on the market.